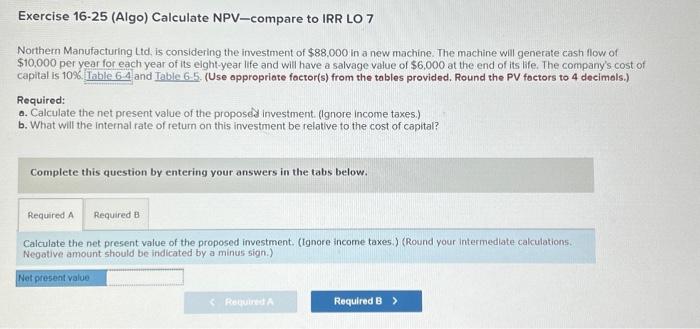

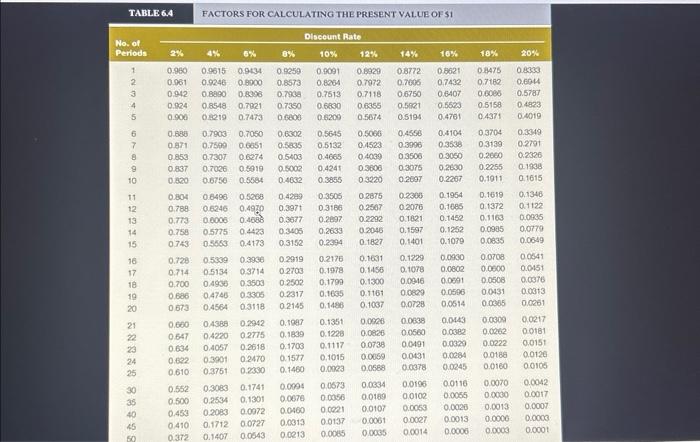

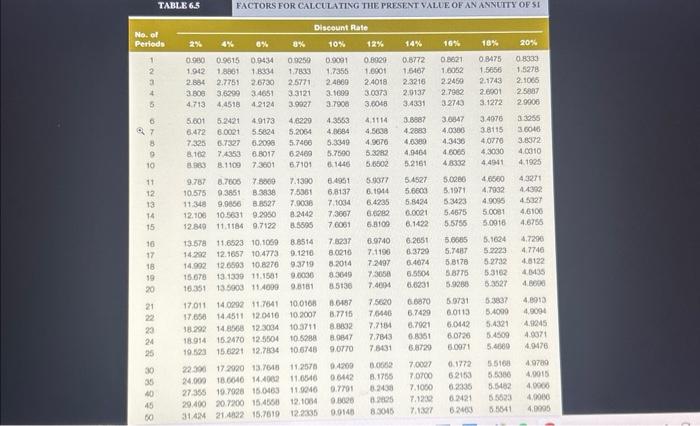

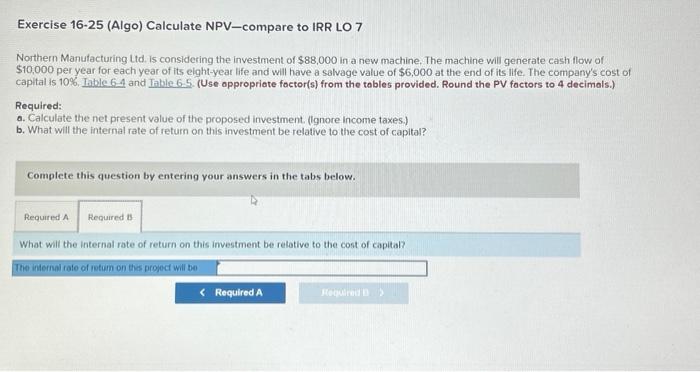

Exercise 1625 (Algo) Calculate NPV-compare to IRR LO 7 Northern Manufacturing Lid, is considering the investment of $88,000 in a new machine. The machine will generate cash flow of $10,000 per year for each year of its eight-year life and will have a salvage value of $6,000 at the end of its life. The company's cost of capital is 10% and Table 6.5. (Use oppropriate foctor(s) from the tables provided. Round the PV foctors to 4 docimols.) Required: a. Calculate the net present value of the proposed investment. (Ignore income taxes.) b. What will the internal rate of return on this investment be relative to the cost of capital? Complete this question by entering your answers in the tabs below. Calculate the net present value of the proposed investment. (Ignore income taxes.) (Round your intermediate calculations. Negative amount should be indicated by a minus sign.) TABLE 6,4 FACTORS FOR CALCULATING THE PRESENT VAL.UB OF $1 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} No. of \\ Periods \end{tabular}} & \multicolumn{9}{|c|}{ Diseeunt Rate } & \multirow[b]{2}{*}{20%} \\ \hline & 2% & 4x & 6% & % & 10% & 12% & 14% & 10% & 18% & \\ \hline 1 & 0.960 & 0.9615 & 0.9134 & 0.9859 & 0.9091 & 0.8929 & 08772 & 08021 & 0.8475 & 0.8303 \\ \hline 2 & 0.961 & 0.9246 & 0.8000 & 0.8573 & 0.8264 & 07072 & 0.7606 & 0.7432 & 0.7182 & 0.604 \\ \hline 3 & 0.942. & 0.8990 & 0.8096 & 0.7938 & 0.7513 & 07118 & 0.6750 & 0.6407 & 0,0005 & 0.578d \\ \hline 4 & 0.024 & 0.8548 & 0.7821 & 0.7350 & 0.6830 & 0.6355 & 0.5n81 & 0.5523 & 0.5158 & 0.4823 \\ \hline 5 & 0.900 & 08219 & 0.7473 & 00000 & 0.6200 & 0.5874 & 0.5194 & 0.4761 & 0.4371 & 0.0019 \\ \hline 6 & 0.680 & 07903 & 0.7050 & 0.6302 & 0.5645 & 0.5060 & 0.4558 & 0.4104 & 0.3704 & 0.3349 \\ \hline 7 & 0.871 & 0.7590 & 0.6651 & 0.5835 & 0.5132 & 0.4523 & 0.3996 & 0.3538 & 0.3139 & 0.2791 \\ \hline 8 & 0.853 & 0.730T & 0.6274 & 0.5403 & 0.4665 & 0.4030 & 03500 & 0.3050 & 0.2660 & 0.2326 \\ \hline 9 & 0.837 & 0.7026 & 0.5919 & 0.5002 & 0.4241 & 0.3606 & 03075 & 0.2690 & 0.2255 & 0.1938 \\ \hline 10 & & 0.6750 & 0.5684 & 0.4632 & 0.3855 & 0.3220 & 0.2097 & 0.22067 & 0,1911 & 0.1615 \\ \hline 11 & 0.804 & 0.0496 & 0.5268 & 0.4289 & 0.3505 & 0.2875 & 0.2300 & 0.1954 & 0.1619 & 0.1346 \\ \hline 12 & 0.788 & 0.6246 & 0.497p & 0.397t & 0.3166 & 0.2507 & 0.2076 & 0.1685 & 0.1372 & 0.1122 \\ \hline 13 & 0.773 & 0.0006 & 0.4086 & 0.3677 & 0.2897 & 0.2292 & 0.1821 & 0.1452 & 0.1163 & 0.0905 \\ \hline 14 & 0.758 & 0.5775 & 0.4423 & 0.3406 & 0.2633 & 0.2045 & 0.1597 & 0.1252 & 0.0935 & 0,0779 \\ \hline 15 & 0.743 & 0.5453 & 0.4173 & 0.3152 & 0.2394 & 0.1827 & 0.1401 & 0.1079 & 0.0635 & 0.0649 \\ \hline 16 & 0.728 & 0.5309 & 0.3966 & 0.2919 & 0.2176 & 0.1691 & 0.1229 & 0.0960 & 0.0708 & 00041 \\ \hline 17 & 0.714 & 0.5134 & 0.3714 & 0.2703 & 0.1978 & 0.1456 & 0.1078 & 0.0802 & 0.0600 & 0.0451 \\ \hline 18 & 0.700 & 0.4956 & 0.3503 & 0.2502 & 0.1790 & 0.1300 & 0.0946 & 0.0801 & 0.0506 & 0.0376 \\ \hline 19 & 0.686 & 0.4746 & 0.3305 & 0.2317 & 0.1635 & 0.1161 & 0.0629 & 0.0506 & 0.0431 & 0.0313 \\ \hline 20 & 0673 & 0.4564 & 0.3118 & 0.2145 & 0.1486 & 0.1037 & 0.0728 & 0.0514 & 0.0005 & 0.0261 \\ \hline 21 & 0.660 & 0,4388 & 0.2942 & 0.1087 & 0.1351 & 0.0526 & 0.0638 & 0.0443 & 0.0309 & 0.0217 \\ \hline 2 & 0.647 & 0.4220 & 0.2775 & 0.1839 & 0.1228 & 0.0826 & 0.0660 & 0.0382 & 0.0262 & 00181 \\ \hline 23 & 0.634 & 0.4057 & 0.2618 & 0,1708 & 0.1117 & 0.0738 & 0.0491 & 0.0329 & 0.0222 & 0.0151 \\ \hline 24 & 0.622 & 0.3901 & 0.2470 & 0.1577 & 0,1015 & 0.0059 & 0.0431 & 0.0284 & 0.0188 & 0.0126 \\ \hline 25 & 0.610 & 0.3751 & 0.2390 & 0.1460 & 0.00023 & 0.0668 & 0.0378 & 0.0245 & 0.0160 & 0.0106 \\ \hline 30 & 0.552 & 0.3083 & 0.1741 & 0.0094 & 0.0673 & 0.0334 & 0.0196 & 0.0116 & 0.0070 & 0.0042 \\ \hline 35 & 0.500 & 0.2534 & 0.1301 & 0.0078 & 0.0056 & 0.0189 & 0.0102 & 0.0055 & 0.0000 & 0.0017 \\ \hline 40 & 0.453 & 0.2003 & 0.0972 & 0.0460 & 0,0021 & 0.0107 & 0.0053 & 0,0020 & 0.0013 & 0.000t \\ \hline 45 & 0.410 & 0.1712 & 0.0727 & 0.0313 & 0.0137 & 0.0061 & 0.0087 & 0.0013 & 0.0000 & 0.0000 \\ \hline & 2 & 407 & 0.0543 & 0.0213 & 0.0065 & 0.0035 & 0.0014 & 0.0006 & 0.0003 & 0.000t \\ \hline \end{tabular} Exercise 1625 (Algo) Calculate NPV-compare to IRR LO 7 Northern Manufacturing Ltd. is considering the investment of $88,000 in a new machine. The machine will generate cash flow of $10,000 per year for each year of its eight-year life and will have a salvage value of $6,000 at the end of its life. The company's cost of capital is 10\%. Iable 6-4 and Table 6-5. (Use oppropriate foctor(s) from the tobles provided. Round the PV factors to 4 decimals.) Required: a. Calculate the net present value of the proposed investment. (Ignore income taxes.) b. What will the internal rate of return on this investment be relative to the cost of capital? Complete this question by entering your answers in the tabs below. What will the internal rate of return on this investment be relative to the cost of capital