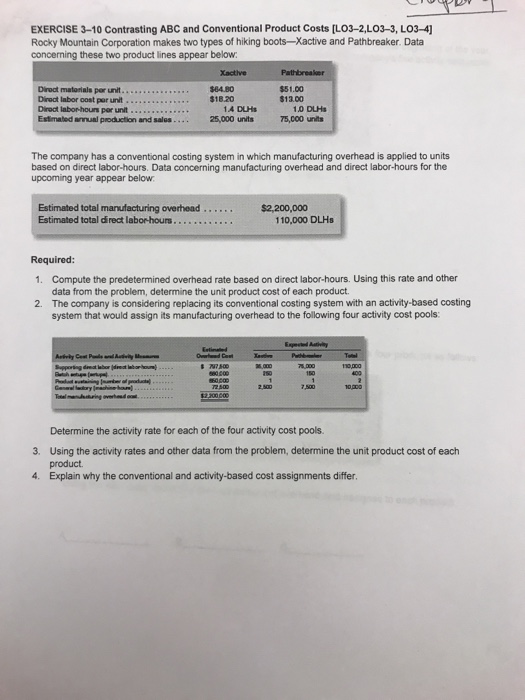

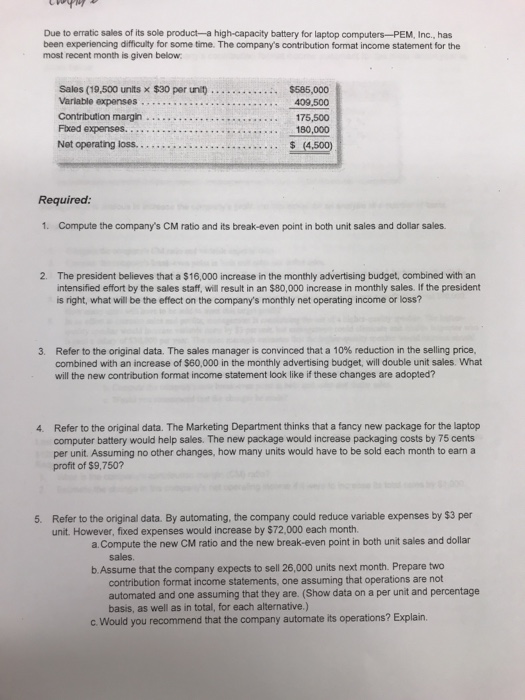

EXERCISE 3-10 Contrasting ABC and Conventional Product Costs [LO3-2,Lo3-3, LO3-4 Rocky Mountain Corporation makes two types of hiking boots-Xactive and Pathbreaker. Data concerning these two product lines appear below $64.80 $18.20 $51.00 $13.00 Diroct matorials por unit Diroct labor oost por unit Diroct labor-hours por unit Estimated annual production and sales....25,000 units 5,000 units 4 DUHs 1.0 DLHs The company has a conventional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below Estimated total manufacturing overhead $2,200,000 110,000 DLHs Required: Compute the predetermined overhead rate based on direct labor-hours. Using this rate and other data from the problem, determine the unit product cost of each product The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: 1. 2. 75,000 2,500 Determine the activity rate for each of the four activity cost pools. Using the activity rates and other data from the problem, determine the unit product cost of each product Explain why the conventional and activity-based cost assignments differ. 3. 4. Due to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM, Inc., has been experiencing difficulty for some time. The company's contribution format income statement for the most recent month is given below Sales (19,500 units x $30 per unl) Variable expenses Contribution margin Fbxed expenses. $585,000 175,500 ...180,000 5 (4500) Required: 1. Compute the company's CM ratio and its break-even point in both unit sales and dollar sales. The president believes that a $16,000 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will result in an $80,000 increase in monthly sales. If the president is right, what will be the effect on the company's monthly net operating income or loss? 2. Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price. combined with an increase of $60,000 in the monthly advertising budget, will double unit sales. What will the new contribution format income statement look like if these changes are adopted? 3. Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would help sales. The new package would increase packaging costs by 75 cents per unit. Assuming no other changes, how many units would have to be sold each month to earn a profit of $9,750? 4. 5. Refer to the original data By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses would increase by $72,000 each month. a.Compute the new CM ratio and the new break-even point in both unit sales and dollar sales b.Assume that the company expects to sell 26,000 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. (Show data on a per unit and percentage basis, as well as in total, for each alternative.) C. Would you recommend that the company automate its operations? Explain