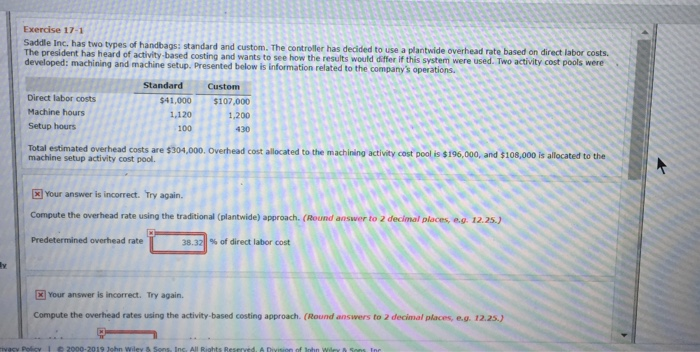

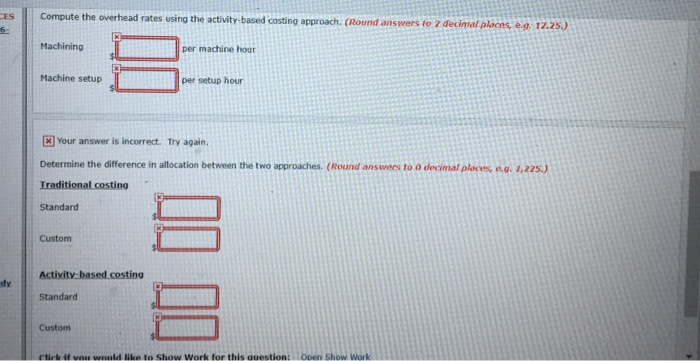

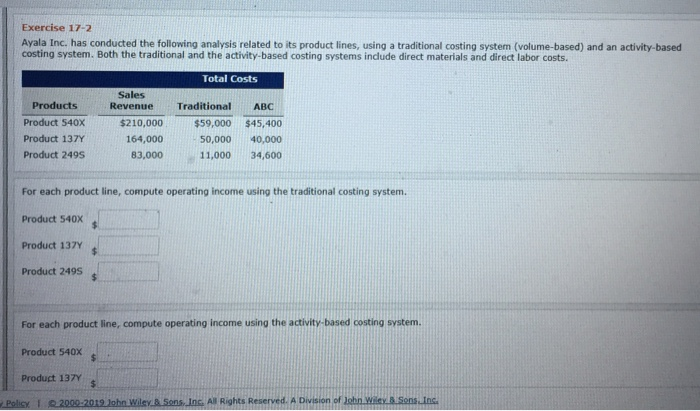

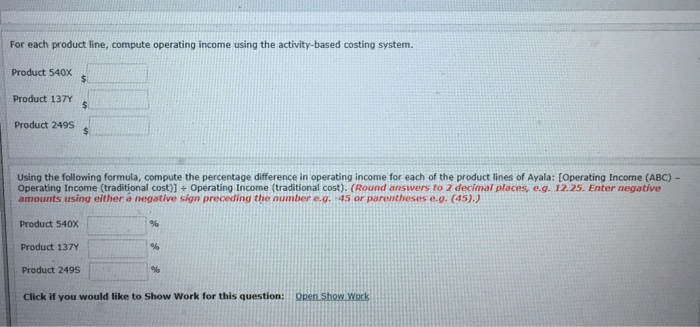

Exercise 17-1 inc, has two types of handbags: standard and custom. The controller has decided to use a plantwide overhead rate based on direct labor costs. activity based costing and wants to see how the results would difer if this system were used. Two activity cost pools were developed: machining and machine setup. Presented below is information related to the company's operations. StandardCustom Direct labor costs Machine hours Setup hours 41,000 $107,000 1,200 430 1,120 100 Total estimated overhead costs are $304,000. Overhead cost allocated machine setup activity cost pool. XYour answer is incorrect. Try again. Compute the overhead rate using the traditional (olantwide) approach. (Round answer to z decimal places, eg. 12.25.) Predetermined ovwerhead rate 38.321 % of direct labor cost X Your answer is incorrect. Try again. Compute the overhead rates using the activity-based costing approach. (Round answers to 2 decimal places, e.g. 12.25.) ES Compute the overhead rates using the activity-based costing approach. (Round answers to 2 decimal places, e.g. 12.25 Machining per machine hour Machine setup per setup hour Your answer is incorrect. Try aqgain. Determine the difference in allocation between the two approaches. (Round answers to o decimal places, e.g.1,225.) Iraditional costing Standarod Custom Standard Custom Work Exercise 17-2 Ayala Inc. has conducted the fllowing analysis related to its product lines, using a traditional costing system (volume-based) and an activity-based costing system. Both the traditional and the activity-based costing systems indude direct materials and direct labor costs. Total Costs Sales Reven Products Product 540X Product 137Y Product 249s ue Traditional ABC $210,000$59,000 $45,400 50,000 40,000 11,000 34,600 164,000 83,000 For each product line, compute operating income using the traditional costing system. Product 540X Product 137Y Product 2495 For each product line, compute operating income using the activity-based costing svstem Product 540X Product 137Y For each product line, compute operating income using the activity-based costing system. Product 540x Product 137Y Product 249S s s s Using the following formula, compute the percentage difference in operating income for each of the product lines of Ayala: [Operating Income (ABC) - Operating Income (traditional cost)] Operating Income (traditional cost) (Round answers to 2 decimal places, eg. 12.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Product 540x | Product 137Y Product 249s Click if you would like to Show Work for this question: Open Show Work