Answered step by step

Verified Expert Solution

Question

1 Approved Answer

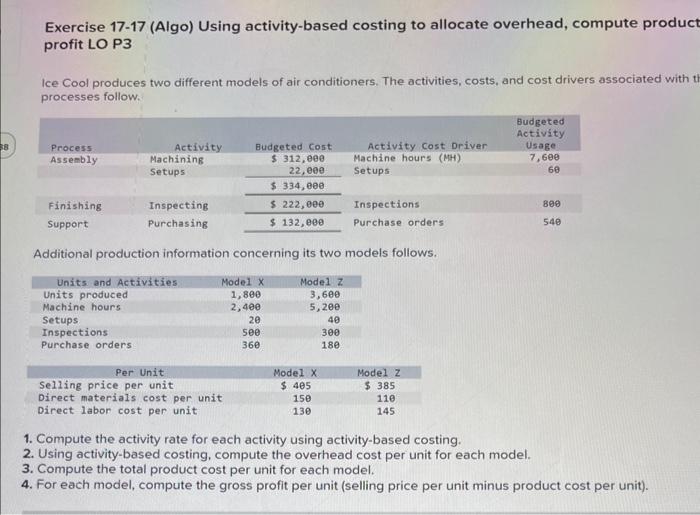

Exercise 17-17 (Algo) Using activity-based costing to allocate overhead, compute product profit LO P3 Ice Cool produces two different models of air conditioners. The

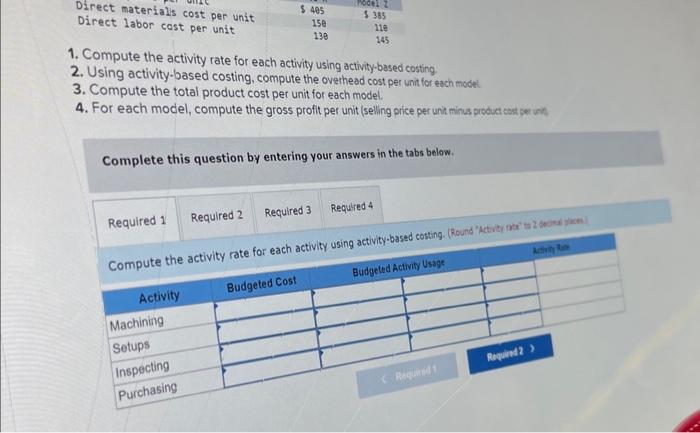

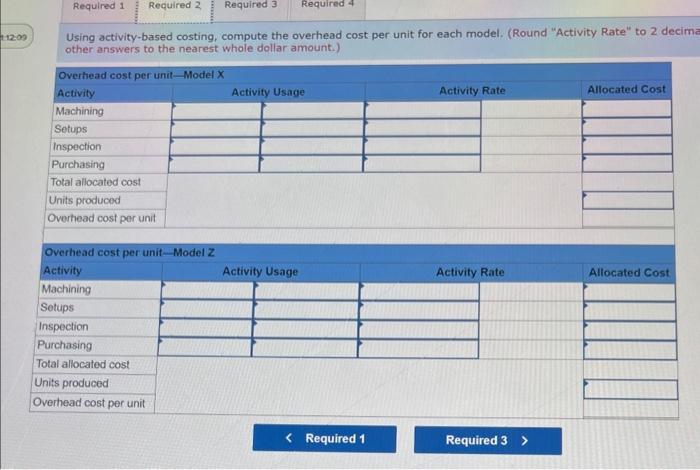

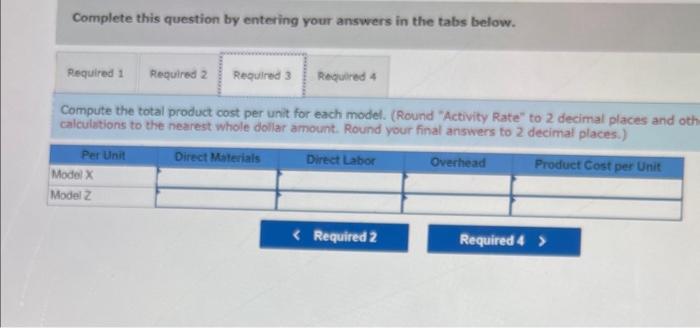

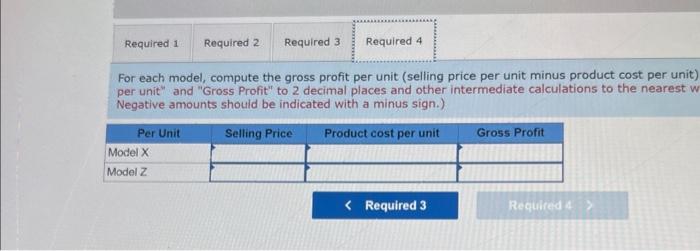

Exercise 17-17 (Algo) Using activity-based costing to allocate overhead, compute product profit LO P3 Ice Cool produces two different models of air conditioners. The activities, costs, and cost drivers associated with th processes follow. Budgeted Activity 8 Process Assembly Activity Machining Setups Budgeted Cost $ 312,000 22,000 Activity Cost Driver Machine hours (MH) Setups Usage 7,600 60 $ 334,000 Finishing Support Inspecting Purchasing $ 222, Inspections 800 $ 132,000 Purchase orders 540 Additional production information concerning its two models follows. Units and Activities. Units produced Machine hours Setups Inspections Purchase orders Model X 1,800 Model Z 3,600 2,400 5,200 20 40 500 300 360 180 Per Unit Model X Selling price per unit $ 405 Direct materials cost per unit 150 Direct labor cost per unit 130 Model Z $ 385 110 145 1. Compute the activity rate for each activity using activity-based costing. 2. Using activity-based costing, compute the overhead cost per unit for each model. 3. Compute the total product cost per unit for each model. 4. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Direct materials cost per unit Direct labor cost per unit Model Z $405 $385 150 110 138 145 1. Compute the activity rate for each activity using activity-based costing 2. Using activity-based costing, compute the overhead cost per unit for each model 3. Compute the total product cost per unit for each model. 4. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the activity rate for each activity using activity-based costing. (Round "Activity rate" to 2 decimal places Activity Machining Setups Inspecting Purchasing Budgeted Cost Budgeted Activity Usage Required 1 Required 2 > Activity Rate 12:09 Required 1 Required 2 Required 3 Required 4 Using activity-based costing, compute the overhead cost per unit for each model. (Round "Activity Rate" to 2 decima other answers to the nearest whole dollar amount.) Overhead cost per unit-Model X Activity Machining Setups Inspection Purchasing Total allocated cost Units produced Overhead cost per unit Overhead cost per unit-Model Z Activity Machining Setups Inspection Purchasing Total allocated cost Units produced Overhead cost per unit Activity Usage Activity Rate Allocated Cost Activity Usage Activity Rate Allocated Cost < Required 1 Required 3 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the total product cost per unit for each model. (Round "Activity Rate" to 2 decimal places and oth calculations to the nearest whole dollar amount. Round your final answers to 2 decimal places.) Per Unit Model X Model Z Direct Materials Direct Labor Overhead Product Cost per Unit Required 1 Required 2 Required 3 Required 4 For each model, compute the gross profit per unit (selling price per unit minus product cost per unit) per unit" and "Gross Profit" to 2 decimal places and other intermediate calculations to the nearest w Negative amounts should be indicated with a minus sign.) Per Unit Model X Model Z Selling Price Product cost per unit Gross Profit < Required 3 Required 4>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started