Answered step by step

Verified Expert Solution

Question

1 Approved Answer

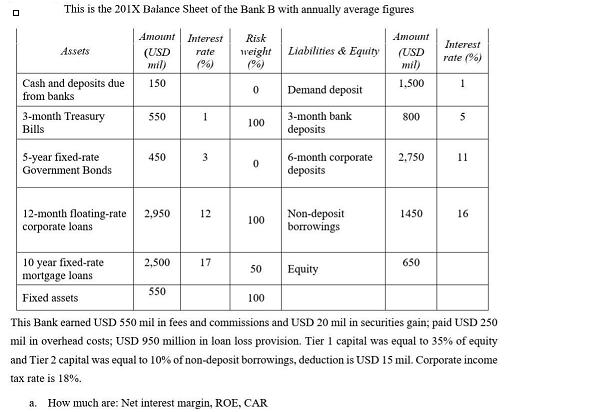

This is the 201X Balance Sheet of the Bank B with annually average figures Amount Interest Risk Amount Interest weight (%) Liabilities & Equity

This is the 201X Balance Sheet of the Bank B with annually average figures Amount Interest Risk Amount Interest weight (%) Liabilities & Equity (USD mil) (USD mil) Assets rate rate (%) (%) Cash and deposits due from banks 150 1.500 1 Demand deposit 3-month Treasury Bills 550 1. 3-month bank 800 100 deposits 5-year fixed-rate Government Bonds 6-month corporate deposits 450 3 2,750 11 12-month floating-rate corporate loans 2,950 Non-deposit borrowings 12 1450 16 100 10 year fixed-rate mortgage loans 2,500 17 650 50 Equity 550 Fixed assets 100 This Bank earned USD 550 mil in fees and commissions and USD 20 mil in securities gain; paid USD 250 mil in overhead costs; USD 950 million in loan loss provision. Tier 1 capital was equal to 35% of equity and Tier 2 capital was equal to 10% of non-deposit borrowings, deduction is USD 15 mil. Corporate income tax rate is 18%. a. How much are: Net interest margin, ROE, CAR

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Bank Bs Net interest margin ROE and CAR are given below Net interest margin is the difference be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started