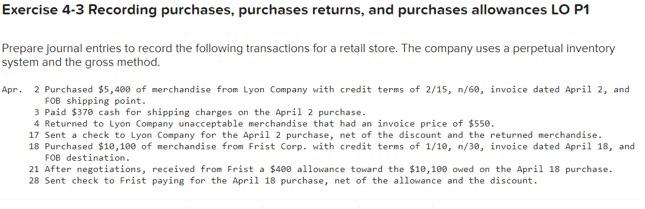

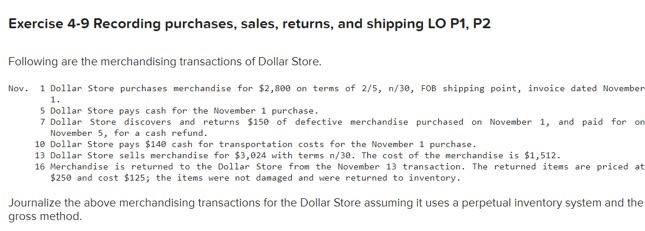

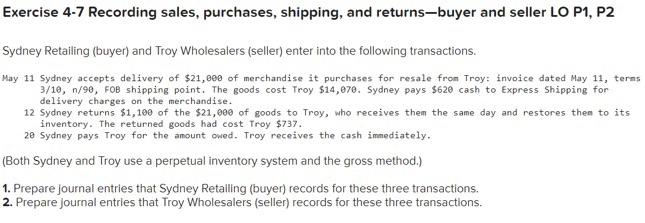

Exercise 4-3 Recording purchases, purchases returns, and purchases allowances LO P1 Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual Inventory system and the gross method. Apr. 2 Purchased $5,408 of merchandise from Lyon Company with credit terms of 2/15, 1/60, invoice dated April 2, and FOB shipping point. 3 Paid $370 cash for shipping charges on the April 2 purchase. 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $550. 17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise. 18 Purchased $10, 100 of merchandise from Frist Corp. with credit terms of 1/10, n/30, invoice dated April 18, and FOB destination. 21 After negotiations, received from Frist a $400 allowance toward the $10,100 owed on the April 18 purchase. 28 Sent check to Frist paying for the April 18 purchase, net of the allowance and the discount. Exercise 4-9 Recording purchases, sales, returns, and shipping LO P1, P2 Following are the merchandising transactions of Dollar Store. Nov. 1 Dollar Store purchases merchandise for $2,808 on terms of 2/5, 1/30, FOB shipping point, invoice dated November 1. 5 Dollar Store pays cash for the November 1 purchase. 7 Dollar Store discovers and returns $150 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund. 10 Dollar Store pays $148 cash for transportation costs for the November 1 purchase. 13 Dollar Store sells merchandise for $3,024 with terms n/38. The cost of the merchandise is $1,512. 16 Merchandise is returned to the Dollar Store from the November 13 transaction. The returned items are priced at $250 and cost $125; the items were not damaged and were returned to inventory. Journalize the above merchandising transactions for the Dollar Store assuming it uses a perpetual inventory system and the gross method. Exercise 4-7 Recording sales, purchases, shipping, and returns-buyer and seller LO P1, P2 Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts delivery of $21,000 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90, FOB shipping point. The goods cost Troy $14,070. Sydney pays $620 cash to Express Shipping for delivery charges on the merchandise. 12 Sydney returns $1,100 of the $21,000 of goods to Troy, who receives then the same day and restores then to its inventory. The returned goods had cost Troy $737. 20 Sydney pays Troy for the amount owed. Troy receives the cash immediately. (Both Sydney and Troy use a perpetual inventory system and the gross method.) 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions. 2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions