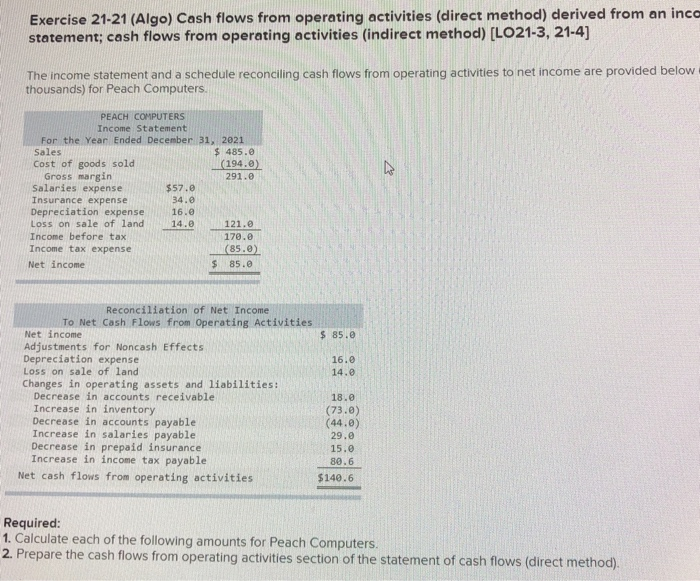

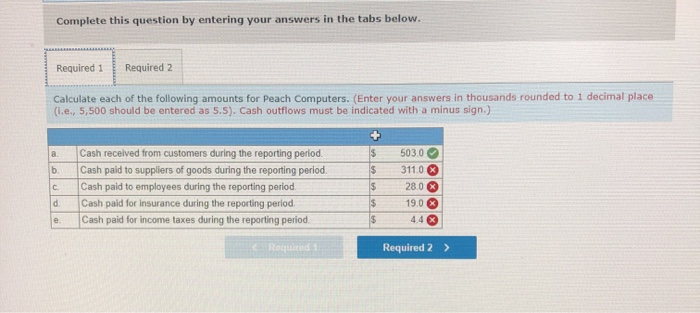

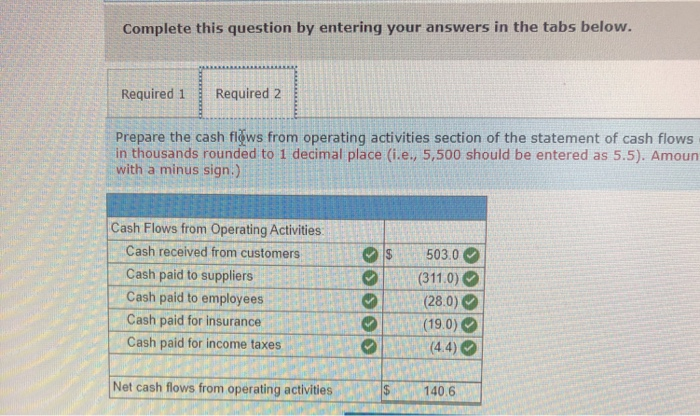

Exercise 21-21 (Algo) Cash flows from operating activities (direct method) derived from an inca statement; cash flows from operating activities (indirect method) [LO21-3, 21-4) The income statement and a schedule reconciling cash flows from operating activities to net income are provided below thousands) for Peach Computers. IN PEACH COMPUTERS Income Statement For the Year Ended December 31, 2021 Sales $ 485.0 Cost of goods sold (194.0) Gross margin 291.0 Salaries expense $57.0 Insurance expense 34. Depreciation expense 16.0 Loss on sale of land 14.0 121. Income before tax 170.0 Income tax expense (85.) Net income $ 85.0 $ 85.0 16. 14.9 Reconciliation of Net Income To Net Cash Flows from Operating Activities Net income Adjustments for Noncash Effects Depreciation expense Loss on sale of land Changes in operating assets and liabilities: Decrease in accounts receivable Increase in inventory Decrease in accounts payable Increase in salaries payable Decrease in prepaid insurance Increase in income tax payable Net cash flows from operating activities 18.0 (73.0) (44.0 29.0 15.0 80.6 $140.6 Required: 1. Calculate each of the following amounts for Peach Computers. 2. Prepare the cash flows from operating activities section of the statement of cash flows (direct method). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate each of the following amounts for Peach Computers. (Enter your answers in thousands rounded to 1 decimal place (1.e., 5,500 should be entered as 5.5). Cash outflows must be indicated with a minus sign.) a $ $ b IC Cash received from customers during the reporting period. Cash paid to suppliers of goods during the reporting period. Cash paid to employees during the reporting period. Cash paid for insurance during the reporting period. Cash paid for income taxes during the reporting period. $ 5030 311.0 X 28.0 19.0 X 4.4 % d. $ $ Required 1 Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the cash flows from operating activities section of the statement of cash flows in thousands rounded to 1 decimal place (i.e., 5,500 should be entered as 5.5). Amoun with a minus sign.) Cash Flows from Operating Activities Cash received from customers Cash paid to suppliers Cash paid to employees Cash paid for insurance Cash paid for income taxes >>> >> 503.0 (311.0) (28.0) (19.0) (4.4) Net cash flows from operating activities 140.6