Answered step by step

Verified Expert Solution

Question

1 Approved Answer

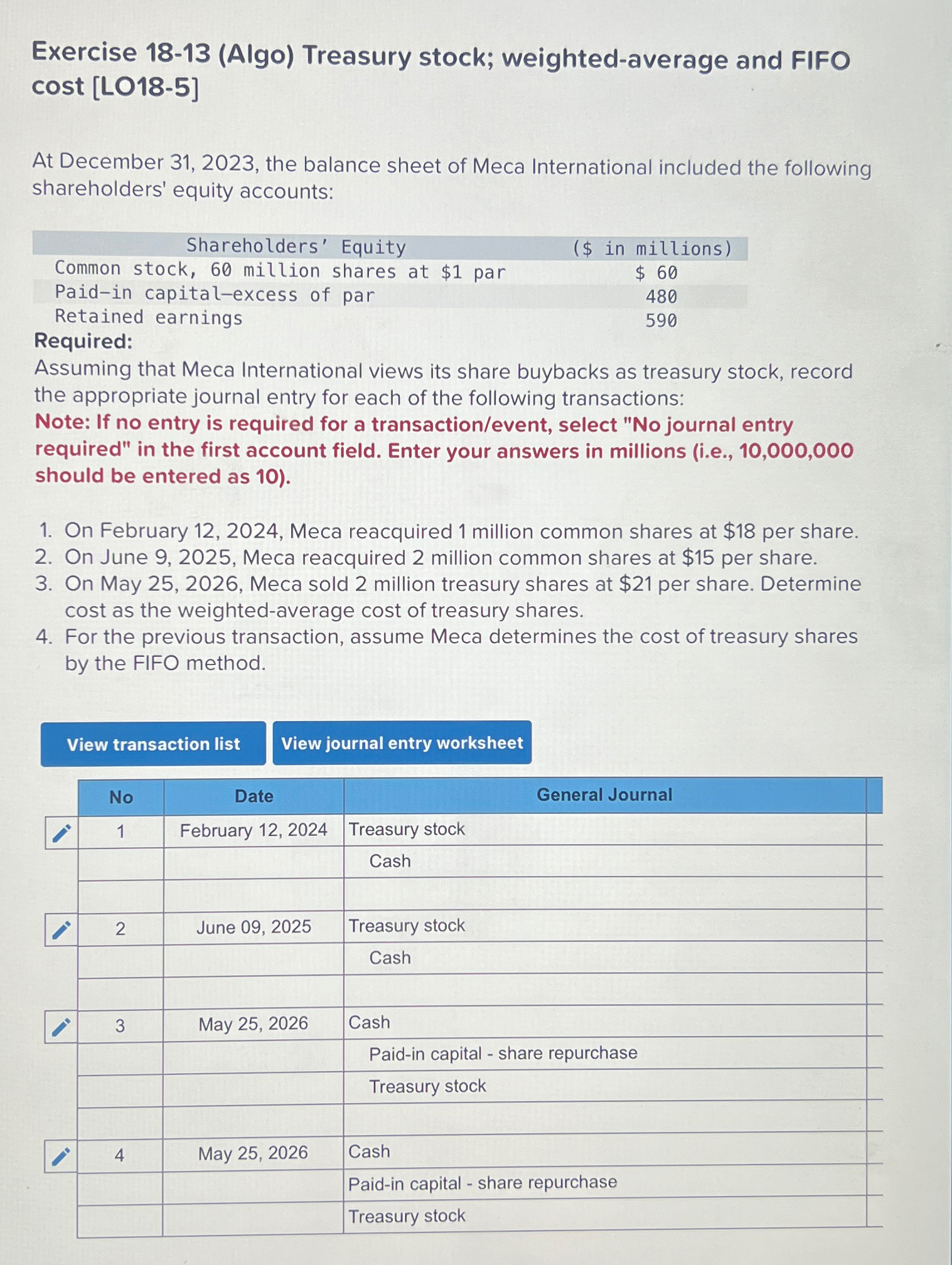

Exercise 18-13 (Algo) Treasury stock; weighted-average and FIFO cost [LO18-5] At December 31, 2023, the balance sheet of Meca International included the following shareholders'

Exercise 18-13 (Algo) Treasury stock; weighted-average and FIFO cost [LO18-5] At December 31, 2023, the balance sheet of Meca International included the following shareholders' equity accounts: Shareholders' Equity Common stock, 60 million shares at $1 par Paid-in capital-excess of par Retained earnings Required: ($ in millions) $ 60 480 590 Assuming that Meca International views its share buybacks as treasury stock, record the appropriate journal entry for each of the following transactions: Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). 1. On February 12, 2024, Meca reacquired 1 million common shares at $18 per share. 2. On June 9, 2025, Meca reacquired 2 million common shares at $15 per share. 3. On May 25, 2026, Meca sold 2 million treasury shares at $21 per share. Determine cost as the weighted-average cost of treasury shares. 4. For the previous transaction, assume Meca determines the cost of treasury shares by the FIFO method. View transaction list View journal entry worksheet No Date General Journal 1 February 12, 2024 Treasury stock Cash 2 June 09, 2025 Treasury stock Cash 3 May 25, 2026 Cash Paid-in capital - share repurchase Treasury stock 4 May 25, 2026 Cash Paid-in capital - share repurchase Treasury stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started