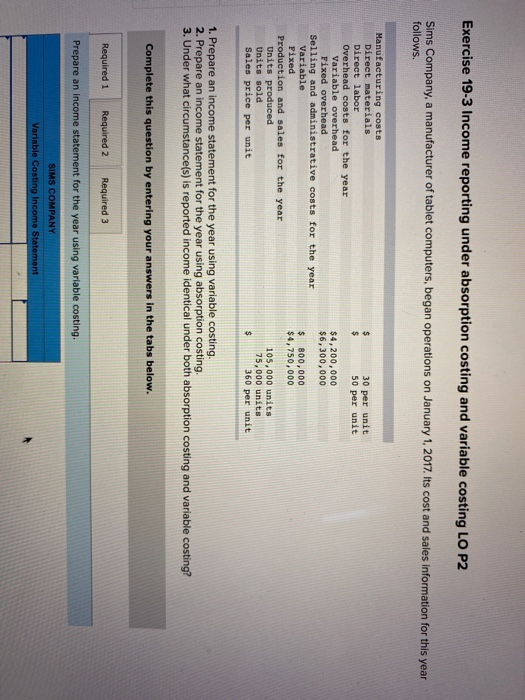

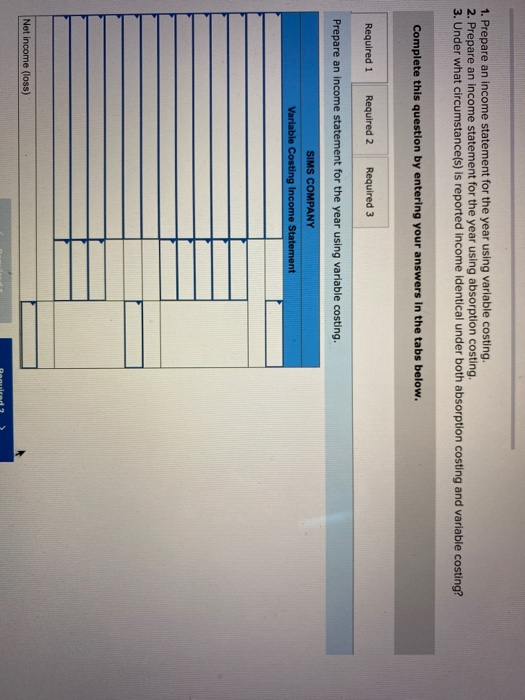

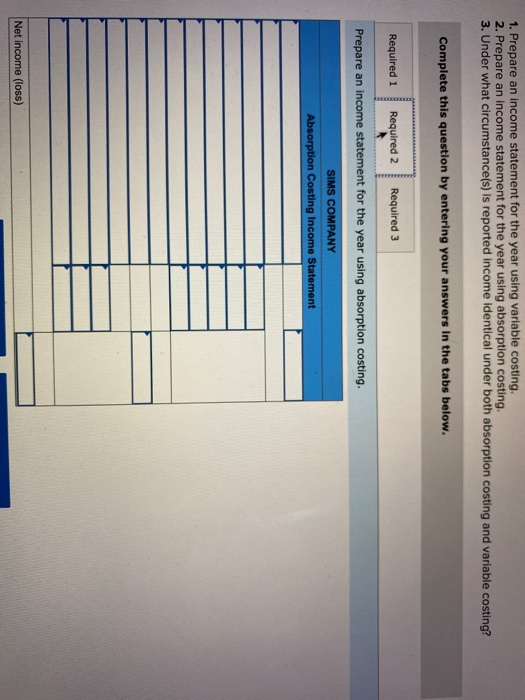

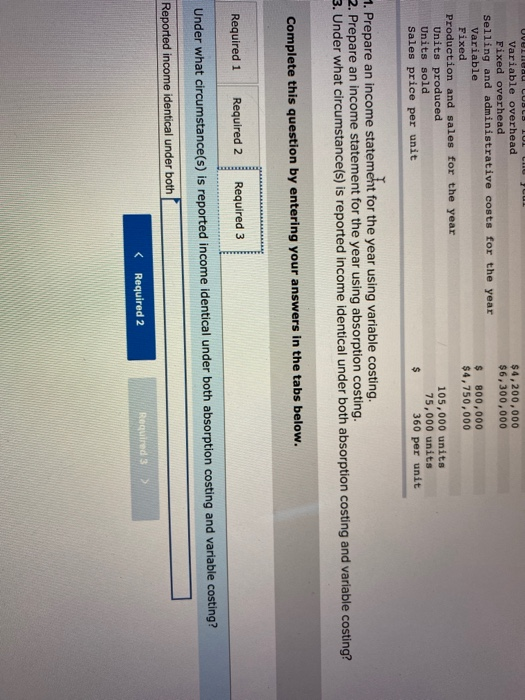

Exercise 19-3 Income reporting under absorption costing and variable costing LO P2 Sims Company, a manufacturer of tablet computers, began operations on January 1, 2017. Its cost and sales information for this year follows. 30 per unit 50 per unit $4,200,000 $6,300,000 Manufacturing costs Direct materials Direct labor Overhead costs for the year Variable overhead Fixed overhead Selling and administrative costs for the year Variable Fixed Production and sales for the year Units produced Units sold Sales price per unit $ 800,000 $4,750,000 105,000 units 75,000 units | 360 per unit 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. 3. Under what circumstance(s) is reported income identical under both absorption costing and variable costing? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. 3. Under what circumstance(s) is reported income identical under both absorption costing and variable costing? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Net income (loss) 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. 3. Under what circumstance(s) is reported income identical under both absorption costing and variable costing? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement for the year using absorption costing. SIMS COMPANY Absorption Costing Income Statement Net income (loss) $4,200,000 $6,300,000 OVOCAL Variable overhead Fixed overhead Selling and administrative costs for the year Variable Fixed Production and sales for the year Units produced Units sold Sales price per unit $ 800,000 $4,750,000 105,000 units 75,000 units 360 per unit 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. 3. Under what circumstance(s) is reported income identical under both absorption costing and variable costing? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Under what circumstance(s) is reported income identical under both absorption costing and variable costing? Reported income identical under both Required 2 Required 3 >