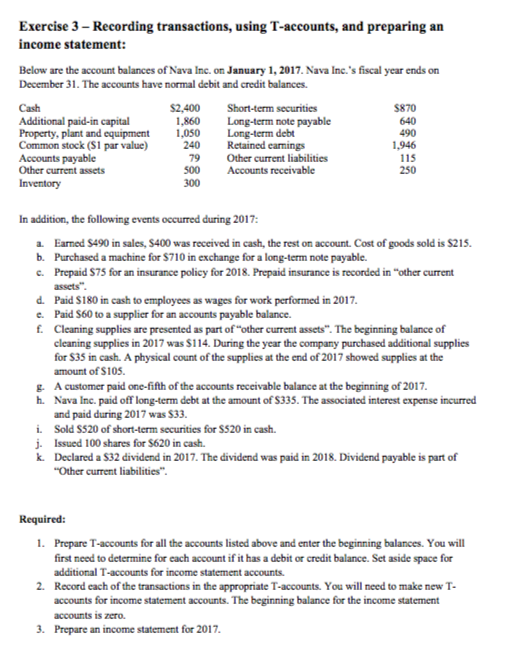

Exercise 3-Recording transactions, using T-accounts, and preparing an income statement: Below are the account balances of Nava Inc. on January 1, 2017. Nava Inc.'s fiscal year ends on December 31. The accounts have normal debit and credit balances. 2,400 Short-term securities 1,860 Long-term note payable Cash Additional paid-in capital Property, plant and equipment ,050 Long-term debt Common stock (S1 par value) Accounts payable Other current assets Inventoryy 240 Retained earnings 79 00Accounts receivable 300 $870 640 490 1,946 115 250 Other current liabilities In addition, the following events occurred during 2017: a. b. c. Earned $490 in sales, $400 was received in cash, the rest on account. Cost of goods sold is $215. Purchased a machine for $710 in exchange for a long-term note payable. Prepaid $75 for an insurance policy for 2018. Prepaid insurance is recorded in "other current assets d. Paid S180 in cash to employees as wages for work performed in 2017 e. Paid S60 to a supplier for an accounts payable balance. f. Cleaning supplies are presented as part of "other current assets". The beginning balance of cleaning supplies in 2017 was $114. During the year the company purchased additional supplies for $35 in cash. A physical count of the supplies at the end of 2017 showed supplies at the amount of S105. g. A customer paid one-fifth of the accounts receivable balance at the beginning of 2017 h. Nava Inc. paid off long-term debt at the amount of S335. The associated interest expense incurred i. j. k. and paid during 2017 was $33. Sold S520 of short-term securities for S520 in cash. Issued 100 shares for $620 in cash. Declared a S32 dividend in 2017The dividend was paid in 2018, Dividend payable is part of Other current liabilities" Required: 1. Prepare T-accounts for all the accounts listed above and enter the beginning balances. You will first need to determine for each account if it has a debit or credit balance. Set aside space for additional T-accounts for income statement accounts 2. Record each of the transactions in the appropriate T-accounts. You will need to make new T accounts for income statement accounts. The beginning balance for the income statement accounts is zero. 3. Prepare an income statement for 2017