Question

Exercise 4-49 (Algo) Dropping Product Lines (LO 4-4) 1. Cotrone Beverages makes energy drinks in three flavors: Original, Strawberry, and Orange. The company is currently

Exercise 4-49 (Algo) Dropping Product Lines (LO 4-4)

1. Cotrone Beverages makes energy drinks in three flavors: Original, Strawberry, and Orange. The company is currently operating at 75 percent of capacity. Worried about the company's performance, the company president is considering dropping the Strawberry flavor. If Strawberry is dropped, the revenue associated with it would be lost and the related variable costs saved. In addition, the company's total fixed costs would be reduced by 15 percent.

Segmented income statements appear as follows:

| Product | Original | Strawberry | Orange | ||||||||

| Sales | $ | 32,300 | $ | 43,000 | $ | 51,200 | |||||

| Variable costs | 22,610 | 38,700 | 40,960 | ||||||||

| Contribution margin | $ | 9,690 | $ | 4,300 | $ | 10,240 | |||||

| Fixed costs allocated to each product line | 4,600 | 6,200 | 7,400 | ||||||||

| Operating profit (loss) | $ | 5,090 | $ | (1,900 | ) | $ | 2,840 | ||||

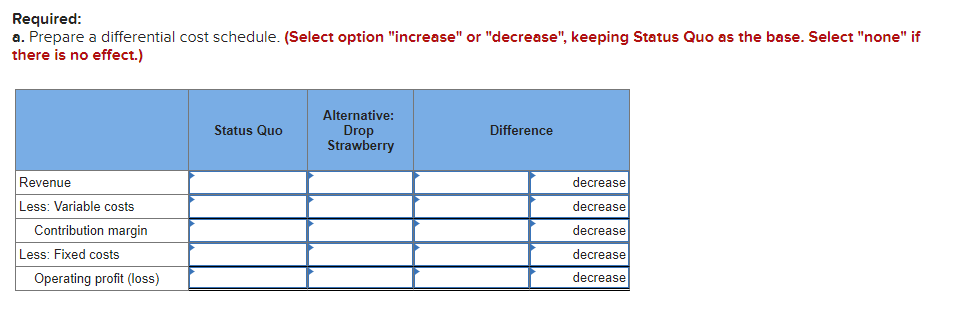

Required:

a. Prepare a differential cost schedule. (Select option "increase" or "decrease", keeping Status Quo as the base. Select "none" if there is no effect.)

2. Exercise 4-37 (Algo) Special Orders (LO 4-1, 2)

Alpine Luggage has a capacity to produce 400,000 suitcases per year. The company is currently producing and selling 320,000 units per year at a selling price of $405 per case. The cost of producing and selling one case follows:

| Variable manufacturing costs | $ | 155 | ||

| Fixed manufacturing costs | 39 | |||

| Variable selling and administrative costs | 80 | |||

| Fixed selling and administrative costs | 20 | |||

| Total costs | $ | 294 | ||

The company has received a special order for 30,000 suitcases at a price of $250 per case. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $51 per suitcase. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations:

| Selling price per case | $ | 250 | |

| Variable manufacturing costs | 155 | ||

| Fixed manufacturing costs | 39 | ||

| Variable selling and administrative costs | 51 | ||

| Fixed selling and administrative costs | 20 | ||

| Net profit (loss) per case | $ | (15 | ) |

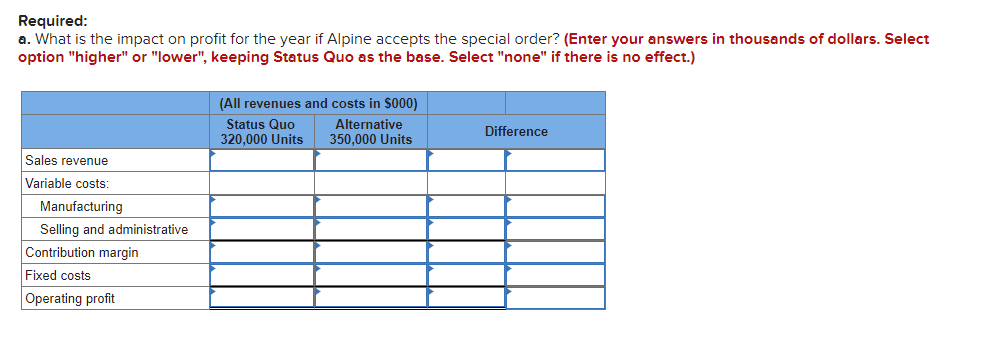

Required:

a. What is the impact on profit for the year if Alpine accepts the special order? (Enter your answers in thousands of dollars. Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started