Answered step by step

Verified Expert Solution

Question

1 Approved Answer

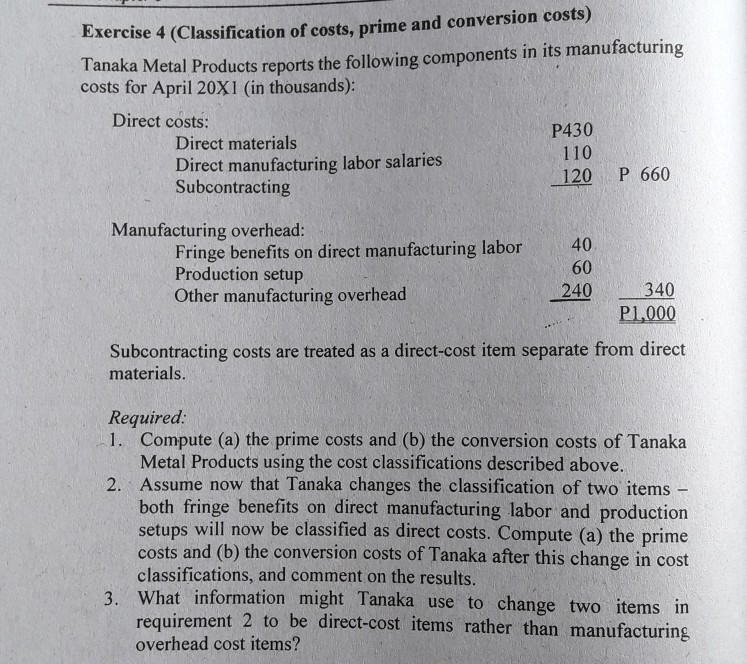

Exercise 4 (Classification of costs, prime and conversion costs) Tanaka Metal Products reports the following components in its manufacturing costs for April 20X1 (in thousands):

Exercise 4 (Classification of costs, prime and conversion costs) Tanaka Metal Products reports the following components in its manufacturing costs for April 20X1 (in thousands): Direct costs: P430 Direct materials Direct manufacturing labor salaries Subcontracting 110 120 P 660 Manufacturing overhead: Fringe benefits on direct manufacturing labor Production setup Other manufacturing overhead 40 60 340 P1,000 240 Subcontracting costs are treated as a direct-cost item separate from direct materials. Required 1. Compute (a) the prime costs and (b) the conversion costs of Tanaka Metal Products using the cost classifications described above 2. Assume now that Tanaka changes the classification of two items both fringe benefits on direct manufacturing labor and production setups will now be classified as direct costs. Compute (a) the prime costs and (b) the conversion costs of Tanaka after this change in cost classifications, and comment on the results. information might Tanaka use to change two items in requirement 2 to be direct-cost items rather than manufacturing overhead cost items

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started