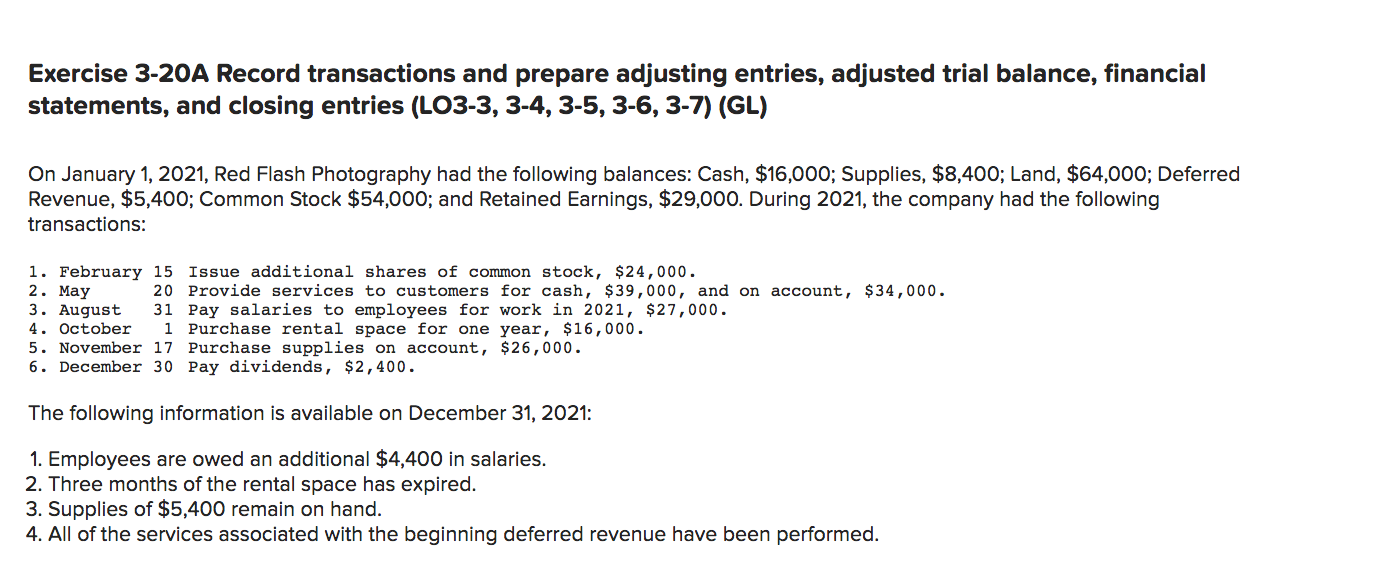

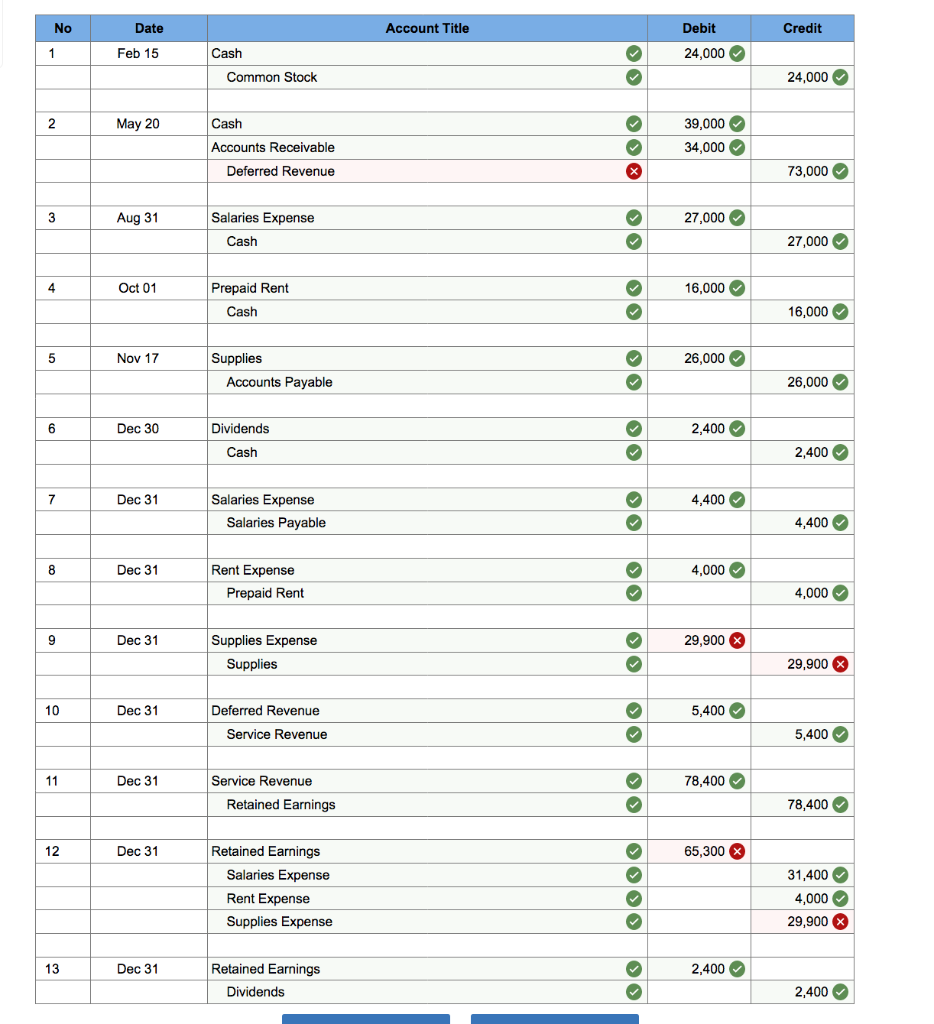

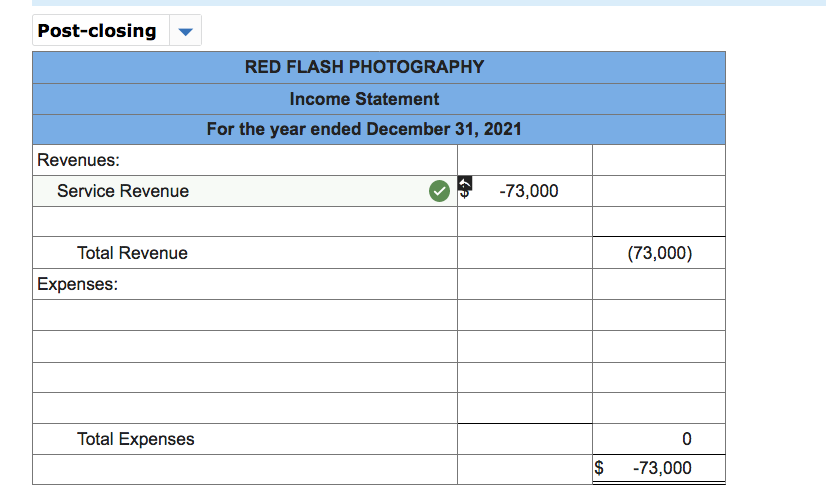

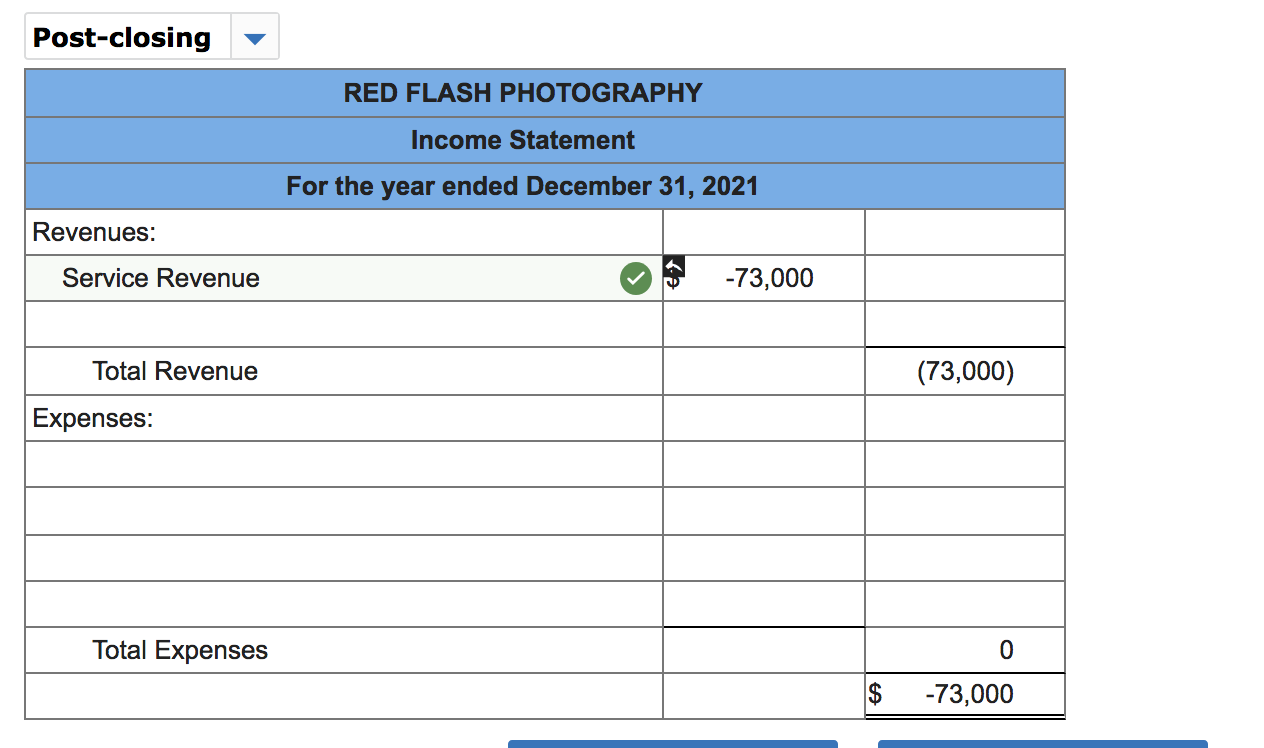

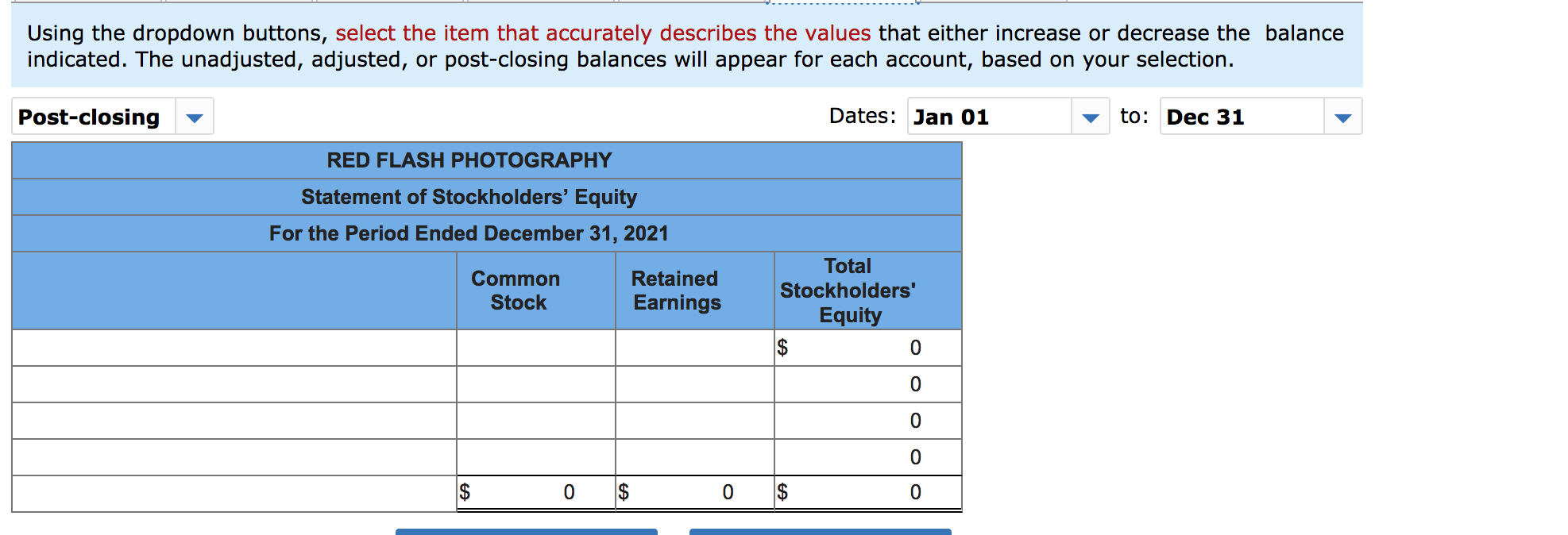

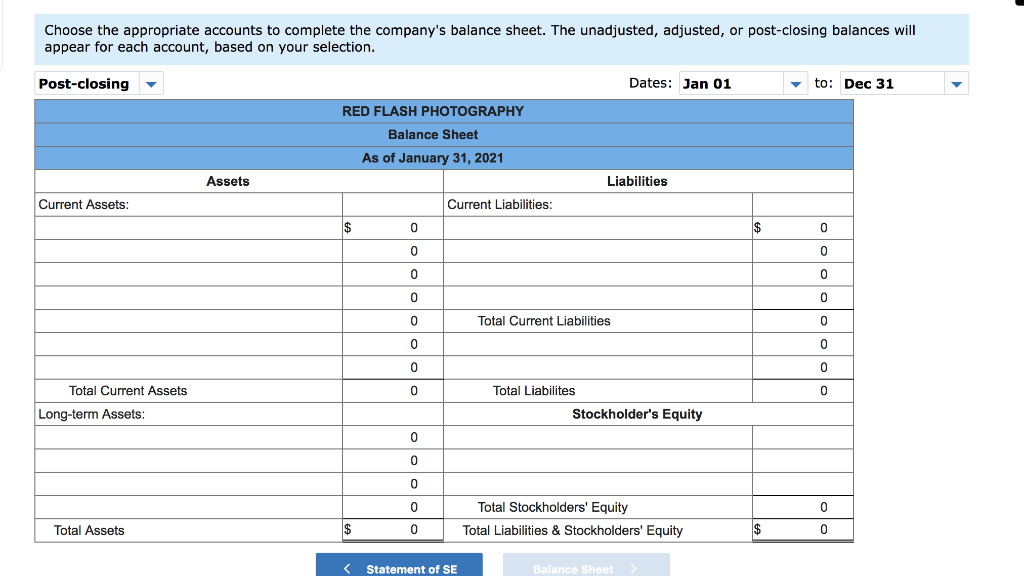

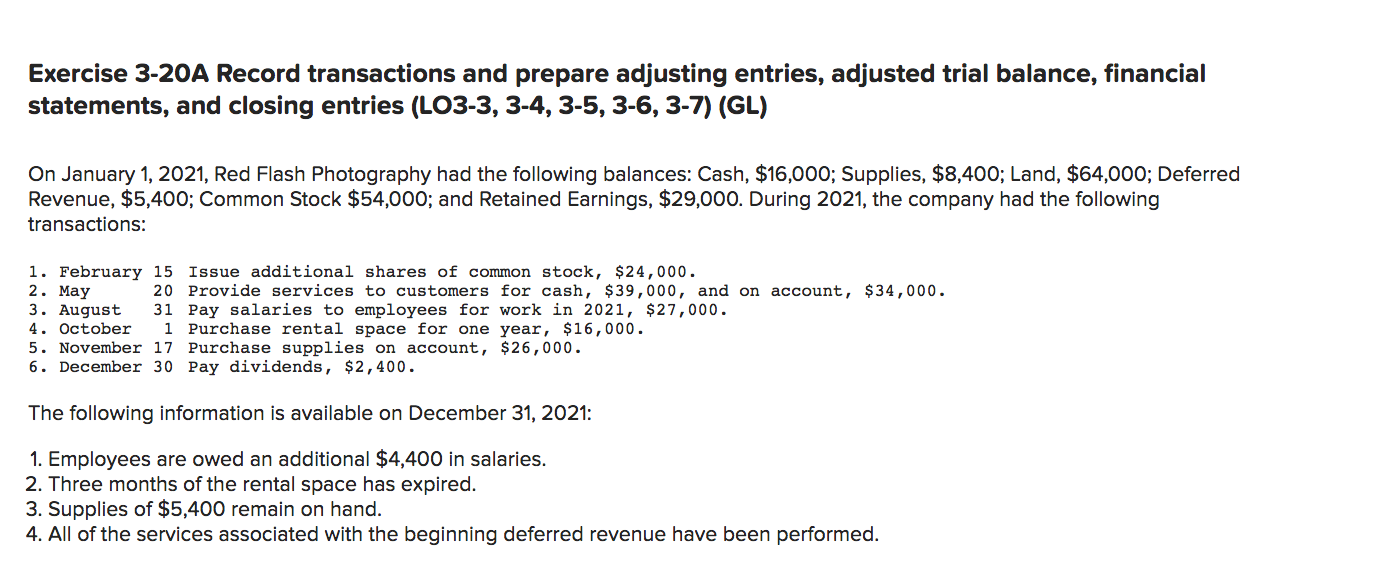

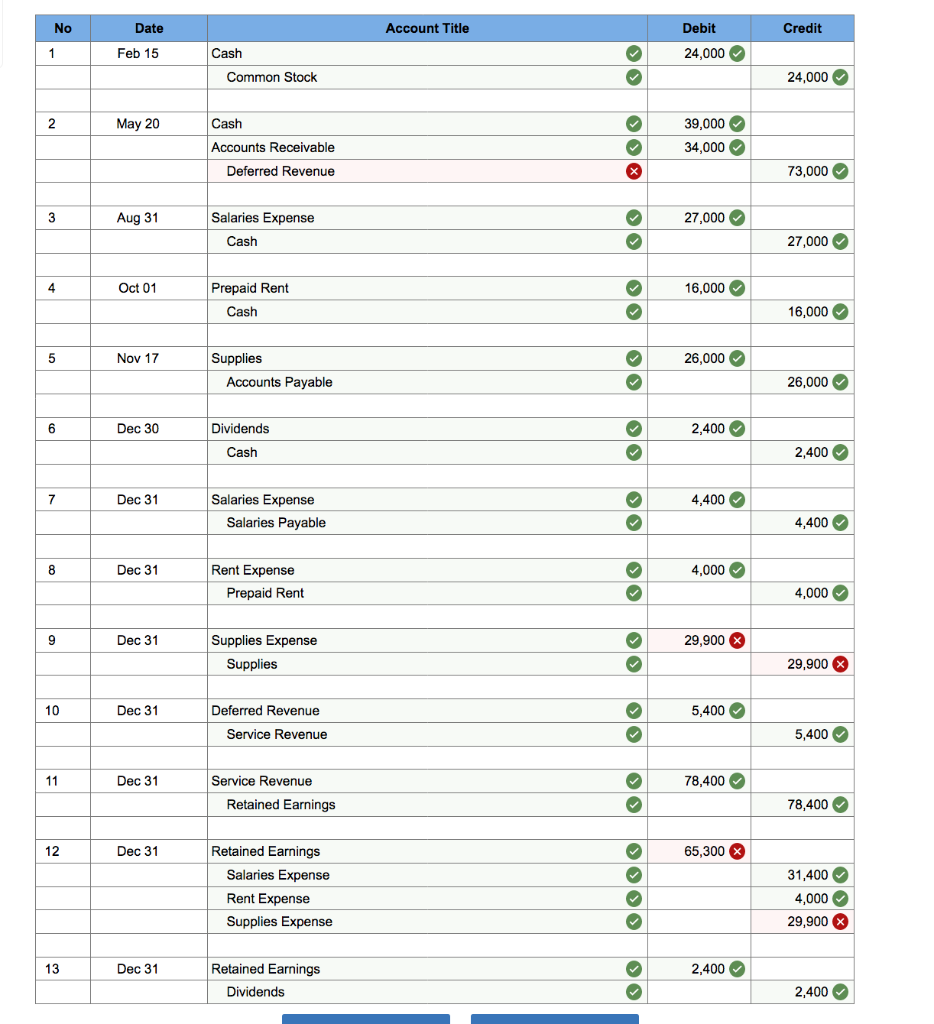

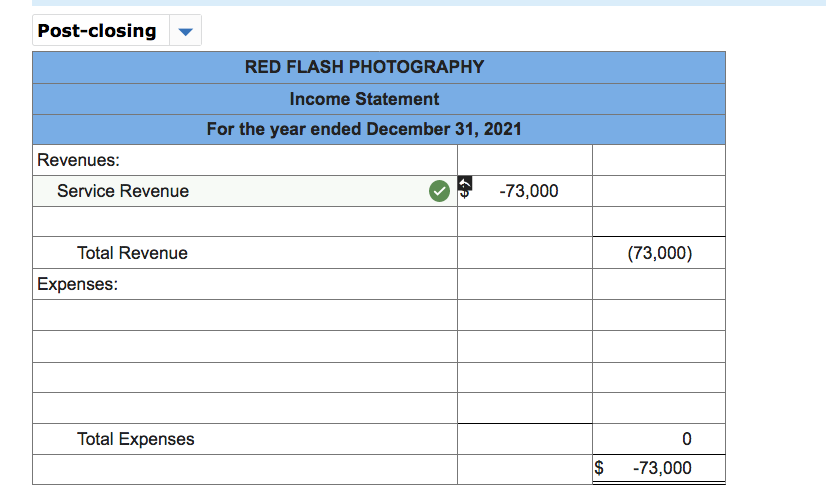

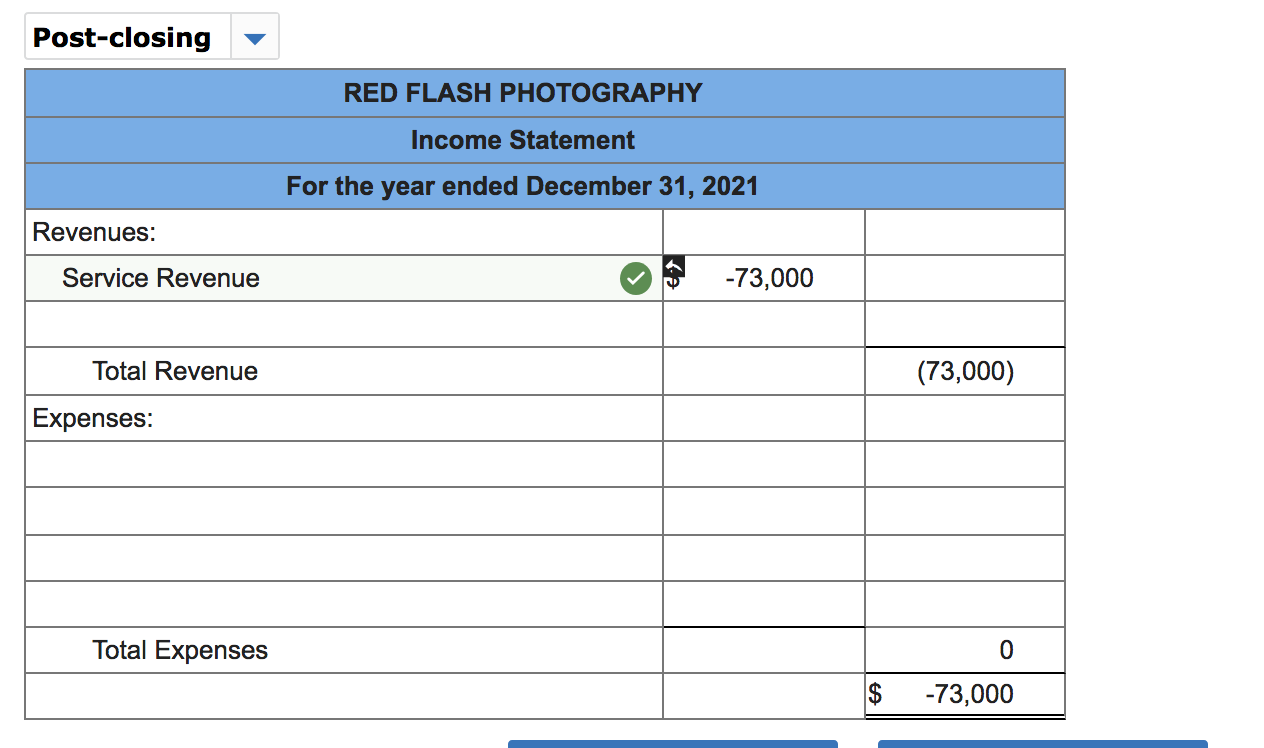

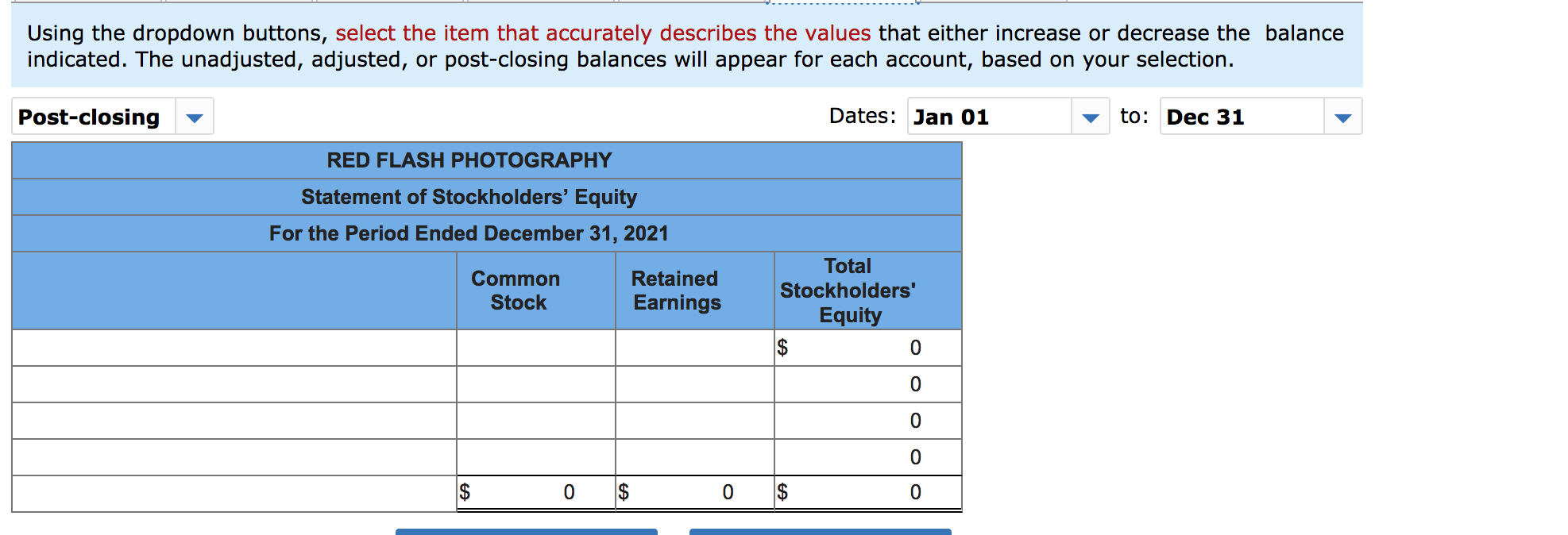

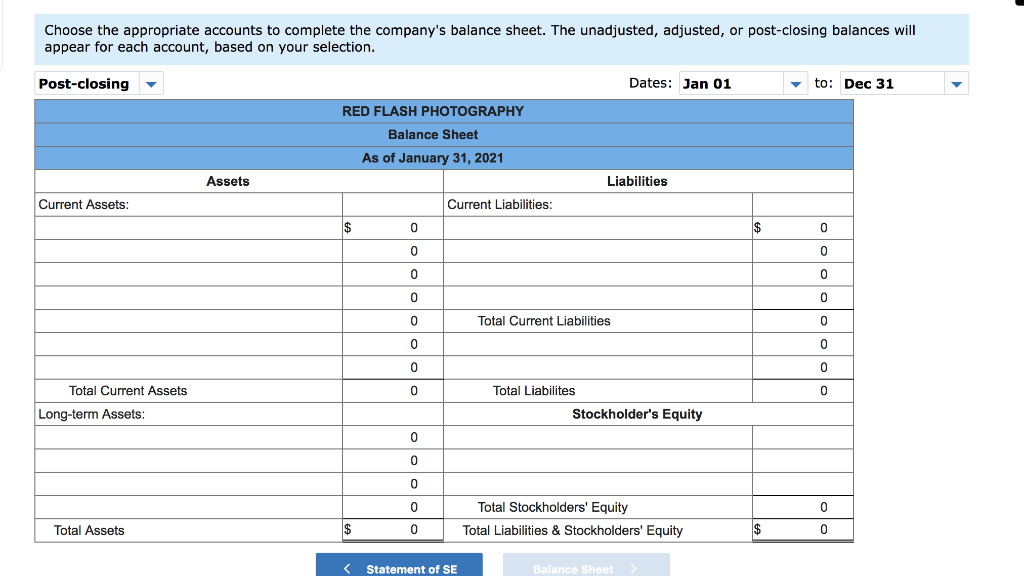

Exercise 3-20A Record transactions and prepare adjusting entries, adjusted trial balance, financial statements, and closing entries (LO3-3, 3-4, 3-5, 3-6, 3-7) (GL) On January 1, 2021, Red Flash Photography had the following balances: Cash, $16,000; Supplies, $8,400; Land, $64,000; Deferred Revenue, $5,400; Common Stock $54,000; and Retained Earnings, $29,000. During 2021, the company had the following transactions: 1. February 15 Issue additional shares of common stock, $24,000. 2. May 20 Provide services to customers for cash, $39,000, and on account, $34,000. 3. August 31 Pay salaries to employees for work in 2021, $27,000. 4. October 1 Purchase rental space for one year, $16,000. 5. November 17 Purchase supplies on account, $26,000. 6. December 30 Pay dividends, $2,400. The following information is available on December 31, 2021: 1. Employees are owed an additional $4,400 in salaries. 2. Three months of the rental space has expired. 3. Supplies of $5,400 remain on hand. 4. All of the services associated with the beginning deferred revenue have been performed. No Date Account Title Debit Credit 1 Feb 15 24,000 Cash Common Stock 24,000 2 May 20 39,000 Cash Accounts Receivable 34,000 Deferred Revenue x 73,000 3 Aug 31 27,000 Salaries Expense Cash 27,000 4 Oct 01 16,000 Prepaid Rent Cash O 16,000 5 Nov 17 26,000 Supplies Accounts Payable 26,000 6 Dec 30 Dividends 2,400 OO Cash 2,400 7 Dec 31 4,400 Salaries Expense Salaries Payable 0 4,400 8 Dec 31 4,000 Rent Expense Prepaid Rent 4,000 9 Dec 31 29,900 X Supplies Expense Supplies 29,900 X 10 Dec 31 5,400 Deferred Revenue Service Revenue 5,400 11 Dec 31 78,400 Service Revenue Retained Earnings 78,400 12 Dec 31 65,300 X Retained Earnings Salaries Expense Rent Expense Supplies Expense 31,400 4,000 29,900 X 13 Dec 31 2,400 Retained Earnings Dividends 2,400 Post-closing RED FLASH PHOTOGRAPHY Income Statement For the year ended December 31, 2021 Revenues: Service Revenue -73,000 Total Revenue (73,000) Expenses: Total Expenses 0 -73,000 $ Post-closing RED FLASH PHOTOGRAPHY Income Statement For the year ended December 31, 2021 Revenues: Service Revenue -73,000 Total Revenue (73,000) Expenses: Total Expenses 0 $ -73,000 Using the dropdown buttons, select the item that accurately describes the values that either increase or decrease the balance indicated. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Post-closing Dates: Jan 01 to: Dec 31 RED FLASH PHOTOGRAPHY Statement of Stockholders' Equity For the Period Ended December 31, 2021 Common Stock Retained Earnings Total Stockholders' Equity $ 0 0 o 0 $ 0 $ 0 $ 0 Choose the appropriate accounts to complete the company's balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Post-closing Dates: Jan 01 to: Dec 31 RED FLASH PHOTOGRAPHY Balance Sheet As of January 31, 2021 Assets Liabilities Current Assets: Current Liabilities: $ 0 $ 0 0 0 0 0 0 0 Total Current Liabilities 0 0 0 0 0 0 0 Total Liabilites 0 Total Current Assets Long-term Assets: Stockholder's Equity 0 0 0 0 0 Total Stockholders' Equity Total Liabilities & Stockholders' Equity Total Assets $ 0 $ 0