Answered step by step

Verified Expert Solution

Question

1 Approved Answer

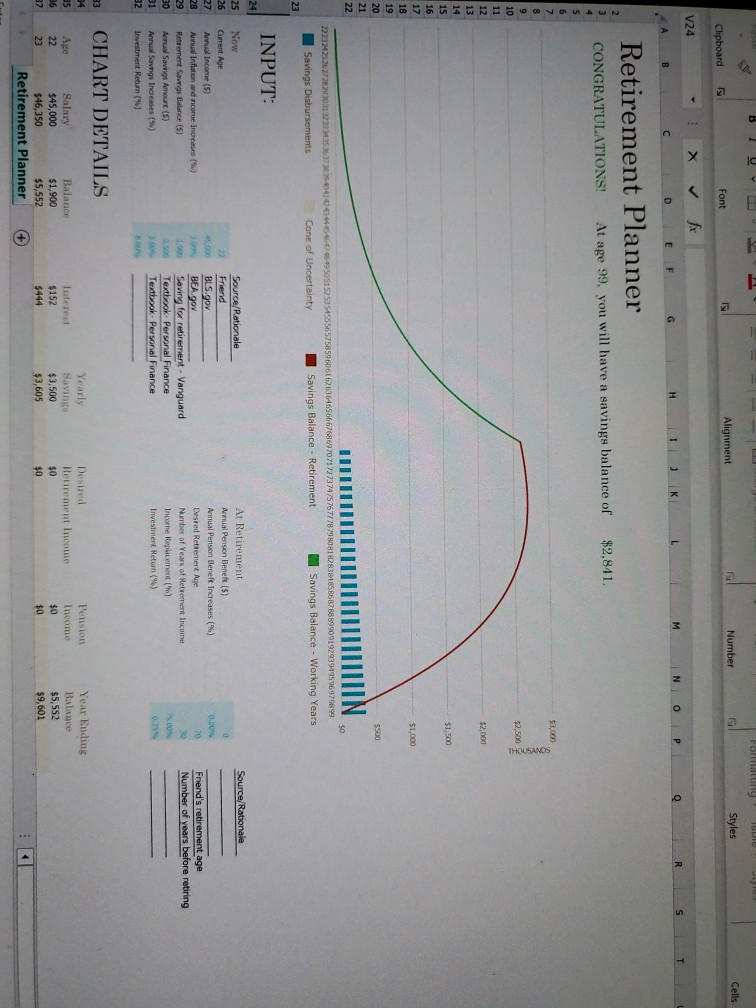

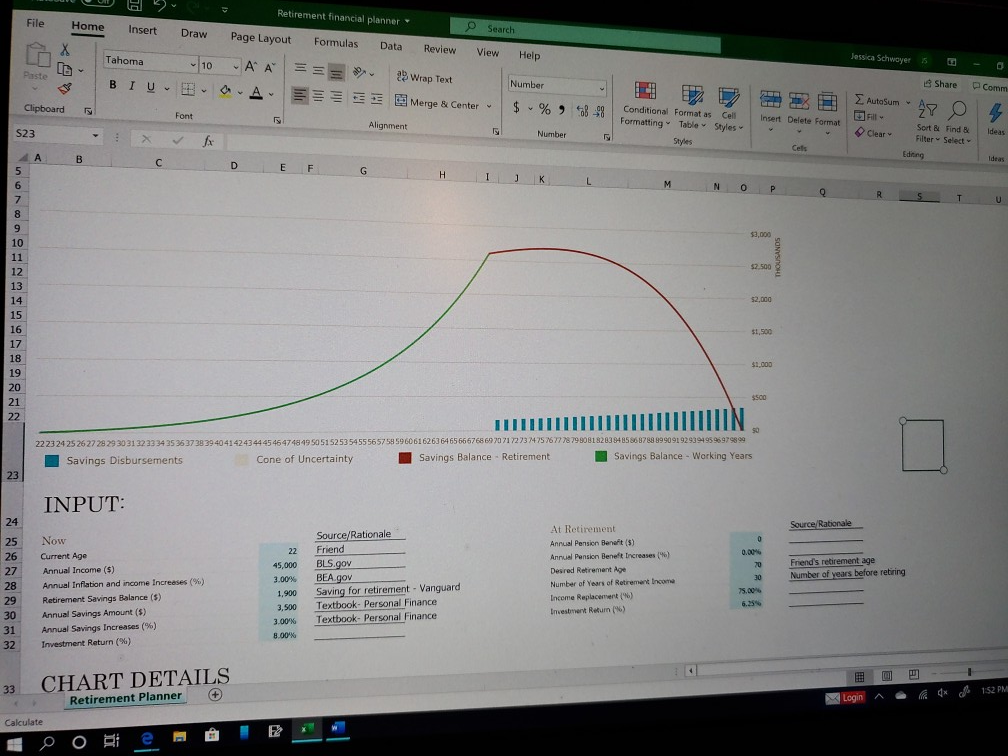

Exercise 4. we are to get the red line to $0. and fill in all the input lines and change the numbers if needed. Formatting

Exercise 4. we are to get the red line to $0. and fill in all the input lines and change the numbers if needed.

Formatting Alignment Number Styles Cells Clipboard Font V24 W 1K N O P Q RR SIT Retirement Planner CONGRATULATIONS! At age 99. you will have a savings balance of $2,841. THOUSANDS $2,500 $2,000 $1,500 $1,000 $500 50 2223242526272829303132333435363738394041044445464748495051525354555657585960616263646566676869707172737475767778798081828384858687888990919293949596979899 Savings Disbursements Cone of Uncertainty Savings Balance - Retirement Savings Balance - Working Years 23 INPUT: Source/Rationale Now Current Age Annual Income (5) Annual Inflation and come Increases (5) Retrement Savings Balance (5) Annual Savings Amount (5) Annual Savngs Increases (9) Investment Return (96) Source/Rationale Friend BLS.gov BEA.gov Saving for retirement. Vanguard Textbook- Personal Finance Textbook - Personal Finance At Retirement Annual Pension Beneft (5) Annual Penson Benelt Increases (%) Desred Retrement Age Number of Years of Retirement Income Income Replacement (%) Investment Return (%) Friend's retirement age Number of years before retiring 31 32 83 CHART DETAILS Desired Retirement Income 35 36 37 Age 22 23 Yearly Savings $3,500 $3,605 Pension Income $0 Salary Balance $45,000 $1,900 $46,350 $5,552 Retirement Planner Year Ending Balance $5,552 $9,601 $0 $152 $444 + H = Retirement financial planner Data File Home Insert Draw Page Layout Formulas Tahoma 10 -AA == 3 BIUB-a.al Clipboard Font s S23 fx A B C D E F Search Review View Help Wrap Text Number Merge & Center $ % 9 4 Jessica Schwoyer 5 - 0 Share Comm 47 04 Sort & Find & Ideas Clear Filter Select Editing 99 Insert Delete Format Alignment Conditional Formatas Cell Formatting Table Styles Styles Number G M N O P Q R S T U. SONO $2,000 $1,500 $1,000 $500 TIITTITUITION IN 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 4041424344454647484950515253545556575859606162636465666768697071727374757677787980818283 84 85 86 87 88 8990919293949596979899 Savings Disbursements Cone of Uncertainty Savings Balance - Retirement Savings Balance - Working Years INPUT: Source/Rationale Now Current Age Annual Income (5) Annual Inflation and income increases (%) Retirement Savings Balance (5) Annual Savings Amount (5) Annual Savings Increases (%) Investment Return (%) Source/Rationale Friend BLS.gov BEA.gov Saving for retirement - Vanguard Textbook- Personal Finance Textbook- Personal Finance Friend's retirement age Number of years before retiring At Retirement Annual Pension Benefit (5) Annual Pension Beneft Increases (96) Desired Retirement Age Number of years of Retrement Income Income Replacement (4) Investment Return (46) 22 45,000 3.00% 1,900 3.500 3.00% 8.00% 28 29 6.25% 30 31 Login - 6 0x of 152 PM 33 CHART DETAILS Retirement Planner + Calculate 320 e - @IE Formatting Alignment Number Styles Cells Clipboard Font V24 W 1K N O P Q RR SIT Retirement Planner CONGRATULATIONS! At age 99. you will have a savings balance of $2,841. THOUSANDS $2,500 $2,000 $1,500 $1,000 $500 50 2223242526272829303132333435363738394041044445464748495051525354555657585960616263646566676869707172737475767778798081828384858687888990919293949596979899 Savings Disbursements Cone of Uncertainty Savings Balance - Retirement Savings Balance - Working Years 23 INPUT: Source/Rationale Now Current Age Annual Income (5) Annual Inflation and come Increases (5) Retrement Savings Balance (5) Annual Savings Amount (5) Annual Savngs Increases (9) Investment Return (96) Source/Rationale Friend BLS.gov BEA.gov Saving for retirement. Vanguard Textbook- Personal Finance Textbook - Personal Finance At Retirement Annual Pension Beneft (5) Annual Penson Benelt Increases (%) Desred Retrement Age Number of Years of Retirement Income Income Replacement (%) Investment Return (%) Friend's retirement age Number of years before retiring 31 32 83 CHART DETAILS Desired Retirement Income 35 36 37 Age 22 23 Yearly Savings $3,500 $3,605 Pension Income $0 Salary Balance $45,000 $1,900 $46,350 $5,552 Retirement Planner Year Ending Balance $5,552 $9,601 $0 $152 $444 + H = Retirement financial planner Data File Home Insert Draw Page Layout Formulas Tahoma 10 -AA == 3 BIUB-a.al Clipboard Font s S23 fx A B C D E F Search Review View Help Wrap Text Number Merge & Center $ % 9 4 Jessica Schwoyer 5 - 0 Share Comm 47 04 Sort & Find & Ideas Clear Filter Select Editing 99 Insert Delete Format Alignment Conditional Formatas Cell Formatting Table Styles Styles Number G M N O P Q R S T U. SONO $2,000 $1,500 $1,000 $500 TIITTITUITION IN 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 4041424344454647484950515253545556575859606162636465666768697071727374757677787980818283 84 85 86 87 88 8990919293949596979899 Savings Disbursements Cone of Uncertainty Savings Balance - Retirement Savings Balance - Working Years INPUT: Source/Rationale Now Current Age Annual Income (5) Annual Inflation and income increases (%) Retirement Savings Balance (5) Annual Savings Amount (5) Annual Savings Increases (%) Investment Return (%) Source/Rationale Friend BLS.gov BEA.gov Saving for retirement - Vanguard Textbook- Personal Finance Textbook- Personal Finance Friend's retirement age Number of years before retiring At Retirement Annual Pension Benefit (5) Annual Pension Beneft Increases (96) Desired Retirement Age Number of years of Retrement Income Income Replacement (4) Investment Return (46) 22 45,000 3.00% 1,900 3.500 3.00% 8.00% 28 29 6.25% 30 31 Login - 6 0x of 152 PM 33 CHART DETAILS Retirement Planner + Calculate 320 e - @IE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started