Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 2 (Exam Spring 2020) Entertain You Inc. is an American company that operates in two businesses, Entertainment and Cable TV. The company gets

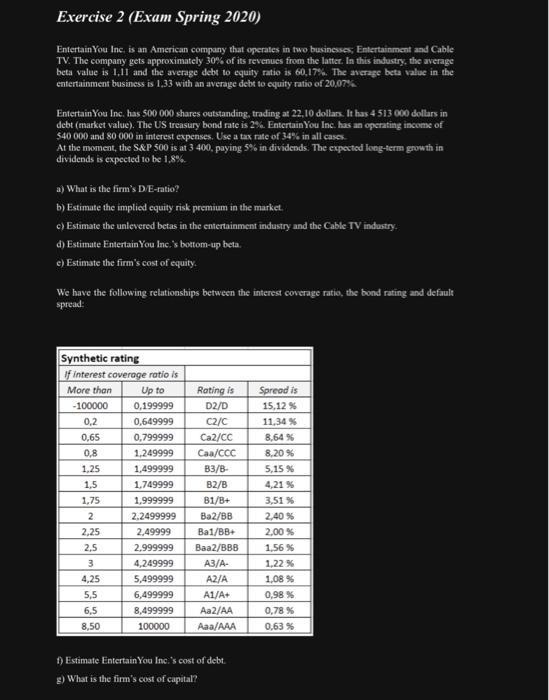

Exercise 2 (Exam Spring 2020) Entertain You Inc. is an American company that operates in two businesses, Entertainment and Cable TV. The company gets approximately 30% of its revenues from the latter. In this industry, the average beta value is 1,11 and the average debt to equity ratio is 60,17%. The average beta value in the entertainment business is 1,33 with an average debt to equity ratio of 20,07% Entertain You Inc. has 500 000 shares outstanding, trading at 22,10 dollars. It has 4 513 000 dollars in debt (market value). The US treasury bond rate is 2%. Entertain You Inc. has an operating income of $40 000 and 80 000 in interest expenses. Use a tax rate of 34% in all cases. At the moment, the S&P 500 is at 3 400, paying 5% in dividends. The expected long-term growth in dividends is expected to be 1,8% a) What is the firm's D/E-ratio? b) Estimate the implied equity risk premium in the market. c) Estimate the unlevered betas in the entertainment industry and the Cable TV industry. d) Estimate Entertain You Inc.'s bottom-up beta. e) Estimate the firm's cost of equity. We have the following relationships between the interest coverage ratio, the bond rating and default spread: Synthetic rating If interest coverage ratio is More than Up to Rating is 0,199999 D2/D 0,649999 C2/C 0,79999 Ca2/CC 1,249999 Caa/CCC 1,499999 B3/B- 1,749999 82/B 1,999999 B1/B+ 2,2499999 Ba2/BB 2,49999 Bal/BB+ 2,999999 Baa2/BBB 4,249999 A3/A- 5,499999 A2/A 6,499999 A1/A+ 8,499999 Aa2/AA 100000 Aaa/AAA -100000 0,2 0,65 0,8 1,25 1,5 1,75 2 2,25 2,5 3 4,25 5,5 6,5 8,50 f) Estimate Entertain You Inc.'s cost of debt. g) What is the firm's cost of capital? Spread is 15,12 % 11,34 % 8,64 % 8,20 % 5,15% 4,21 % 3,51 % 2,40 % 2,00 % 1,56% 1,22 % 1,08 % 0,98 % 0,78 % 0,63 %

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a The firms DE ratio is 6017 b The implied equity risk premi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started