Question

Exercise 16-28 Comparison of alternative methods of distribution of joint costs, decision for further processing, chocolate products The Chocolate Factory produces and distributes chocolate products.

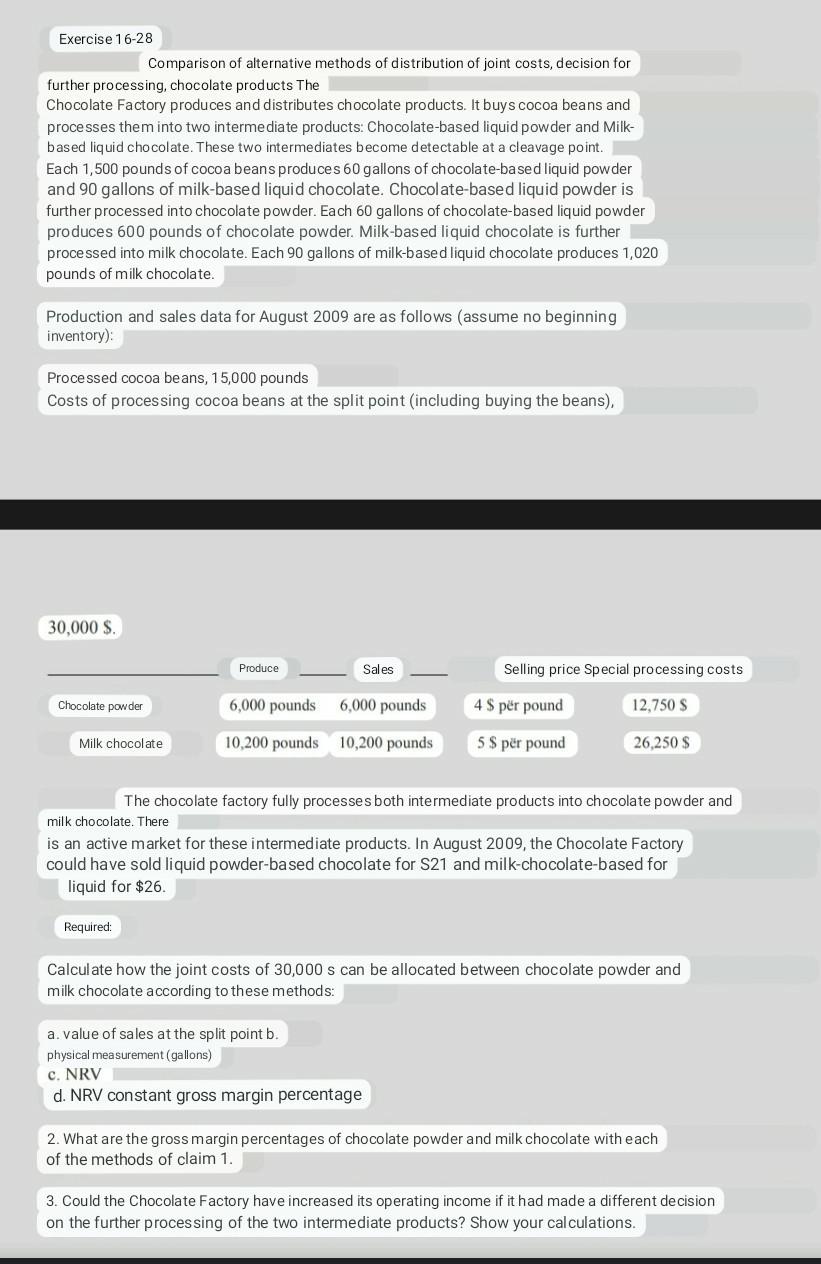

Exercise 16-28 Comparison of alternative methods of distribution of joint costs, decision for further processing, chocolate products The Chocolate Factory produces and distributes chocolate products. It buys cocoa beans and processes them into two intermediate products: Chocolate-based liquid powder and Milk- based liquid chocolate. These two intermediates become detectable at a cleavage point. Each 1,500 pounds of cocoa beans produces 60 gallons of chocolate-based liquid powder and 90 gallons of milk-based liquid chocolate. Chocolate-based liquid powder is further processed into chocolate powder. Each 60 gallons of chocolate-based liquid powder produces 600 pounds of chocolate powder. Milk-based liquid chocolate is further processed into milk chocolate. Each 90 gallons of milk-based liquid chocolate produces 1,020 pounds of milk chocolate. Production and sales data for August 2009 are as follows (assume no beginning inventory): Processed cocoa beans, 15,000 pounds Costs of processing cocoa beans at the split point (including buying the beans), 30,000 $. Chocolate powder Milk chocolate Produce Required: 6,000 pounds 10,200 pounds Sales 6,000 pounds 10,200 pounds a. value of sales at the split point b. physical measurement (gallons) The chocolate factory fully processes both intermediate products into chocolate powder and milk chocolate. There is an active market for these intermediate products. In August 2009, the Chocolate Factory could have sold liquid powder-based chocolate for S21 and milk-chocolate-based for liquid for $26. Selling price Special processing costs 12,750 S 26,250 $ 4 $ pr pound 5 $ pr pound Calculate how the joint costs of 30,000 s can be allocated between chocolate powder and milk chocolate according to these methods: c. NRV d. NRV constant gross margin percentage 2. What are the gross margin percentages of chocolate powder and milk chocolate with each of the methods of claim 1. 3. Could the Chocolate Factory have increased its operating income if it had made a different decision on the further processing of the two intermediate products? Show your calculations.

Comparison of alternative methnds nf distrihution of inint costs derisinn for further processing, chocolate products The Chocolate Factory produces and distributes chocolate products. It buys cocoa beans and processes them into two intermediate products: Chocolate-based liquid powder and Milkbased liquid chocolate. These two intermediates become detectable at a cleavage point. Each 1,500 pounds of cocoa beans produces 60 gallons of chocolate-based liquid powder and 90 gallons of milk-based liquid chocolate. Chocolate-based liquid powder is further processed into chocolate powder. Each 60 gallons of chocolate-based liquid powder produces 600 pounds of chocolate powder. Milk-based liquid chocolate is further processed into milk chocolate. Each 90 gallons of milk-based liquid chocolate produces 1,020 pounds of milk chocolate. Production and sales data for August 2009 are as follows (assume no beginning inventory): Processed cocoa beans, 15,000 pounds Costs of processing cocoa beans at the split point (including buying the beans), 30,000$. The chocolate factory fully processe both intermediate products into chocolate powder and milk chocolate. There is an active market for these intermediate products. In August 2009, the Chocolate Factory could have sold liquid powder-based chocolate for S21 and milk-chocolate-based for Calculate how the joint costs of 30,000s can be allocated between chocolate powder and milk chocolate according to these methods: a. value of sales at the split point b. physical measurement (gallons) c. NRV d. NRI 2. What are the gross margin percentages of chocolate powder and milk chocolate with each of the methods of claim 1. 3. Could the Chocolate Factory have increased its operating income if it had made a different decision on the further processing of the two intermediate products? Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started