Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 2: Choosing Among Projects (40 points) Three mutually exclusive projects are being considered for a remote river valley: Project R, a recreational facility, has

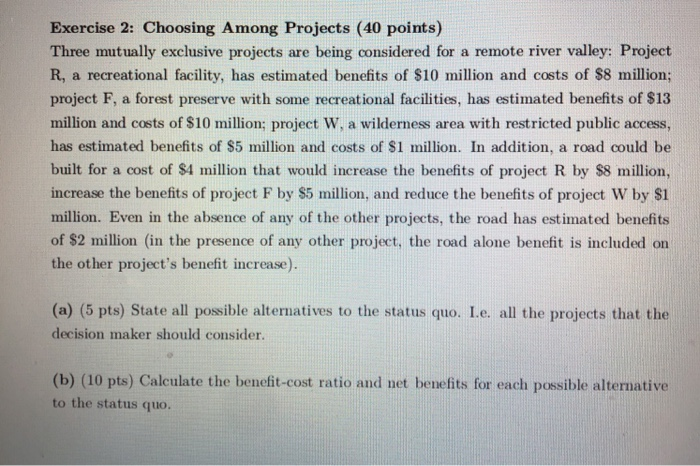

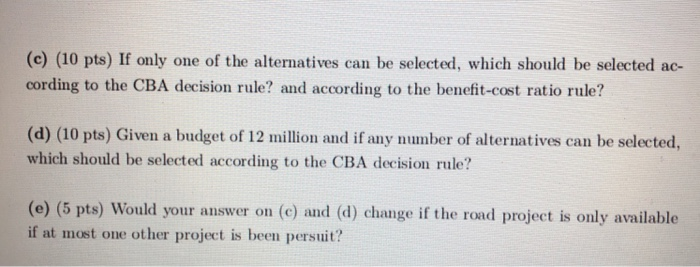

Exercise 2: Choosing Among Projects (40 points) Three mutually exclusive projects are being considered for a remote river valley: Project R, a recreational facility, has estimated benefits of $10 million and costs of $8 million; project F, a forest preserve with some recreational facilities, has estimated benefits of $13 million and costs of $10 million; project W. a wilderness area with restricted public access, has estimated benefits of $5 million and costs of $1 million. In addition, a road could be built for a cost of $4 million that would increase the benefits of project R by $8 million, increase the benefits of project F by $5 million, and reduce the benefits of project W by $1 million. Even in the absence of any of the other projects, the road has estimated benefits of $2 million (in the presence of any other project, the road alone benefit is included on the other project's benefit increase). (a) (5 pts) State all possible alternatives to the status quo. I.e. all the projects that the decision maker should consider. (b) (10 pts) Calculate the benefit-cost ratio and net benefits for each possible alternative to the status quo. (c) (10 pts) If only one of the alternatives can be selected, which should be selected ac- cording to the CBA decision rule? and according to the benefit-cost ratio rule? (d) (10 pts) Given a budget of 12 million and if any number of alternatives can be selected, which should be selected according to the CBA decision rule? (e) (5 pts) Would your answer on (C) and (d) change if the road project is only available if at most one other project is been persuit

Exercise 2: Choosing Among Projects (40 points) Three mutually exclusive projects are being considered for a remote river valley: Project R, a recreational facility, has estimated benefits of $10 million and costs of $8 million; project F, a forest preserve with some recreational facilities, has estimated benefits of $13 million and costs of $10 million; project W. a wilderness area with restricted public access, has estimated benefits of $5 million and costs of $1 million. In addition, a road could be built for a cost of $4 million that would increase the benefits of project R by $8 million, increase the benefits of project F by $5 million, and reduce the benefits of project W by $1 million. Even in the absence of any of the other projects, the road has estimated benefits of $2 million (in the presence of any other project, the road alone benefit is included on the other project's benefit increase). (a) (5 pts) State all possible alternatives to the status quo. I.e. all the projects that the decision maker should consider. (b) (10 pts) Calculate the benefit-cost ratio and net benefits for each possible alternative to the status quo. (c) (10 pts) If only one of the alternatives can be selected, which should be selected ac- cording to the CBA decision rule? and according to the benefit-cost ratio rule? (d) (10 pts) Given a budget of 12 million and if any number of alternatives can be selected, which should be selected according to the CBA decision rule? (e) (5 pts) Would your answer on (C) and (d) change if the road project is only available if at most one other project is been persuit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started