Question

Exercise 2-12 Selected transactions for Alvarado Company during its first month in business are presented below. Sept. 1 Invested $10,000 cash in the business in

Exercise 2-12

Selected transactions for Alvarado Company during its first month in business are presented below.

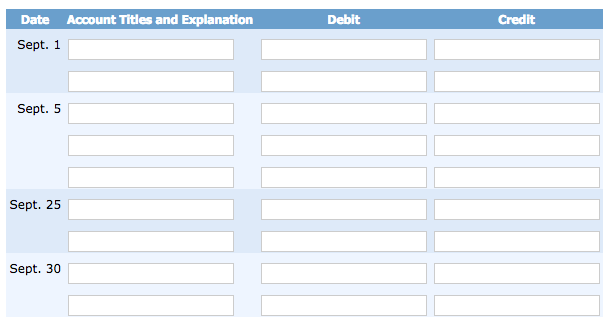

Sept. 1 Invested $10,000 cash in the business in exchange for common stock.

5 Purchased equipment for $10,000 paying $2,000 in cash and the balance on account.

25 Paid $1,000 cash on balance owed for equipment.

30 Declared and paid a $500 cash dividend.

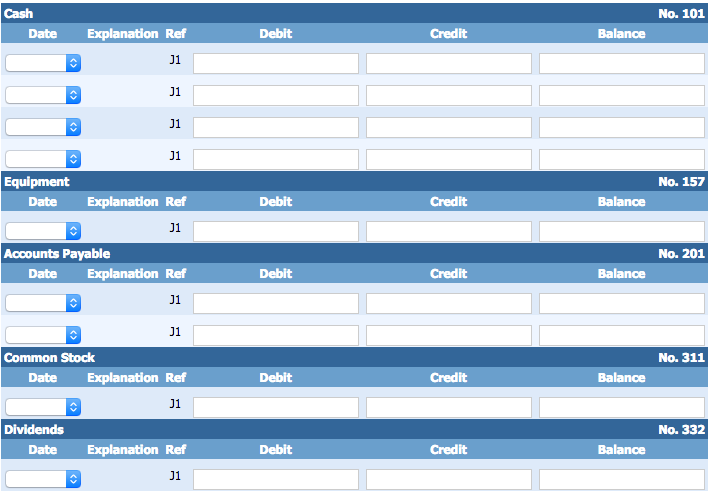

Alvarados chart of accounts shows No. 101 Cash, No. 157 Equipment, No. 201 Accounts Payable, No. 311 Common Stock, and No. 332 Dividends.

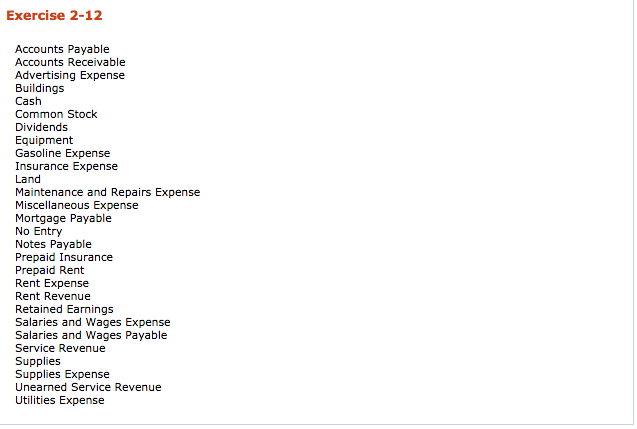

Accounts list:

Journalize the transactions.

Post the transactions using the standard account form.

This is all one question, thank you for any help!!

Exercise 2-12 Accounts Payable Accounts Receivable Advertising Expense Buildings Cash Common Stock Dividends Equipment Gasoline Expense Insurance Expense Land Maintenance and Repairs Expense Miscellaneous Expense Mortgage Payable No Entry Notes Payable Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Service Revenue Supplies Supplies Expense Unearned Service Revenue Utilities ExpenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started