Question: Exercise #3: A baker must lease a ne ease a new equipment for a monthly payment of $5,000 in order to manufacture its new range

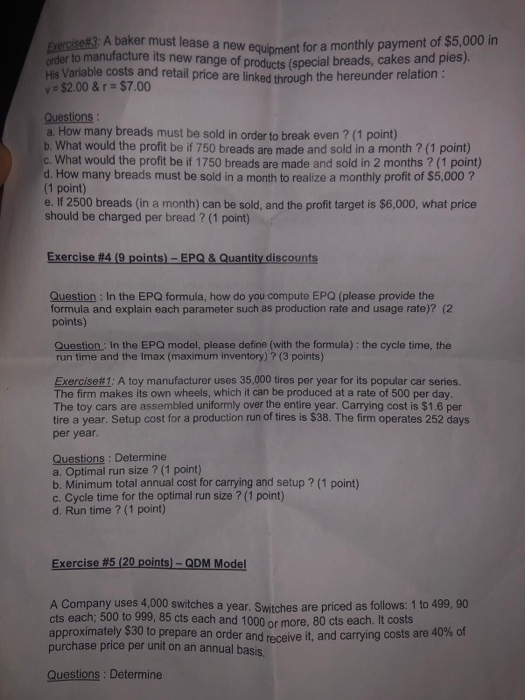

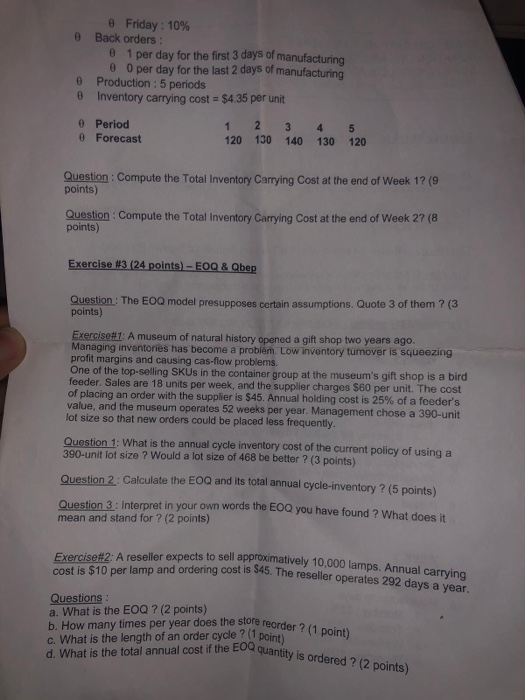

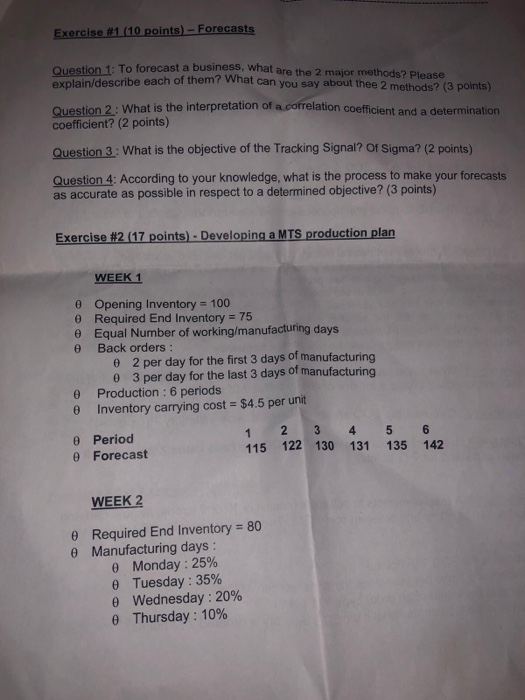

Exercise #3: A baker must lease a ne ease a new equipment for a monthly payment of $5,000 in order to manufacture its new range w range of products (special breads, cakes and pies). His Variable costs and retail price are linked through the hereunder relation. v = $2.00 &r= $7.00 Questions: a. How many breads must be sold in order to break even ? (1 point) b. What would the profit be if 750 breads are made and sold in a month 7 (1 point) c. What would the profit be if 1750 breads are made and sold in 2 months 7 (1 point) d. How many breads must be sold in a month to realize a monthly profit of $5,000 ? (1 point) e. If 2500 breads (in a month) can be sold, and the profit target is $6,000, what price should be charged per bread ? (1 point) Exercise #4 (9 points) - EPQ & Quantity discounts Question : In the EPQ formula, how do you compute EPQ (please provide the formula and explain each parameter such as production rate and usage rate)? (2 points) Question : in the EPQ model, please define (with the formula) : the cycle time, the run time and the Imax (maximum inventory)? (3 points) Exercise#1: A toy manufacturer uses 35,000 tires per year for its popular car series. The firm makes its own wheels, which it can be produced at a rate of 500 per day. The toy cars are assembled uniformly over the entire year. Carrying cost is $1.6 per tire a year. Setup cost for a production run of tires is $38. The firm operates 252 days per year. Questions : Determine a. Optimal run size ? (1 point) b. Minimum total annual cost for carrying and setup ? (1 point) c. Cycle time for the optimal run size ? (1 point) d. Run time ? (1 point) Exercise #5 (20 points) - QDM Model A Company uses 4,000 switches a year. Switches are priced as follows: 1 to 499,90 cts each: 500 to 999, 85 cts each and 1000 or more, 80 cts each. It costs approximately $30 to prepare an order and receive it, and carrying costs are 40% purchase price per unit on an annual basis Questions : Determine 0 Friday: 10% Back orders: 0 1 per day for the first 3 days of manufacturing 0 0 per day for the last 2 days of manufacturing Production : 5 periods Inventory carrying cost = $4.35 per unit 0 0 @ Period 0 Forecast 1 120 2 130 3 140 4 130 5 120 Question: Compute the Total Inventory Carrying Cost at the end of Week 1? (9 points) Question: Compute the Total Inventory Carrying Cost at the end of Week 2? (8 points) Exercise #3 (24 points) - EOQ & Qbep Question: The EOQ model presupposes certain assumptions. Quote 3 of them ? (3 points) Exercise#1: A museum of natural history opened a gift shop two years ago. Managing inventories has become a problem. Low inventory turnover is squeezing profit margins and causing cas-flow problems. One of the top-selling SKUs in the container group at the museum's gift shop is a bird feeder. Sales are 18 units per week, and the supplier charges $60 per unit. The cost of placing an order with the supplier is $45. Annual holding cost is 25% of a foeder's value, and the museum operates 52 weeks per year. Management chose a 390-unit lot size so that new orders could be placed less frequently Question 1: What is the annual cycle inventory cost of the current policy of using a 390-unit lot size ? Would a lot size of 468 be better? (3 points) Question 2. Calculate the EOQ and its total annual cycle-inventory? (5 points) Question 3. Interpret in your own words the too you have found ? What does mean and stand for? (2 points) Exercise#2: A reseller expects to sell approatively 10,000 lamps. Annual carving cost is $10 per lamp and ordering cost is $45. The reseller ing cost is $45. The reseller operates 292 days a year. Questions: a. What is the EOQ? (2 points) b. How many times per year does the store reorder c. What is the length of an order cycle ? (1 point d. What is the total annual cost if the EOQ quant the store reorder ? (1 point) the EOQ quantity is ordered ? (2 points) Exercise #1 (10 points) - Forecasts Question 1: To forecast a business, what are the 2 major methods? Please explain/describe each of them what can you say about thee 2 methods? (3 points) Question 2: What is the interpretation of a correlation coefficient and a determination coefficient? (2 points) Question 3: What is the objective of the Tracking Signal? Of Sigma? (2 points) Question 4: According to your knowledge, what is the process to make your forecasts as accurate as possible in respect to a determined objective? (3 points) Exercise #2 (17 points) - Developing a MTS production plan WEEK 1 e Opening Inventory = 100 e Required End Inventory = 75 e Equal Number of working/manufacturing days e Back orders: 0 2 per day for the first 3 days of manufacturing 0 3 per day for the last 3 days of manufacturing e Production : 6 periods 0 Inventory carrying cost = $4.5 per unit 1 Period 2 3 4 5 Forecast 115 122 130 131 135 6 142 WEEK 2 Required End Inventory = 80 e Manufacturing days: Monday: 25% Tuesday: 35% Wednesday : 20% Thursday: 10% a. The optimal order quantity (5 points) b. The total annual cost -> Minimum cost order size (15 points) Exercise #3: A baker must lease a ne ease a new equipment for a monthly payment of $5,000 in order to manufacture its new range w range of products (special breads, cakes and pies). His Variable costs and retail price are linked through the hereunder relation. v = $2.00 &r= $7.00 Questions: a. How many breads must be sold in order to break even ? (1 point) b. What would the profit be if 750 breads are made and sold in a month 7 (1 point) c. What would the profit be if 1750 breads are made and sold in 2 months 7 (1 point) d. How many breads must be sold in a month to realize a monthly profit of $5,000 ? (1 point) e. If 2500 breads (in a month) can be sold, and the profit target is $6,000, what price should be charged per bread ? (1 point) Exercise #4 (9 points) - EPQ & Quantity discounts Question : In the EPQ formula, how do you compute EPQ (please provide the formula and explain each parameter such as production rate and usage rate)? (2 points) Question : in the EPQ model, please define (with the formula) : the cycle time, the run time and the Imax (maximum inventory)? (3 points) Exercise#1: A toy manufacturer uses 35,000 tires per year for its popular car series. The firm makes its own wheels, which it can be produced at a rate of 500 per day. The toy cars are assembled uniformly over the entire year. Carrying cost is $1.6 per tire a year. Setup cost for a production run of tires is $38. The firm operates 252 days per year. Questions : Determine a. Optimal run size ? (1 point) b. Minimum total annual cost for carrying and setup ? (1 point) c. Cycle time for the optimal run size ? (1 point) d. Run time ? (1 point) Exercise #5 (20 points) - QDM Model A Company uses 4,000 switches a year. Switches are priced as follows: 1 to 499,90 cts each: 500 to 999, 85 cts each and 1000 or more, 80 cts each. It costs approximately $30 to prepare an order and receive it, and carrying costs are 40% purchase price per unit on an annual basis Questions : Determine 0 Friday: 10% Back orders: 0 1 per day for the first 3 days of manufacturing 0 0 per day for the last 2 days of manufacturing Production : 5 periods Inventory carrying cost = $4.35 per unit 0 0 @ Period 0 Forecast 1 120 2 130 3 140 4 130 5 120 Question: Compute the Total Inventory Carrying Cost at the end of Week 1? (9 points) Question: Compute the Total Inventory Carrying Cost at the end of Week 2? (8 points) Exercise #3 (24 points) - EOQ & Qbep Question: The EOQ model presupposes certain assumptions. Quote 3 of them ? (3 points) Exercise#1: A museum of natural history opened a gift shop two years ago. Managing inventories has become a problem. Low inventory turnover is squeezing profit margins and causing cas-flow problems. One of the top-selling SKUs in the container group at the museum's gift shop is a bird feeder. Sales are 18 units per week, and the supplier charges $60 per unit. The cost of placing an order with the supplier is $45. Annual holding cost is 25% of a foeder's value, and the museum operates 52 weeks per year. Management chose a 390-unit lot size so that new orders could be placed less frequently Question 1: What is the annual cycle inventory cost of the current policy of using a 390-unit lot size ? Would a lot size of 468 be better? (3 points) Question 2. Calculate the EOQ and its total annual cycle-inventory? (5 points) Question 3. Interpret in your own words the too you have found ? What does mean and stand for? (2 points) Exercise#2: A reseller expects to sell approatively 10,000 lamps. Annual carving cost is $10 per lamp and ordering cost is $45. The reseller ing cost is $45. The reseller operates 292 days a year. Questions: a. What is the EOQ? (2 points) b. How many times per year does the store reorder c. What is the length of an order cycle ? (1 point d. What is the total annual cost if the EOQ quant the store reorder ? (1 point) the EOQ quantity is ordered ? (2 points) Exercise #1 (10 points) - Forecasts Question 1: To forecast a business, what are the 2 major methods? Please explain/describe each of them what can you say about thee 2 methods? (3 points) Question 2: What is the interpretation of a correlation coefficient and a determination coefficient? (2 points) Question 3: What is the objective of the Tracking Signal? Of Sigma? (2 points) Question 4: According to your knowledge, what is the process to make your forecasts as accurate as possible in respect to a determined objective? (3 points) Exercise #2 (17 points) - Developing a MTS production plan WEEK 1 e Opening Inventory = 100 e Required End Inventory = 75 e Equal Number of working/manufacturing days e Back orders: 0 2 per day for the first 3 days of manufacturing 0 3 per day for the last 3 days of manufacturing e Production : 6 periods 0 Inventory carrying cost = $4.5 per unit 1 Period 2 3 4 5 Forecast 115 122 130 131 135 6 142 WEEK 2 Required End Inventory = 80 e Manufacturing days: Monday: 25% Tuesday: 35% Wednesday : 20% Thursday: 10% a. The optimal order quantity (5 points) b. The total annual cost -> Minimum cost order size (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts