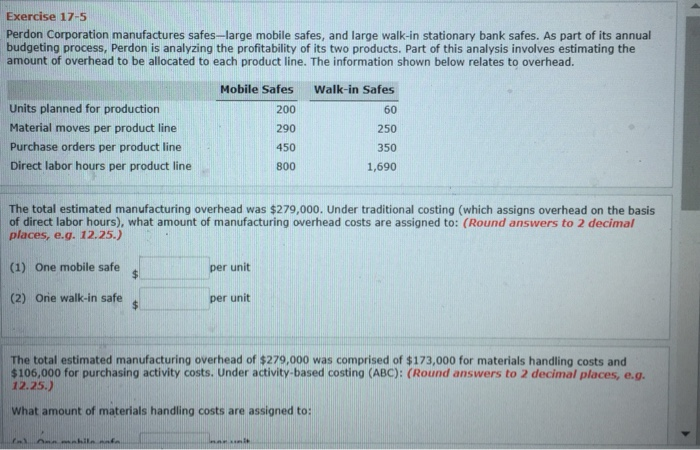

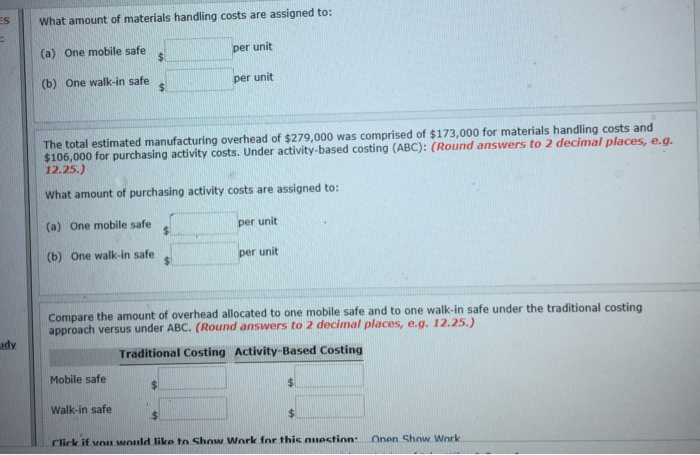

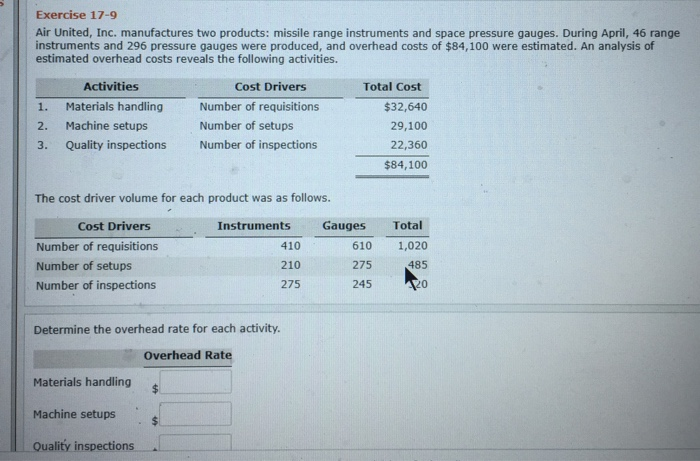

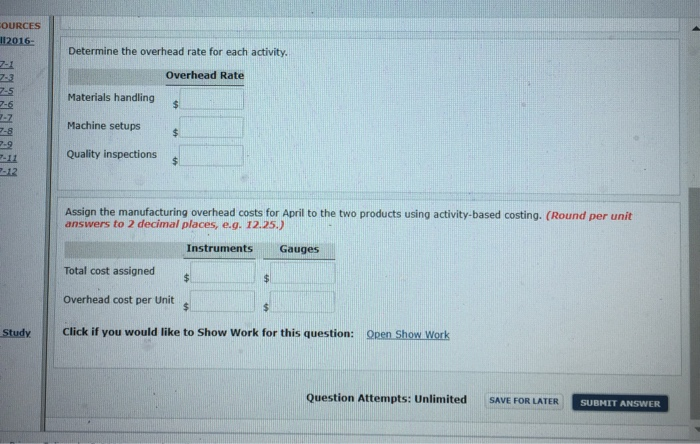

Exercise 17-5 Perdon Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Perdon is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be allocated to each product line. The information shown below relates to overhead. Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line Mobile Safes 200 290 450 800 Walk-in Safes 60 250 350 1,690 The total estimated manufacturing overhead was $279,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, e.g. 12.25.) (1) One mobile safe (2) Onie walk-in safe per unit per unit The total estimated manufacturing overhead of $279,000 was comprised of $173,000 for materials handling costs and $106,000 for purchasing activity costs. Under activity-based costing (ABC): (Round answers to 2 decimal places, e.g 12.25.) What amount of materials handling costs are assigned to: What amount of materials handling costs are assigned to: (a) One mobile safe per unit (b) One walk-in safe per unit The total estimated manufacturing overhead of $279,000 was comprised of $173,00o for materials handling costs and $106,000 for purchasing activity costs. Under activity-based costing (ABC): (Round answers to 2 decimal places, e.g. 12.25.) What amount of purchasing activity costs are assigned to: (a) One mobile safe (b) One walk-in safe per unit per unit Compare the amount of overhead allocated to one mobile safe and to one walk-in safe under the traditional costing approach versus under ABC. (Round answers to 2 decimal places, e.g. 12.25.) dy Traditional Costing Activity-Based Costing Mobile safe Walk-in safe Click if von wonld like to Show Work for this nuection: Onen Show Work Exercise 17-9 Air United, Inc. manufactures two products: missile range instruments and space pressure gauges. During April, 46 range instruments and 296 pressure gauges were produced, and overhead costs of $84,100 were estimated. An analysis of estimated overhead costs reveals the following activities. Activities Materials handlingNumber of requisitions Machine setups Quality inspections Number of inspections Cost Drivers Total Cost 1. 2. 3. $32,640 29,100 22,360 $84,100 Number of setups The cost driver volume for each product was as follows. Cost Drivers Instruments Gauges Total Number of requisitions Number of setups Number of inspections 410 210 275 610 1,020 275 245 485 0 Determine the overhead rate for each activity. Overhead Rate Materials handling Machine setups Quality inspections OURCES 12016- Determine the overhead rate for each activity. Overhead Rate 7-5 Materials handling Machine setups Quality inspectionss s 7-11 Assign the manufacturing overhead costs for April to the two products using activity-based costing. (Round per unit answers to 2 decimal places, e.g. 12.25.) Instruments Gauges Total cost assigned Overhead cost per Unit Study Click if you would like to Show Work for this question: Open Show Work Question Attempts: Unlimited