Question

Exercise 16-30 (Algo) Sales Activity Variance (LO 16-3) The following data are available for the most recent year of operations for Slacker & Sons. The

Exercise 16-30 (Algo) Sales Activity Variance (LO 16-3)

The following data are available for the most recent year of operations for Slacker & Sons. The revenue portion of the sales activity variance is $288,000 F.

| Master budget based on actual sales of 161,000 units: | |||

| Revenue | $ | 3,600,000 | |

| Materials | 861,000 | ||

| Labor | 636,000 | ||

| Variable manufacturing overhead and administrative costs | 136,000 | ||

| Fixed manufacturing overhead and administrative costs | 410,000 | ||

Required:

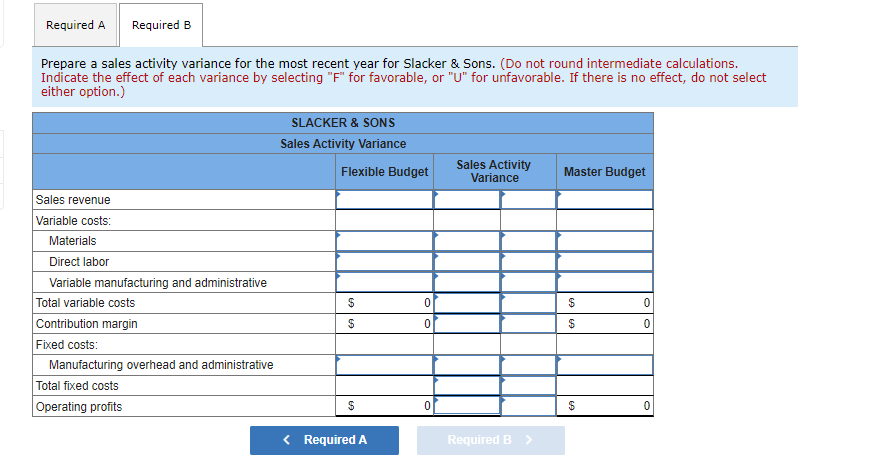

b. Prepare a sales activity variance for the most recent year for Slacker & Sons.

2.

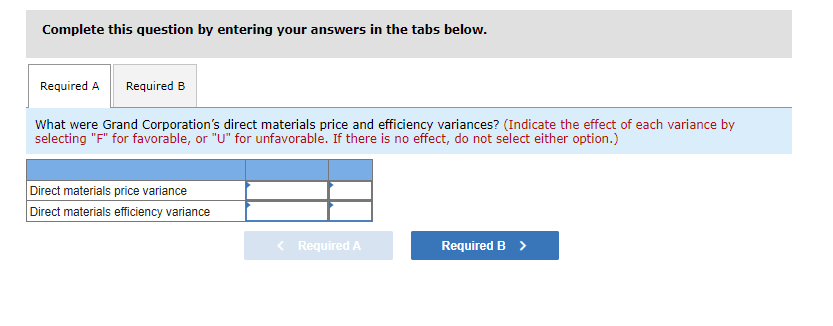

Exercise 16-41 (Algo) (Appendix used in requirement [b]) Variable Cost Variances (LO 16-5, 7)

Information on Grand Corporations direct materials costs follows.

| Quantities of chemical Y purchased and used | 20,300 | gallons | |

| Actual cost of chemical Y used | $ | 430,500 | |

| Standard price per gallon of chemical Y | $ | 23.60 | |

| Standard quantity of chemical Y allowed | 18,700 | gallons | |

Grand Corporation has no materials inventories.

Required:

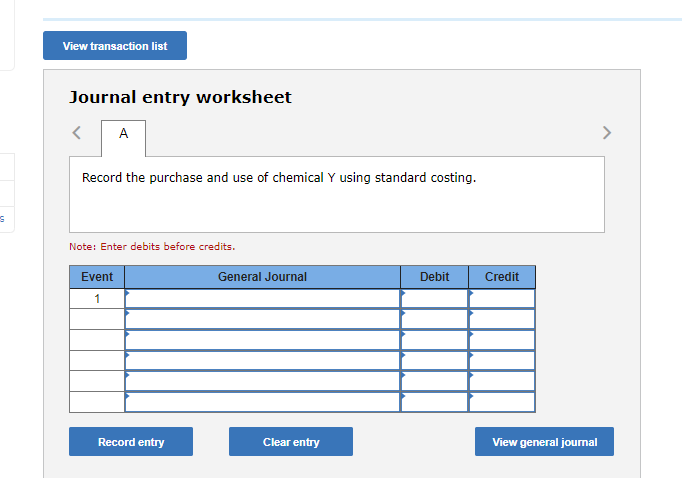

a. What were Grand Corporations direct materials price and efficiency variances? b. (Appendix) Prepare the journal entries to record the purchase and use of chemical Y using standard costing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started