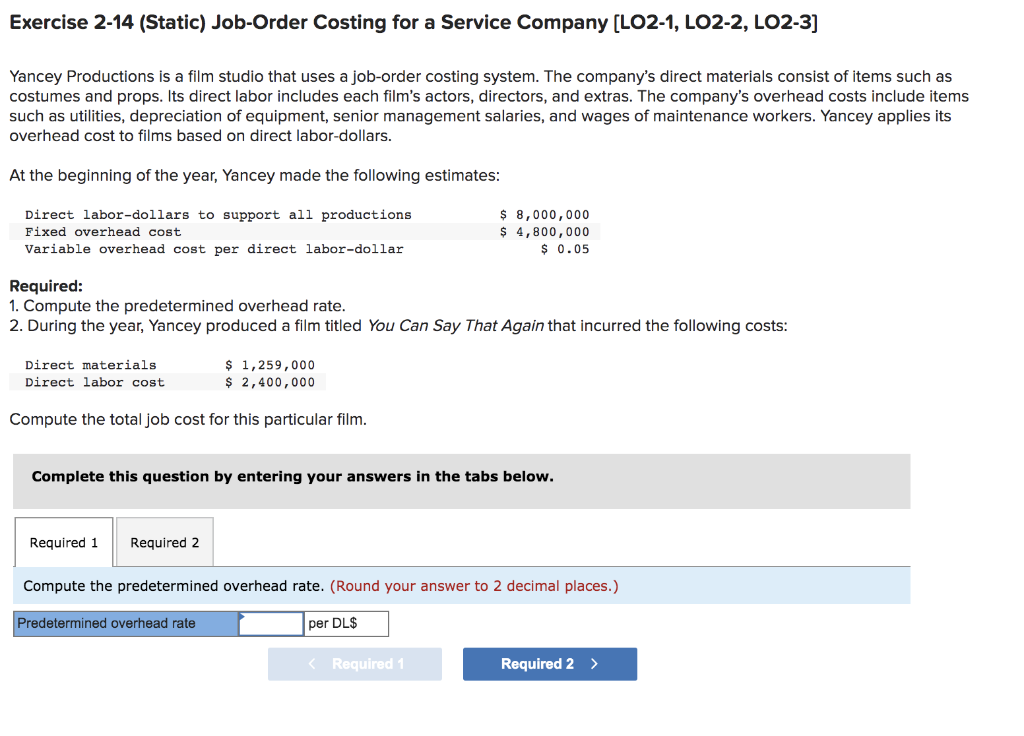

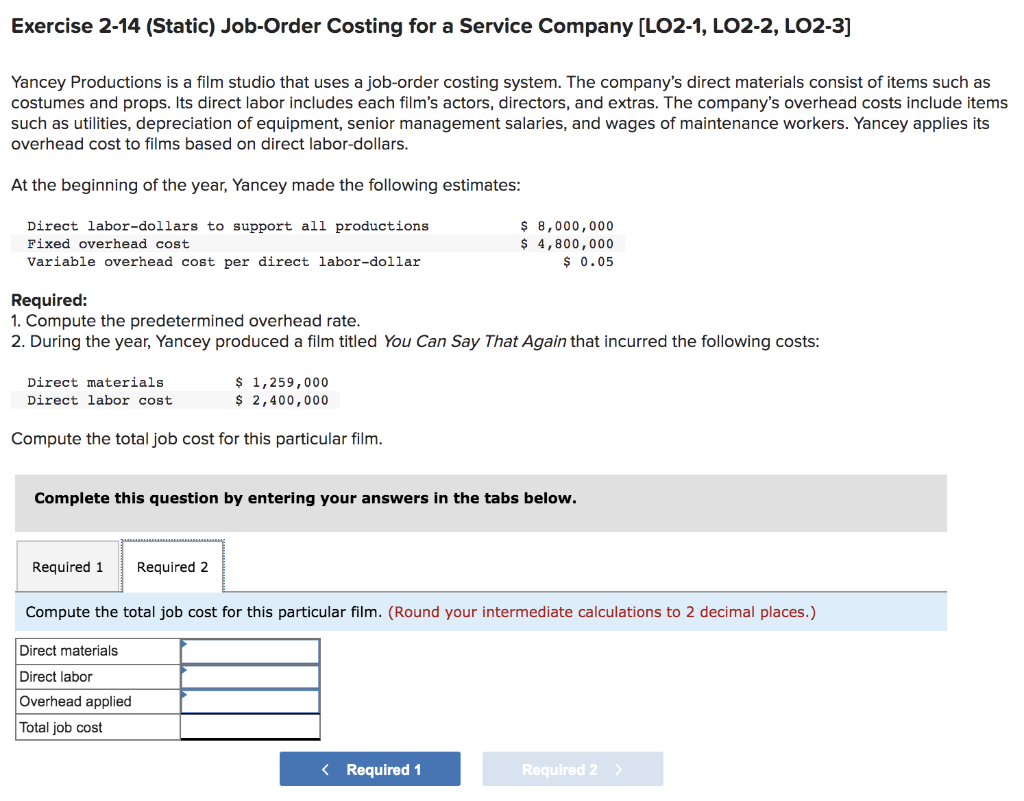

Exercise 2-8 (Static) Applying Overhead Cost; Computing Unit Product Cost [LO2-2, LO2-3] Newhard Company assigns overhead cost to jobs on the basis of 125% of direct labor cost. The job cost sheet for Job 313 includes $10,000 in direct materials cost and $12,000 in direct labor cost. A total of 1,000 units were produced in Job 313. Required: a. What is the total manufacturing cost assigned to Job 313? b. What is the unit product cost for Job 313? a. Total manufacturing cost b. Unit product cost Exercise 2-10 (Static) Applying Overhead Cost to a Job [LO2-2] Sigma Corporation applies overhead cost to jobs on the basis of direct labor cost. Job V, which was started and completed during the current period, shows charges of $5,000 for direct materials, $8,000 for direct labor, and $6,000 for overhead on its job cost sheet. Job W, which is still in process at year-end, shows charges of $2,500 for direct materials and $4,000 for direct labor. Required: 1a. Should any overhead cost be applied to Job W at year-end? O Yes O NO 1b. How much overhead cost should be applied to Job W? Overhead cost 2. How will the costs included in Job W's job cost sheet be reported within Sigma Corporation's financial statements at the end of the year? O Raw Materials O Work-in-Process O Finished Goods Exercise 2-14 (Static) Job-Order Costing for a Service Company (LO2-1, LO2-2, LO2-3] Yancey Productions is a film studio that uses a job-order costing system. The company's direct materials consist of items such as costumes and props. Its direct labor includes each film's actors, directors, and extras. The company's overhead costs include items such as utilities, depreciation of equipment, senior management salaries, and wages of maintenance workers. Yancey applies its overhead cost to films based on direct labor-dollars. At the beginning of the year, Yancey made the following estimates: Direct labor-dollars to support all productions Fixed overhead cost Variable overhead cost per direct labor-dollar $ 8,000,000 $ 4,800,000 $ 0.05 Required: 1. Compute the predetermined overhead rate. 2. During the year, Yancey produced a film titled You Can Say That Again that incurred the following costs: Direct materials Direct labor cost $ 1,259,000 $ 2,400,000 Compute the total job cost for this particular film. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the predetermined overhead rate. (Round your answer to 2 decimal places.) Predetermined overhead rate per DL$ Exercise 2-14 (Static) Job-Order Costing for a Service Company [LO2-1, LO2-2, LO2-3] Yancey Productions is a film studio that uses a job-order costing system. The company's direct materials consist of items such as costumes and props. Its direct labor includes each film's actors, directors, and extras. The company's overhead costs include items such as utilities, depreciation of equipment, senior management salaries, and wages of maintenance workers. Yancey applies its overhead cost to films based on direct labor-dollars. At the beginning of the year, Yancey made the following estimates: Direct labor-dollars to support all productions Fixed overhead cost Variable overhead cost per direct labor-dollar $ 8,000,000 $ 4,800,000 $ 0.05 Required: 1. Compute the predetermined overhead rate. 2. During the year, Yancey produced a film titled You Can Say That Again that incurred the following costs: Direct materials Direct labor cost $ 1,259,000 $ 2,400,000 Compute the total job cost for this particular film. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the total job cost for this particular film. (Round your intermediate calculations to 2 decimal places.) Direct materials Direct labor Overhead applied Total job cost