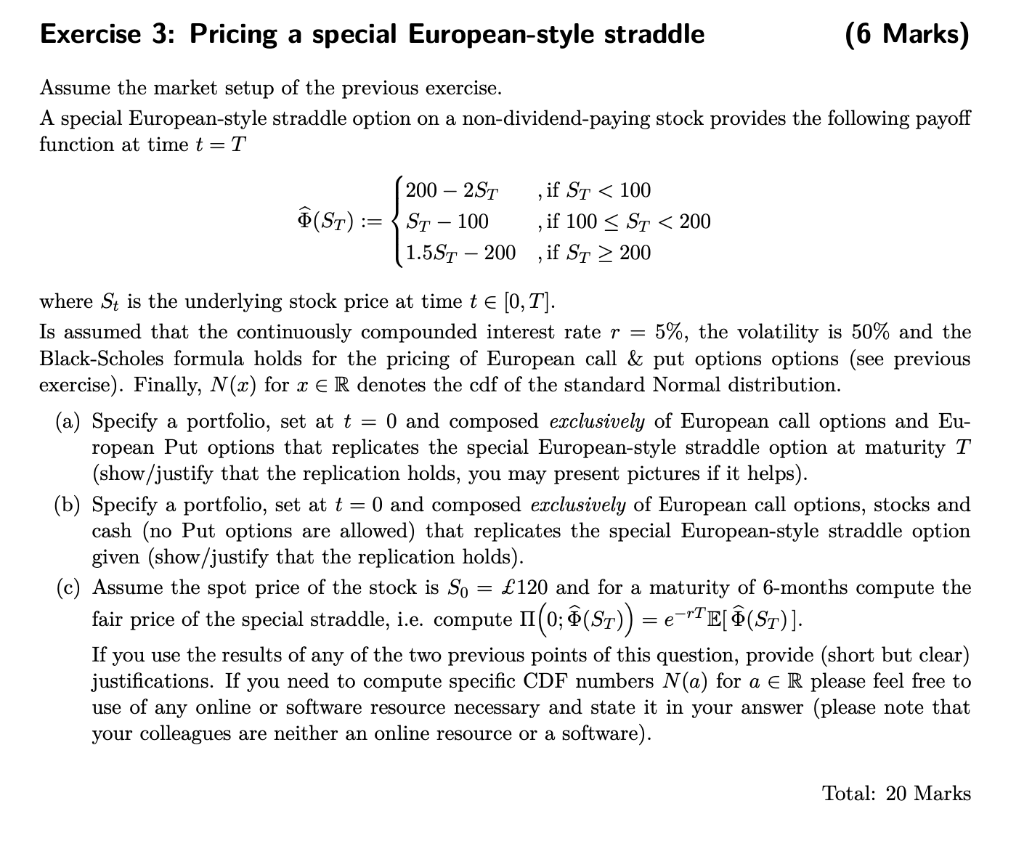

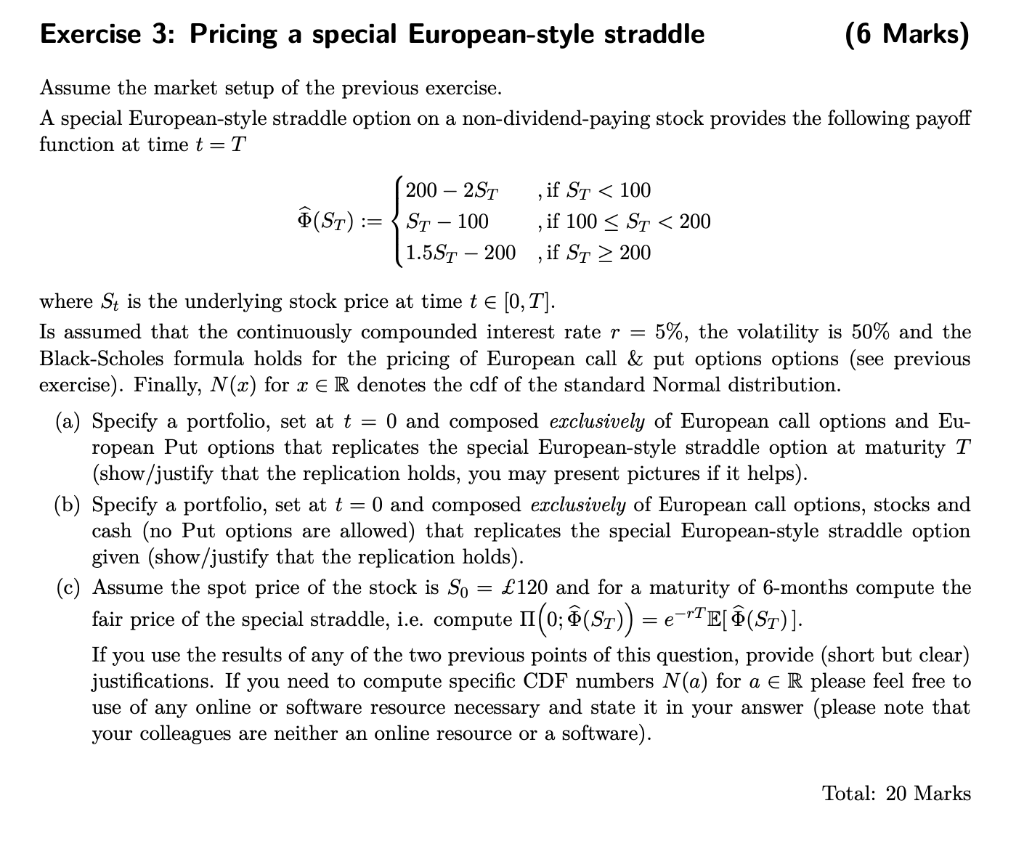

Exercise 3: Pricing a special European-style straddle (6 Marks) Assume the market setup of the previous exercise. A special European-style straddle option on a non-dividend-paying stock provides the following payoff function at time t=T (ST):= 200 2ST , if ST 200 where St is the underlying stock price at time t 0,T]. Is assumed that the continuously compounded interest rate r = 5%, the volatility is 50% and the Black-Scholes formula holds for the pricing of European call & put options options (see previous exercise). Finally, N(x) for x E R denotes the cdf of the standard Normal distribution. (a) Specify a portfolio, set at t = 0 and composed exclusively of European call options and Eu- ropean Put options that replicates the special European-style straddle option at maturity T (show/justify that the replication holds, you may present pictures if it helps). (b) Specify a portfolio, set at t = 0 and composed exclusively of European call options, stocks and cash (no Put options are allowed) that replicates the special European-style straddle option given (show/justify that the replication holds). Assume the spot price of the stock is so = 120 and for a maturity of 6-months compute the fair price of the special straddle, i.e. compute II(0; (St)) = e-TEL (ST)]. If you use the results of any of the two previous points of this question, provide (short but clear) justifications. If you need to compute specific CDF numbers N(a) for a E R please feel free to use of any online or software resource necessary and state it in your answer (please note that your colleagues are neither an online resource or a software). Total: 20 Marks Exercise 3: Pricing a special European-style straddle (6 Marks) Assume the market setup of the previous exercise. A special European-style straddle option on a non-dividend-paying stock provides the following payoff function at time t=T (ST):= 200 2ST , if ST 200 where St is the underlying stock price at time t 0,T]. Is assumed that the continuously compounded interest rate r = 5%, the volatility is 50% and the Black-Scholes formula holds for the pricing of European call & put options options (see previous exercise). Finally, N(x) for x E R denotes the cdf of the standard Normal distribution. (a) Specify a portfolio, set at t = 0 and composed exclusively of European call options and Eu- ropean Put options that replicates the special European-style straddle option at maturity T (show/justify that the replication holds, you may present pictures if it helps). (b) Specify a portfolio, set at t = 0 and composed exclusively of European call options, stocks and cash (no Put options are allowed) that replicates the special European-style straddle option given (show/justify that the replication holds). Assume the spot price of the stock is so = 120 and for a maturity of 6-months compute the fair price of the special straddle, i.e. compute II(0; (St)) = e-TEL (ST)]. If you use the results of any of the two previous points of this question, provide (short but clear) justifications. If you need to compute specific CDF numbers N(a) for a E R please feel free to use of any online or software resource necessary and state it in your answer (please note that your colleagues are neither an online resource or a software). Total: 20 Marks