Exercise 4. Perez Company had the following transactions during January: 1. Jan 1 Issued $100,000 in stock to owners in exchange for cash to

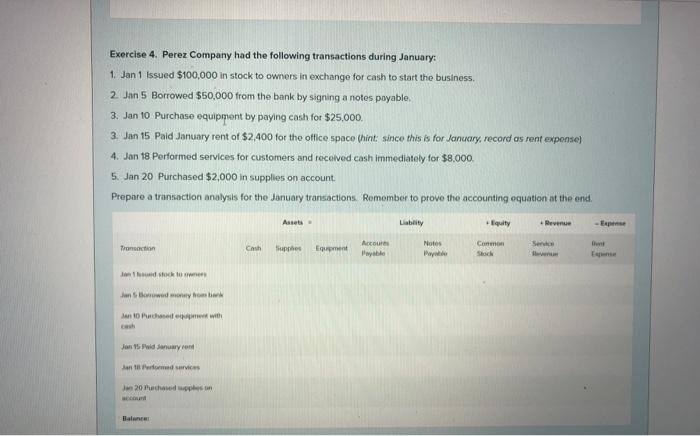

Exercise 4. Perez Company had the following transactions during January: 1. Jan 1 Issued $100,000 in stock to owners in exchange for cash to start the business. 2. Jan 5 Borrowed $50,000 from the bank by signing a notes payable. 3. Jan 10 Purchase equipmont by paying cash for $25,000. 3. Jan 15 Paid January rent of $2,400 for the office space (hint: since this is for January, record as rent expense) 4. Jan 18 Performed services for customers and recoived cash immediately for $8.000. 5. Jan 20 Purchased $2,000 in supplies on account. Prepare a transaction analysis for the January transactions. Remember to prove the accounting equation at the end. Assets Liablity Equity Revenue -Espense Accours Notes Conmon Service Transaction Cash fiupphes Equpment Payable Payate Stock ven Espense Ja nd stock to ener Jan SBorowed money hom bark Jan 10 Purchaned egpmet with cesh Jan 15 Paid January rent Jan tPertomed services Jan 20 Pechased upples on ccod Balance

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started