Answered step by step

Verified Expert Solution

Question

1 Approved Answer

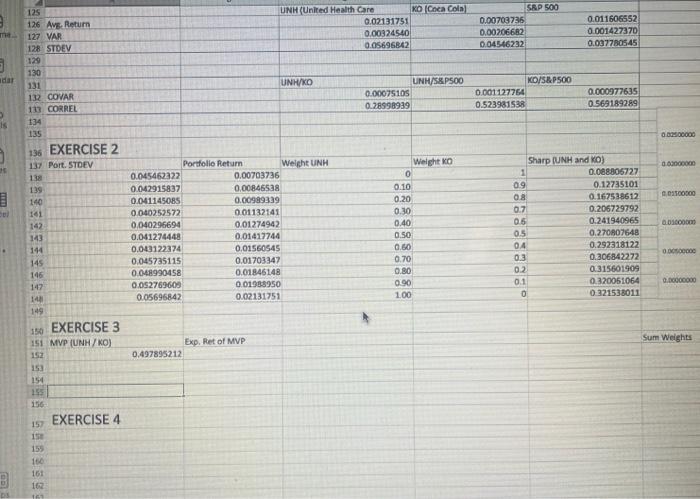

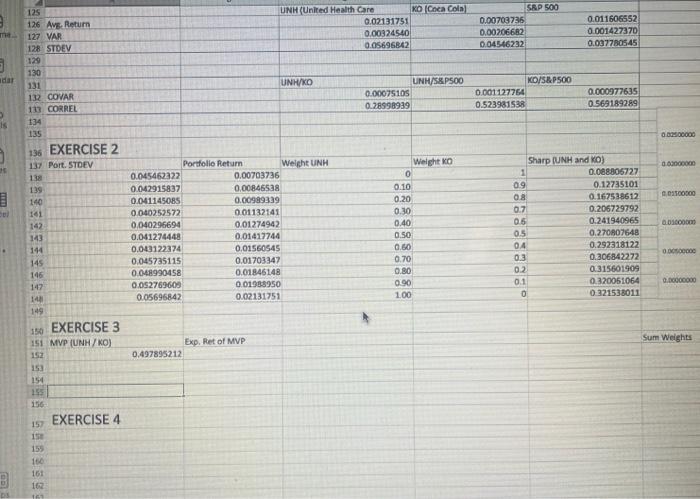

EXERCISE 3 MNP (UNH/NO) 0,497895212. Exp. Fet of MVP EXERCISE 4 157 155 16. 16 Exerclse 5 For a moment, assume the correlation between the

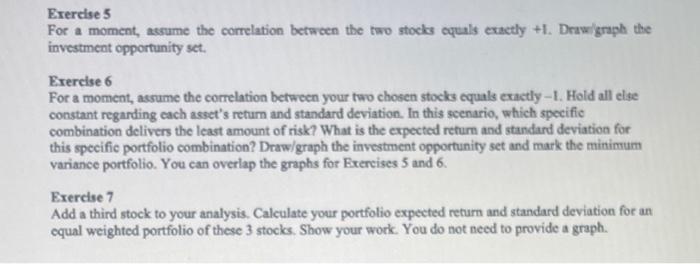

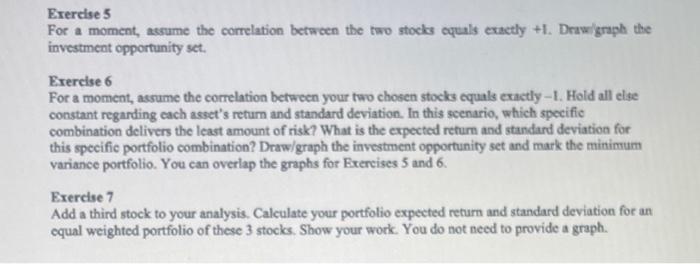

EXERCISE 3 MNP (UNH/NO) 0,497895212. Exp. Fet of MVP EXERCISE 4 157 155 16. 16 Exerclse 5 For a moment, assume the correlation between the two stocks equals exactly +1. Draw/graph the investment opportunity set. Exercise 6 For a moment, assume the correlation between your two chosen stocks equals exactly 1. Hold all else constant regarding each asset's retum and standard deviation. In this scenario, which specific combination delivers the least amount of risk? What is the expected retum and standard deviation for this specific portfolio combination? Draw/graph the investment opportunity set and mark the minimum variance portfolio. You can overiap the graphs for Exercises 5 and 6 . Exercise 7 Add a third stock to your analysis. Calculate your portfolio expected return and standard deviation for an equal weighted portfolio of these 3 stocks. Show your work. You do not need to provide a graph. EXERCISE 3 MNP (UNH/NO) 0,497895212. Exp. Fet of MVP EXERCISE 4 157 155 16. 16 Exerclse 5 For a moment, assume the correlation between the two stocks equals exactly +1. Draw/graph the investment opportunity set. Exercise 6 For a moment, assume the correlation between your two chosen stocks equals exactly 1. Hold all else constant regarding each asset's retum and standard deviation. In this scenario, which specific combination delivers the least amount of risk? What is the expected retum and standard deviation for this specific portfolio combination? Draw/graph the investment opportunity set and mark the minimum variance portfolio. You can overiap the graphs for Exercises 5 and 6 . Exercise 7 Add a third stock to your analysis. Calculate your portfolio expected return and standard deviation for an equal weighted portfolio of these 3 stocks. Show your work. You do not need to provide a graph

EXERCISE 3 MNP (UNH/NO) 0,497895212. Exp. Fet of MVP EXERCISE 4 157 155 16. 16 Exerclse 5 For a moment, assume the correlation between the two stocks equals exactly +1. Draw/graph the investment opportunity set. Exercise 6 For a moment, assume the correlation between your two chosen stocks equals exactly 1. Hold all else constant regarding each asset's retum and standard deviation. In this scenario, which specific combination delivers the least amount of risk? What is the expected retum and standard deviation for this specific portfolio combination? Draw/graph the investment opportunity set and mark the minimum variance portfolio. You can overiap the graphs for Exercises 5 and 6 . Exercise 7 Add a third stock to your analysis. Calculate your portfolio expected return and standard deviation for an equal weighted portfolio of these 3 stocks. Show your work. You do not need to provide a graph. EXERCISE 3 MNP (UNH/NO) 0,497895212. Exp. Fet of MVP EXERCISE 4 157 155 16. 16 Exerclse 5 For a moment, assume the correlation between the two stocks equals exactly +1. Draw/graph the investment opportunity set. Exercise 6 For a moment, assume the correlation between your two chosen stocks equals exactly 1. Hold all else constant regarding each asset's retum and standard deviation. In this scenario, which specific combination delivers the least amount of risk? What is the expected retum and standard deviation for this specific portfolio combination? Draw/graph the investment opportunity set and mark the minimum variance portfolio. You can overiap the graphs for Exercises 5 and 6 . Exercise 7 Add a third stock to your analysis. Calculate your portfolio expected return and standard deviation for an equal weighted portfolio of these 3 stocks. Show your work. You do not need to provide a graph

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started