Question: Exercise 4 (Bull and bear spreads with negative value). (See Example 8.8 in Lecture note 1.) Con- sider an asset with price (S) 120. We

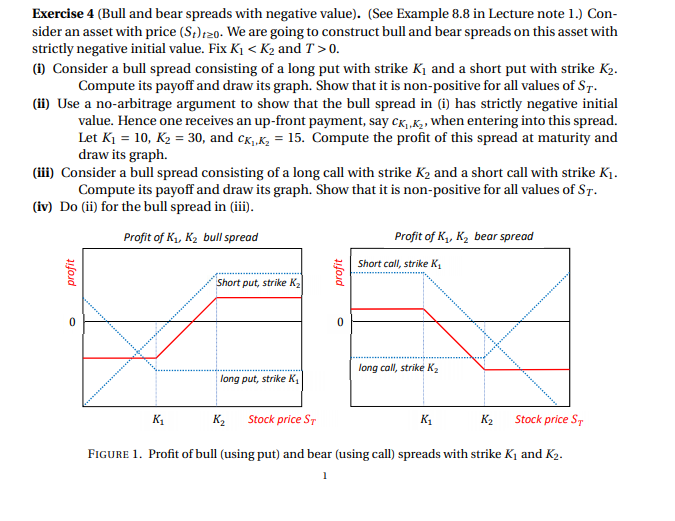

Exercise 4 (Bull and bear spreads with negative value). (See Example 8.8 in Lecture note 1.) Con- sider an asset with price (S) 120. We are going to construct bull and bear spreads on this asset with strictly negative initial value. Fix K1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts