Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 17-9 (Algo) Analyzing risk and capital structure LO P3 Required information Use the following information for the Exercises below. (Algo) [The following information applies

Exercise 17-9 (Algo) Analyzing risk and capital structure LO P3

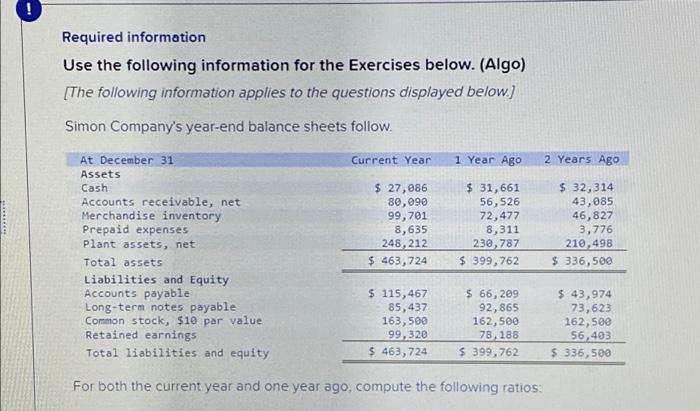

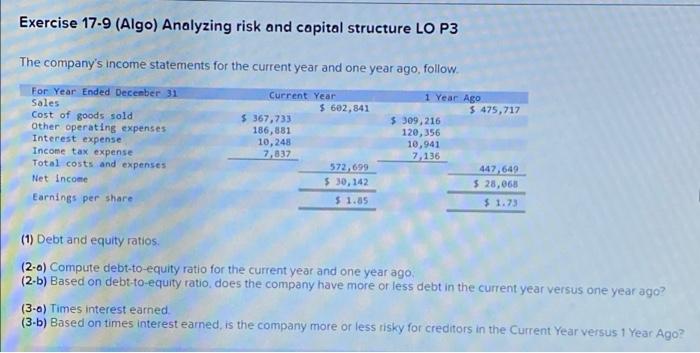

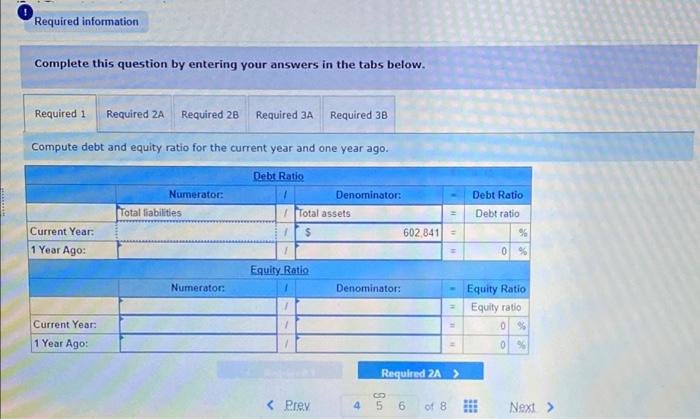

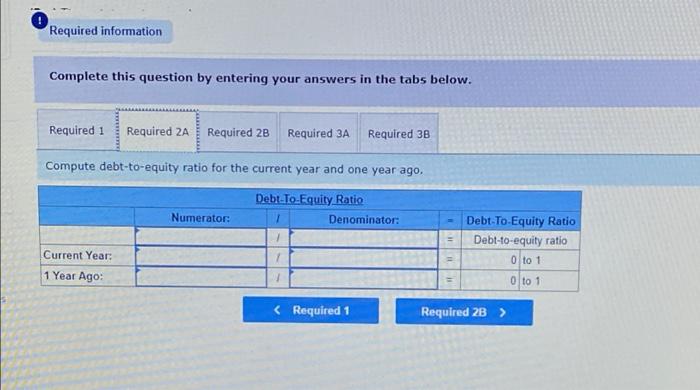

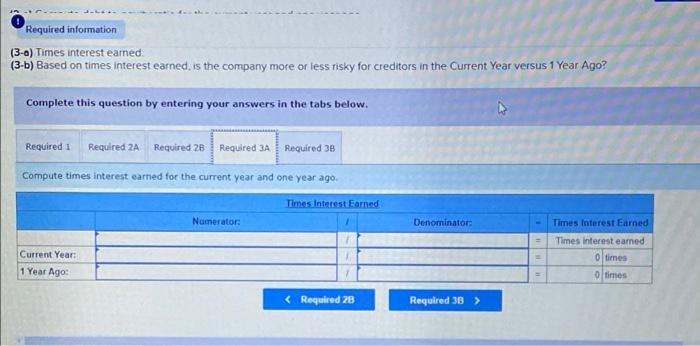

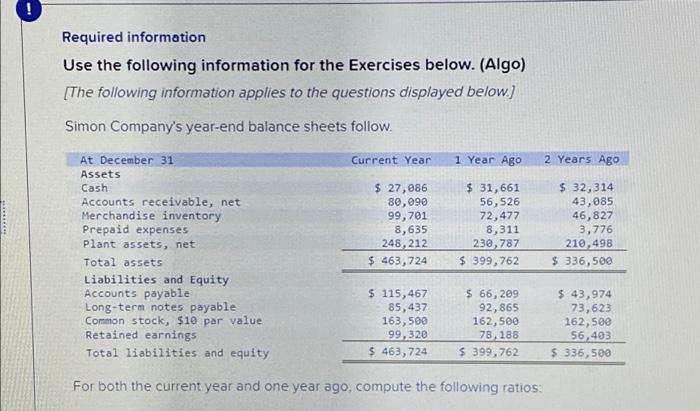

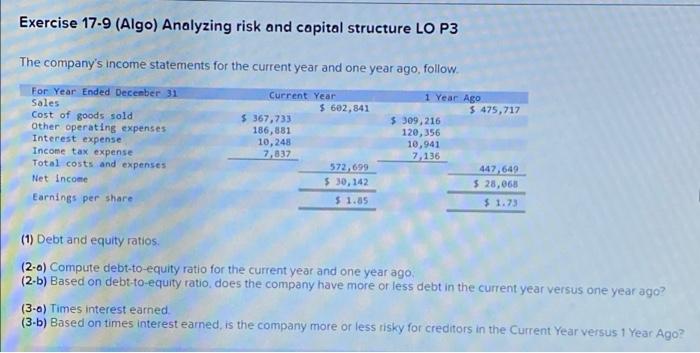

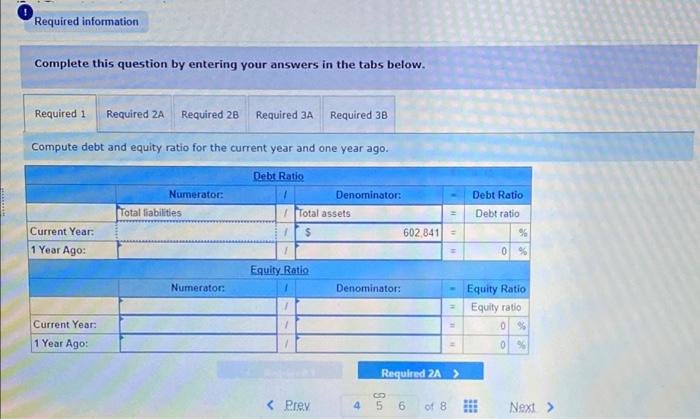

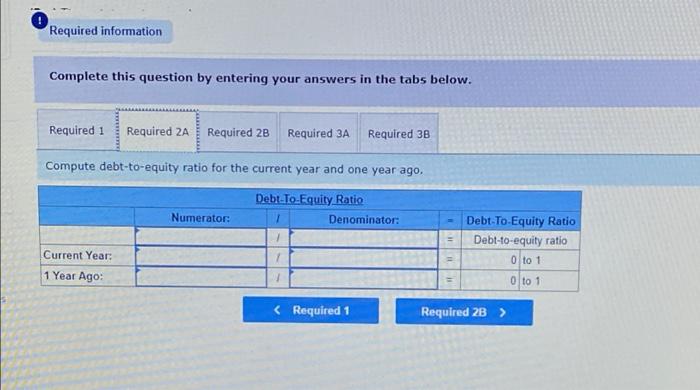

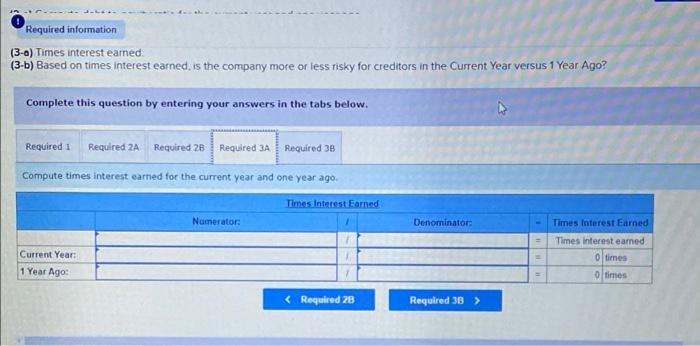

Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 27,086 80,090 99,701 8,635 248,212 $ 463,724 $ 31,661 56, 526 72,477 8,311 230,787 $ 399,762 $ 32,314 43,085 46,827 3,776 210.498 $ 336,500 $ 115,467 85,437 163,500 99,320 $ 463,724 $ 66,209 92,865 162,500 78,188 $ 399,762 $ 43,974 73,623 162,500 56,403 $ 336,500 For both the current year and one year ago, compute the following ratios: Exercise 17-9 (Algo) Analyzing risk and capital structure LO P3 The company's income statements for the current year and one year ago, follow. For Year Ended December 31 Current Year 1 Year Ago Sales $ 602,841 5.475,717 Cost of goods sold $ 367,733 $ 309,216 Other operating expenses 186,881 120,356 Interest expense 10,248 10,941 Income tax expense 7,837 7.136 Total costs and expenses 572,699 447,649 Net Income $ 30,142 $ 28,068 Earnings per share 51.85 $ 1.73 (1) Debt and equity ratios. (2-6) Compute debt-to-equity ratio for the current year and one year ago (2.b) Based on debt-to-equity ratio does the company have more or less debt in the current year versus one year ago? (3-0) Times interest earned (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? Required information Complete this question by entering your answers in the tabs below. Required 1 Required 2A Required 28 Required A Required 38 Compute debt and equity ratio for the current year and one year ago Debt Ratio Numerator Denominator: Debt Ratio Total liabilities Total assets Debt ratio 1 $ 602 841) = Current Year: 1 Year Ago: 0 % Equity Ratio Numerator: Denominator: ### Equity Ratio Equity ratio 05 0 % 11 Current Year: 1 Year Ago: = Required 2A Required information Complete this question by entering your answers in the tabs below. Required 1 Required 2A Required 2B Required 3A Required 3B Compute debt-to-equity ratio for the current year and one year ago Numerator: Debt-To-Equity Ratio Denominator: Debt To Equity Ratio Debt-to-equity ratio 0 to 1 1 Current Year: 1 Year Ago: 1 0 to 1 Required information (3-6) Times interest earned (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 1 Required 2A Required 26 Required 3A Required 38 Compute times interest earned for the current year and one year ago Times. Interest Earned Numerator: Denominator = Times Interest Earned Times interest eamed O times O times Current Year: 1 Year Ago:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started