Answered step by step

Verified Expert Solution

Question

1 Approved Answer

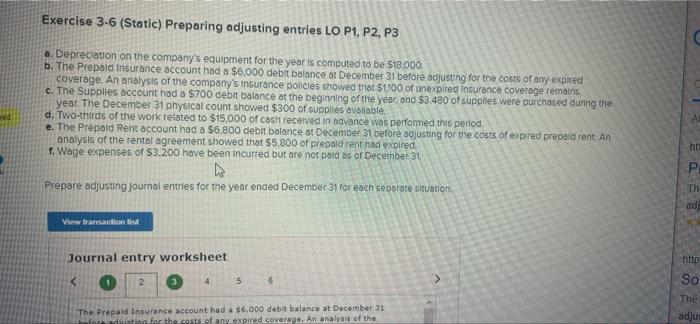

Exercise 3-6 (Static) Preparing adjusting entries LO P1, P2, P3 a. Depreciation on the company's equipment for the year is computed to be $18,000.

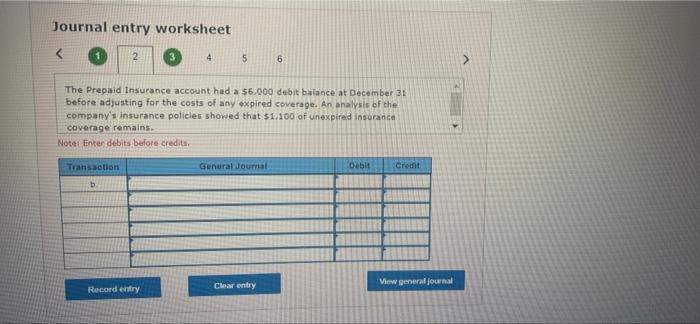

Exercise 3-6 (Static) Preparing adjusting entries LO P1, P2, P3 a. Depreciation on the company's equipment for the year is computed to be $18,000. b. The Prepaid Insurance account had a $6,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's Insurance policies showed that $1100 of unexpired Insurance coverage remains c. The Supplies account had a $700 debit balance at the beginning of the year, and $3.480 of supplles were purchased during the year. The December 31 physical count showed $300 of supplies available d. Two-thirds of the work related to $15,000 of cash received in advance was performed this period. e. The Prepaid Rent account had a $6.800 debit balance at December 31 before adjusting for the costs of expired prepaid rent. An analysis of the rental agreement showed that $5,800 of prepaid rent had expired f. Wage expenses of $3,200 have been incurred but are not paid as of December 31 Prepare adjusting journal entries for the year ended December 31 for each separate situation. View transaction list Journal entry worksheet < 2 4 5 6 The Prepaid Insurance account had a $6,000 debit balance at December 31 efore aduisting for the costs of any expired coverage. An analysis of the ht P Th ad http: So The adjus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started