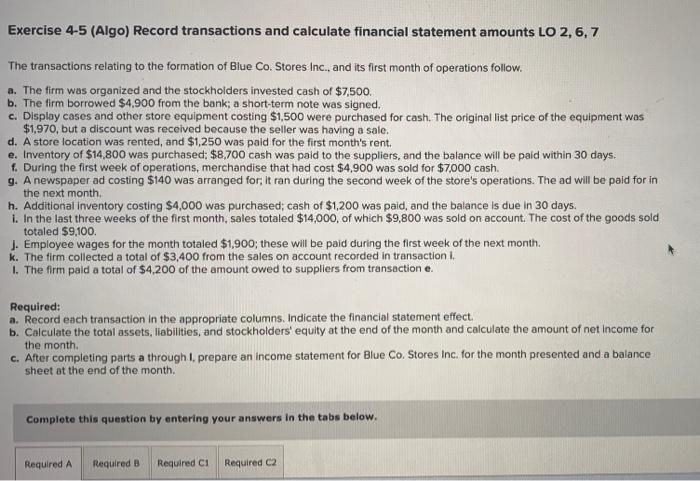

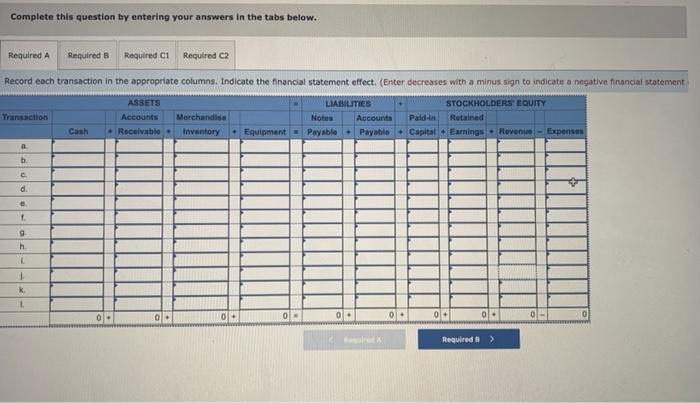

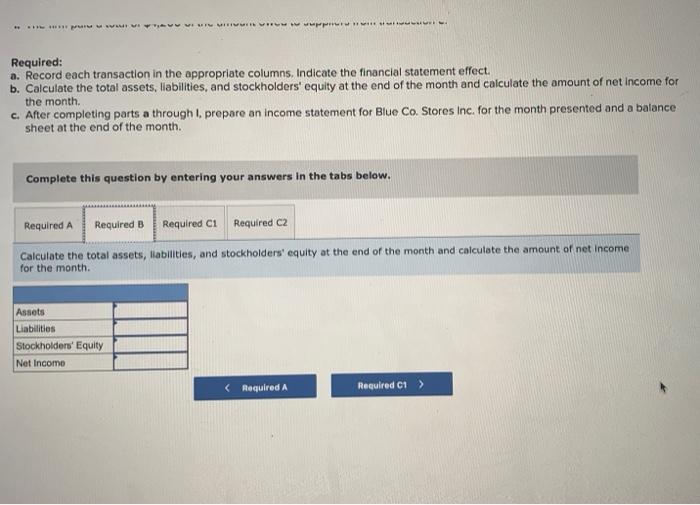

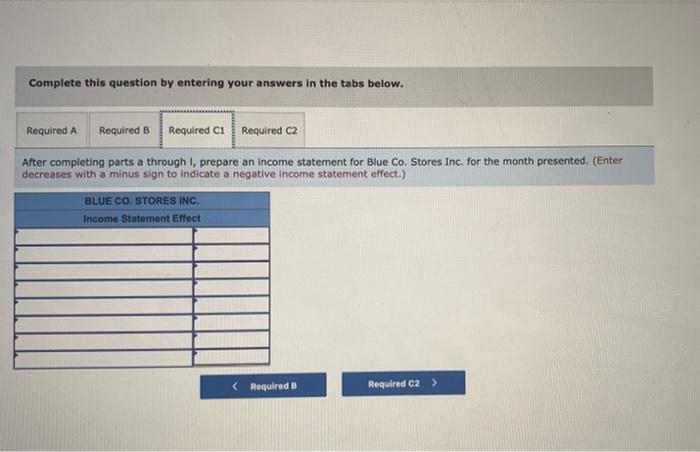

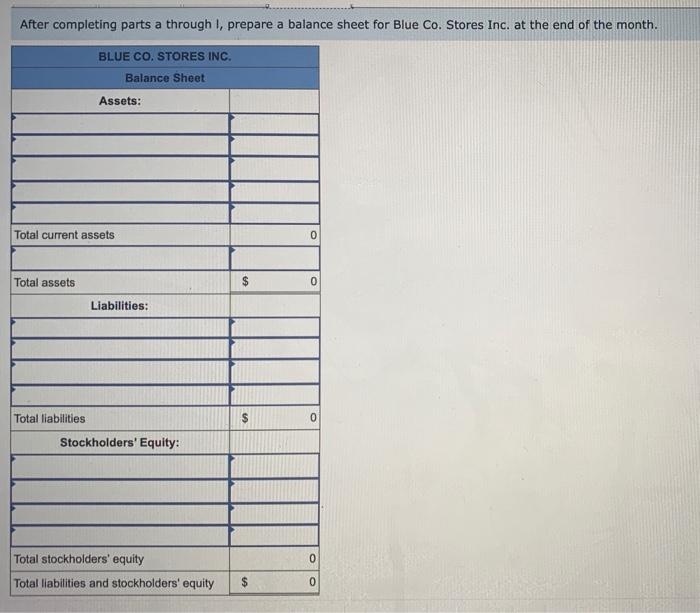

Exercise 4-5 (Algo) Record transactions and calculate financial statement amounts LO 2, 6,7 The transactions relating to the formation of Blue Co. Stores Inc., and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $7,500. b. The firm borrowed $4,900 from the bank; a short-term note was signed. c. Display cases and other store equipment costing $1,500 were purchased for cash. The original list price of the equipment was $1,970, but a discount was received because the seller was having a sale. d. A store location was rented, and $1,250 was paid for the first month's rent. e. Inventory of $14,800 was purchased: $8,700 cash was paid to the suppliers, and the balance will be paid within 30 days. f. During the first week of operations, merchandise that had cost $4,900 was sold for $7,000cash. 9. A newspaper ad costing $140 was arranged for, it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $4,000 was purchased; cash of $1,200 was paid, and the balance is due in 30 days. i. In the last three weeks of the first month, sales totaled $14,000, of which $9,800 was sold on account. The cost of the goods sold totaled \$9.100. J. Employee wages for the month totaled $1,900; these will be paid during the first week of the next month. k. The firm collected a total of $3,400 from the sales on account recorded in transaction I. I. The firm paid a total of $4,200 of the amount owed to suppliers from transaction e. Required: a. Record each transaction in the appropriate columns. Indicate the financial statement effect. b. Calculate the total assets, liabilities, and stockholders' equity at the end of the month and calculate the amount of net income for the month. c. After completing parts a through I, prepare an income statement for Blue Co. Stores Inc. for the month presented and a balance sheet at the end of the month. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required: a. Record each transaction in the appropriate columns, Indicate the financial statement effect. b. Calculate the total assets, liabilities, and stockholders' equity at the end of the month and calculate the amount of net income for the month. c. After completing parts a through I, prepare an income statement for Blue Co. Stores inc. for the month presented and a balance sheet at the end of the month. Complete this question by entering your answers in the tabs below. Calculate the total assets, liabilities, and stockholders' equity at the end of the month and calculate the amount of net income for the month. Complete this question by entering your answers in the tabs below. After completing parts a through I, prepare an income statement for Blue Co. Stores Inc. for the month presented. (Enter decreases with a minus sign to indicate a negative income statement effect.) After completing parts a through I, prepare a balance sheet for Blue Co. Stores Inc. at the end of the month