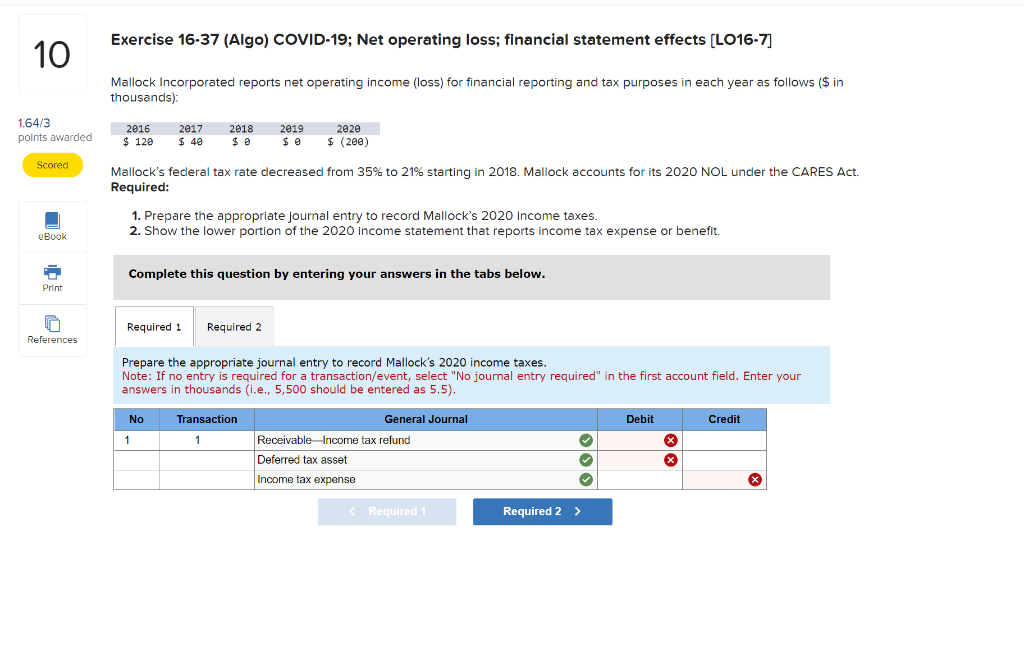

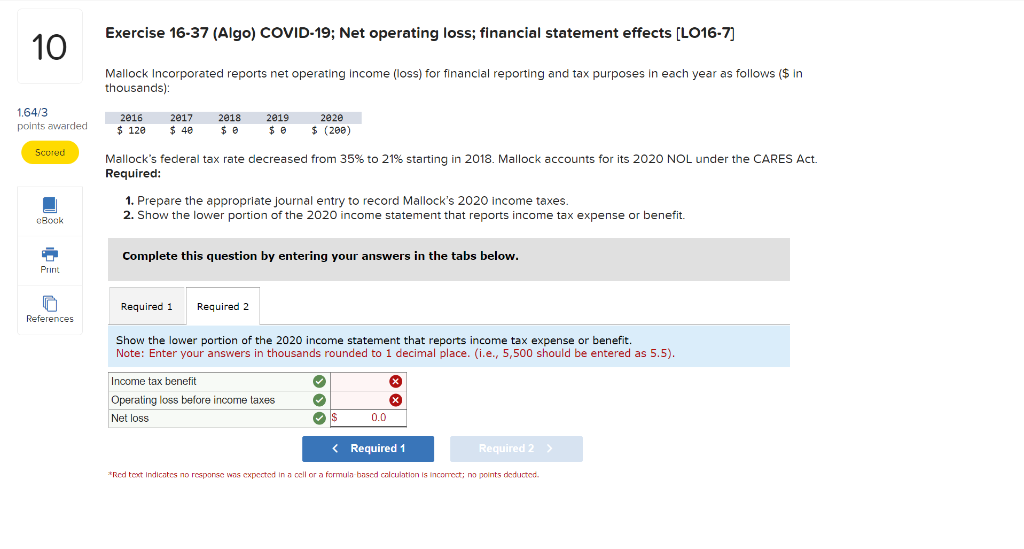

Exercise 16-37 (Algo) COVID-19; Net operating loss; financial statement effects [LO16-7] Mallock Incorporated reports net operating income (loss) for financial reporting and tax purposes in each year as follows (\$ in thousands): Mallock's fecleral tax rate decreased from 35\% to 21% starting in 2018 . Mallock accounts for its 2020 NOL under the CARES Act. Required: 1. Prepare the appropriate journal entry to record Mallock's 2020 income taxes. 2. Show the lower portion of the 2020 income statement that reports income tax expense or benefit. Complete this question by entering your answers in the tabs below. Prepare the appropriate journal entry to record Mallock's 2020 income taxes. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands (i.e., 5,500 should be entered as 5.5). Exercise 16-37 (Algo) COVID-19; Net operating loss; financial statement effects [LO16-7] Mallock Incorporated reports net operating income (loss) for financial reporting and tax purposes in each year as follows (\$ in thousands): Mallock's federal tax rate decreased from 35% to 21% starting in 2018. Mallock accounts for its 2020 NOL under the CARES Act. Required: 1. Prepare the appropriate journal entry to record Mallock's 2020 income taxes. 2. Show the lower portion of the 2020 income statement that reports income tax expense or benefit. Complete this question by entering your answers in the tabs below. Show the lower portion of the 2020 income statement that reports income tax expense or benefit. Note: Enter your answers in thousands rounded to 1 decimal place. (i.e., 5,500 should be entered as 5.5). *Red teat indiestes no resporse was experted in a cell or a formula-bascd calculation is incorrot; no points deducted. Exercise 16-37 (Algo) COVID-19; Net operating loss; financial statement effects [LO16-7] Mallock Incorporated reports net operating income (loss) for financial reporting and tax purposes in each year as follows (\$ in thousands): Mallock's fecleral tax rate decreased from 35\% to 21% starting in 2018 . Mallock accounts for its 2020 NOL under the CARES Act. Required: 1. Prepare the appropriate journal entry to record Mallock's 2020 income taxes. 2. Show the lower portion of the 2020 income statement that reports income tax expense or benefit. Complete this question by entering your answers in the tabs below. Prepare the appropriate journal entry to record Mallock's 2020 income taxes. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands (i.e., 5,500 should be entered as 5.5). Exercise 16-37 (Algo) COVID-19; Net operating loss; financial statement effects [LO16-7] Mallock Incorporated reports net operating income (loss) for financial reporting and tax purposes in each year as follows (\$ in thousands): Mallock's federal tax rate decreased from 35% to 21% starting in 2018. Mallock accounts for its 2020 NOL under the CARES Act. Required: 1. Prepare the appropriate journal entry to record Mallock's 2020 income taxes. 2. Show the lower portion of the 2020 income statement that reports income tax expense or benefit. Complete this question by entering your answers in the tabs below. Show the lower portion of the 2020 income statement that reports income tax expense or benefit. Note: Enter your answers in thousands rounded to 1 decimal place. (i.e., 5,500 should be entered as 5.5). *Red teat indiestes no resporse was experted in a cell or a formula-bascd calculation is incorrot; no points deducted