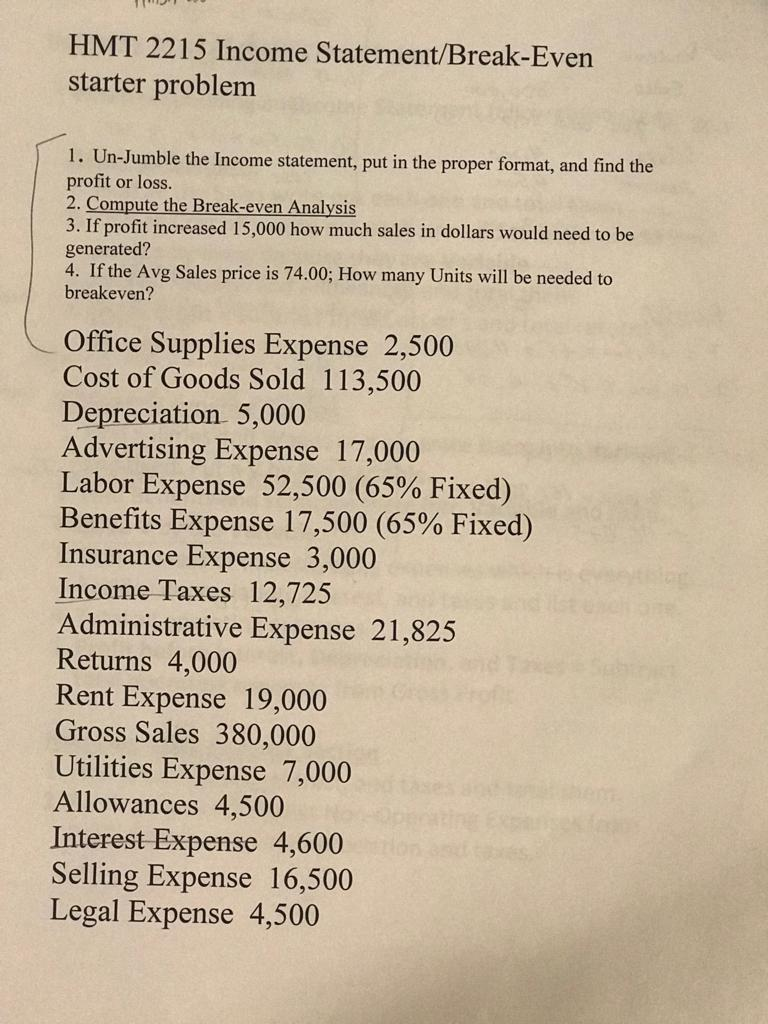

Question

Exercise 3.2 I. Assume that variable costs are not controlled and that budgeted costs of sales for food and beverage increase to $600,000 and total

Exercise 3.2

I. Assume that variable costs are not controlled and that budgeted costs of sales for food and beverage increase to $600,000 and total sales are as budgeted ($1,665.472.20). Calculate profit for Barnaby's Hideaway. All other costs remain the same.

2. Calculate the new variable rate and new contribution rate, assuming the same variable salaries and employee benefits.

3. Calculate the break-even point for Barnaby's Hideaway using the new contribution rate.

4. Using the new contribution rate, calculate the sales level necessary for Barnaby's Hideaway to earn the budgeted profit of $166,794.43.

5. Assum e that the new contribution margin falls to $12.60. Calculate the number of customers necessary to break even.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started