Question

Exercise 2-20 Identifying effects of posting errors on the trial balance LO A1, P2 Posting errors are identified in the following table. In column (1),

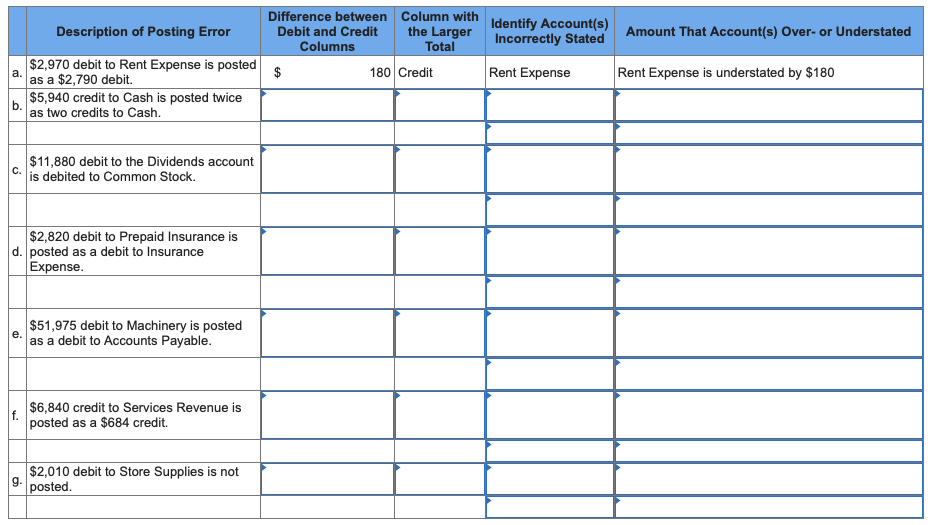

Exercise 2-20 Identifying effects of posting errors on the trial balance LO A1, P2

Posting errors are identified in the following table. In column (1), enter the amount of the difference between the two trial balance columns (debit and credit) due to the error. In column (2), identify the trial balance column (debit or credit) with the larger amount if they are not equal. In column (3), identify the account(s) affected by the error. In column (4), indicate the amount by which the account(s) in column (3) is under- or overstated. Item (a) is completed as an example. (Select "None" if there is no effect.)

Description of Posting Error Difference between Debit and Credit Columns Column with the Larger Total Identify Account(s) Incorrectly Stated Amount That Account(s) Over-or Understated 180 Credit Rent Expense Rent Expense is understated by $180 $2,970 debit to Rent Expense is posted as a $2,790 debit. $5,940 credit to Cash is posted twice as two credits to Cash. $11,880 debit to the Dividends account is debited to Common Stock. $2,820 debit to Prepaid Insurance is posted as a debit to Insurance Expense. $51,975 debit to Machinery is posted as a debit to Accounts Payable. $6,840 credit to Services Revenue is posted as a $684 credit. $2,010 debit to Store Supplies is not posted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started