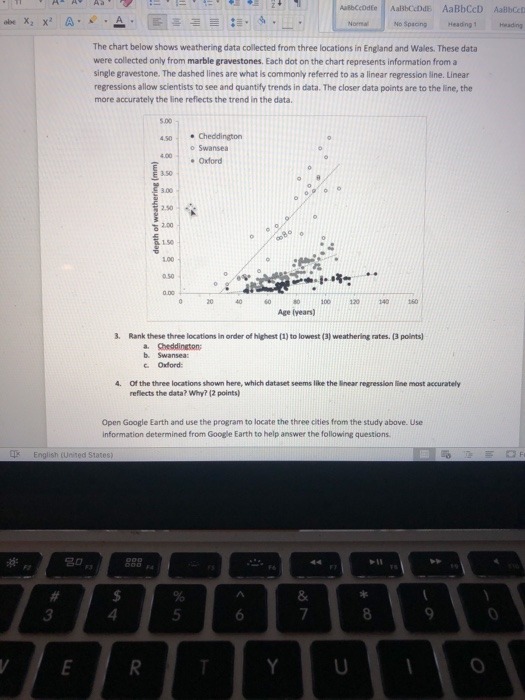

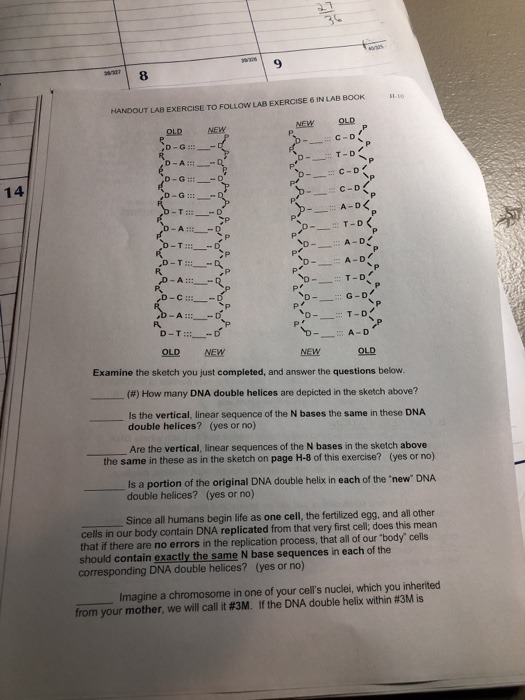

Exercise 3.3 (An Anticipated Output Shock I) Consider a two-period small open endowment economy populated by a large number of households with preferences described by the lifetime utility function where Ci and C2 denote, respectively, consumption in periods 1 and 2. Suppose that households receive exogenous endowments of goods given by Q1 = Q2 = 10 in periods 1 and 2, respectively. Every household enters period 1 with some debt, denoted B;, inherited from the past. Let By be equal to -5. The interest rate on these liabilities, denoted ro, is 20 percent. Finally, suppose that the country enjoys free capital mobility and that the world interest rate on assets held between periods 1 and 2, denoted r*, is 10 percent. 1. Compute the equilibrium levels of consumption, the trade balance, and the current account in periods 1 and 2. 2. Assume now that the endowment in period 2 is expected to increase from 10 to 15. Calculate the effect of this anticipated output increase on consumption, the trade balance, and the current account in both periods. Provide intuition.AmebCcOdEn AndbOLDde A3BhCCD AaBbCCD E No Spicing Handing 1 Heading The chart below shows weathering data collected from three locations in England and Wales. These data were collected only from marble gravestones. Each dot on the chart represents information from a single gravestone. The dashed lines are what is commonly referred to as a linear regression line. Linear regressions allow scientists to see and quantify trends in data. The closer data points are to the line, the more accurately the line reflects the trend in the data. * Cheddington o Swansea Oxford (mmj depth o 100 0.50 40 60 106 120 140 Age [year) 3. Rank these three locations In order of highest [1) to lowest (3) weathering rates. (3 points] a. Cheddington Swansea: Ordord 4. Of the three locations shown here, which dataset seems like the near regression line most accurately reflects the data? Why? (2 points) Open Google Earth and use the program to locate the three cities from the study above. Use Information determined from Google Earth to help answer the following questions English (United States) E OF FS 4 5 B 9 O m R T Y U OSuppose that an economy is in the middle of a recession and government policy makers want to increase aggregate demand by $800$800dollar sign, 800 billion. If the economy's marginal propensity to consume is 0.90.90, point, 9 and there is no crowding out, the government should do which of the ?following fiscal policy actions a. Increase taxes by $8$8dollar sign, 8 billion O b. Increase government spending by $80$80dollar sign, 80 billion O c. Decrease government spending $80$80dollar sign, 80 billion d. Increase the money supply by $800$800dollar sign, 800 billion O2. Suppose the economy is in a recession. Policymakers estimate that aggregate demand is RM100 billion short of the amount necessary to generate the long-run natural rate of output. That is, if aggregate demand were shifted to the right by RM100 billion, the economy would be in long-run equilibrium. a. If the government chooses to use fiscal policy to stabilize the economy, by how much should they increase government spending if the marginal propensity to consume (MPC) is 0.75 and there is no crowding out? b. If the government chooses to use fiscal policy to stabilize the economy, by how much should they increase government spending if the marginal propensity to consume (MPC) is 0.80 and there is no crowding out? C. If there is crowding out, will the government need to spend more or less than the amounts you found in (a) and (b) above? Why? d. If investment is very sensitive to changes in the interest rate, is crowding out more of a problem or less of a problem? Why? e. If policy makers discover that the lag for fiscal policy is two years, should that make them more likely to employ fiscal policy as a stabilization tool or more likely to allow the economy to adjust on its own? Why?2. Suppose the economy is in a recession. Policymakers estimate that aggregate demand is RM100 billion short of the amount necessary to generate the long-run natural rate of output. That is, if aggregate demand were shifted to the right by RM100 billion, the economy would be in long-run equilibrium. a. If the government chooses to use fiscal policy to stabilize the economy, by how much should they increase government spending if the marginal propensity to consume (MPC) is 0.75 and there is no crowding out? b. If the government chooses to use fiscal policy to stabilize the economy, by how much should they increase government spending if the marginal propensity to consume (MPC) is 0.80 and there is no crowding out? C. If there is crowding out, will the government need to spend more or less than the amounts you found in (a) and (b) above? Why? d. If investment is very sensitive to changes in the interest rate, is crowding out more of a problem or less of a problem? Why? e. If policy makers discover that the lag for fiscal policy is two years, should that make them more likely to employ fiscal policy as a stabilization tool or more likely to allow the economy to adjust on its own? Why?8 HANDOUT LAR EXERCISE TO FOLLOW LAB EXERCISE 6 IN LAB BOOK HI-10 NEW NEW OLD OLD : C-DX R D- A :_ T- D 14 LSC-D/ D-: A-D