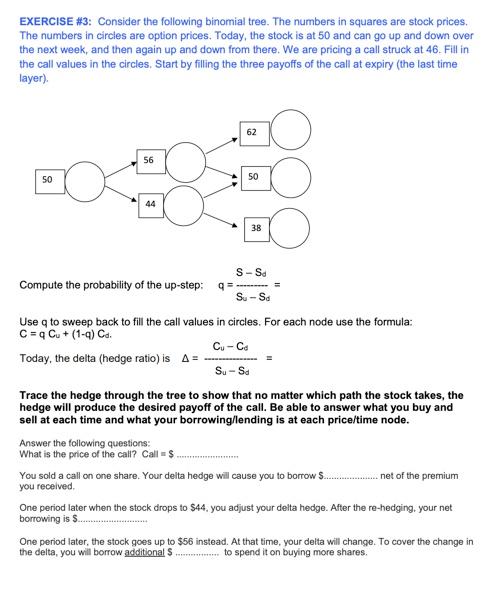

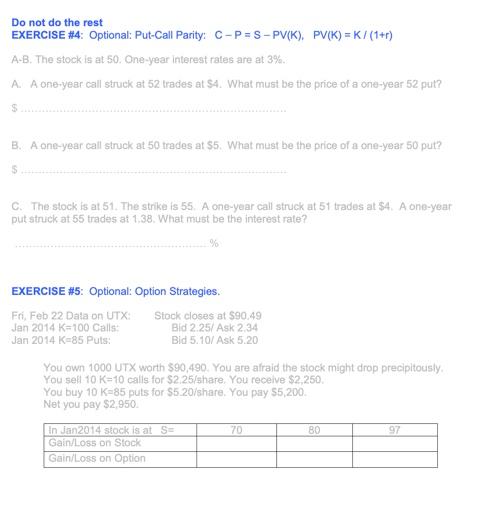

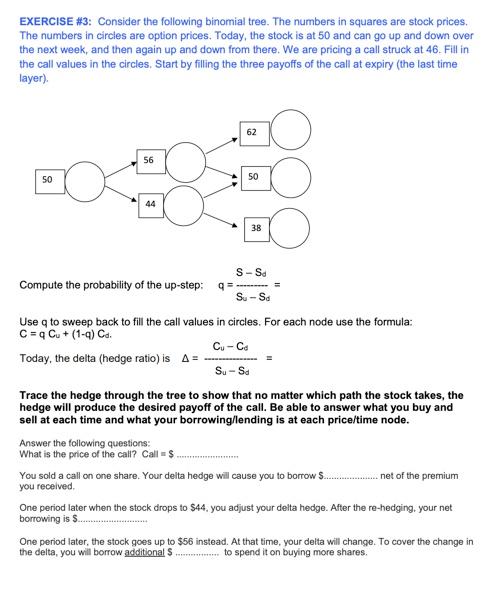

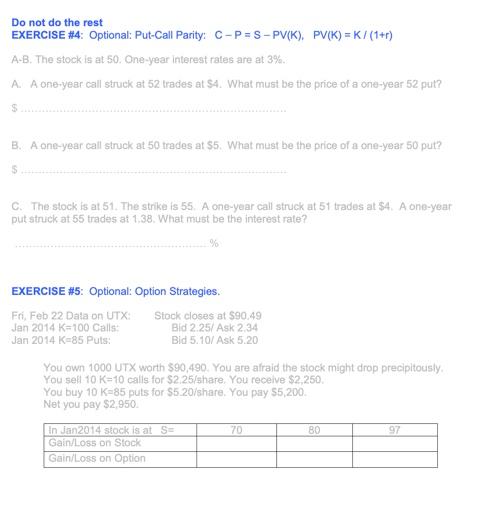

EXERCISE #3: Consider the following binomial tree. The numbers in squares are stock prices. The numbers in circles are option prices. Today, the stock is at 50 and can go up and down over the next week, and then again up and down from there. We are pricing a call struck at 46. Fill in the call values in the circles, Start by filling the three payoffs of the call at expiry (the last time layer). 62 56 50 50 1 44 38 SS. Compute the probability of the up-step: q Su-Sd Use a to sweep back to fill the call values in circles. For each node use the formula: C = q Cu + (1-9) Ca. Cu-Cd Today, the delta (hedge ratio) is A= Su - Sd Trace the hedge through the tree to show that no matter which path the stock takes, the hedge will produce the desired payoff of the call. Be able to answer what you buy and sell at each time and what your borrowing/lending is at each price/time node. Answer the following questions: What is the price of the call? Calls You sold a call on one share. Your delta hedge will cause you to borrow $. net of the premium you received One period later when the stock drops to $44. you adjust your delta hedge. After the re-hedging, your net borrowing is . One period later, the stock goes up to $56 instead. At that time, your delta will change. To cover the change in the delta, you will borrow additional to spend it on buying more shares. Do not do the rest EXERCISE #4: Optional: Put-Call Parity: C-P=S-PV(K), PV(K) = K / (1+r) A-B. The stock is at 50. One-year Interest rates are at 3% A. A one-year call struck at 52 trades at $4. What must be the price of a one-year 52 put? S B. A one-year call struck at 50 trades at $5. What must be the price of a one-year 50 put? S C. The stock is at 51. The strike is 55. A one-year call struck at 51 trades at $4. A one-year put struck at 55 trades at 1,38. What must be the interest rate? 9 EXERCISE #5: Optional: Option Strategies. Fri, Feb 22 Data on UTX: Stock closes at $90.49 Jan 2014 K-100 Calls Bid 2.25/Ask 2.34 Jan 2014 K=85 Puls: Bid 5.10/ Ask 5.20 You own 1000 UTX worth 590,490. You are afraid the stock might drop precipitously, You sell 10 K=10 calls for $2.25/share. You receive $2,250 You buy 10 K=85 puls for $5 20/share. You pay $5,200 Net you pay $2,950 70 BO 97 In Jan 2014 stock is at S= Gain/Loss on Stock Gain/Loss on Option