Answered step by step

Verified Expert Solution

Question

1 Approved Answer

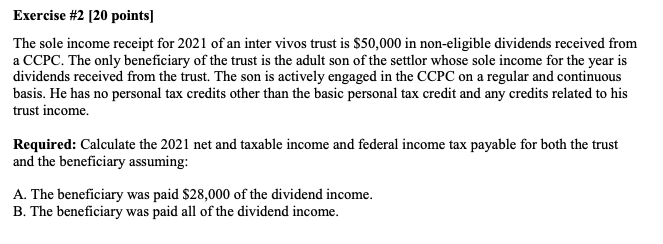

Exercise #2 [20 points] The sole income receipt for 2021 of an inter vivos trust is $50,000 in non-eligible dividends received from a CCPC.

Exercise #2 [20 points] The sole income receipt for 2021 of an inter vivos trust is $50,000 in non-eligible dividends received from a CCPC. The only beneficiary of the trust is the adult son of the settlor whose sole income for the year is dividends received from the trust. The son is actively engaged in the CCPC on a regular and continuous basis. He has no personal tax credits other than the basic personal tax credit and any credits related to his trust income. Required: Calculate the 2021 net and taxable income and federal income tax payable for both the trust and the beneficiary assuming: A. The beneficiary was paid $28,000 of the dividend income. B. The beneficiary was paid all of the dividend income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started