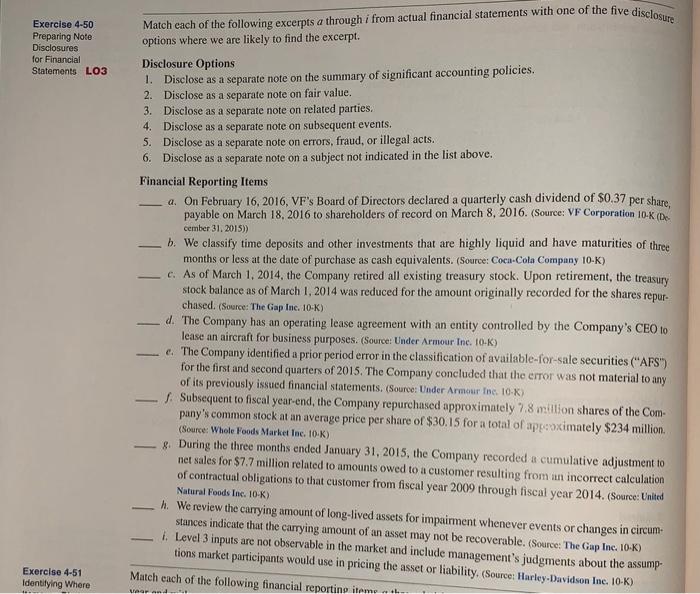

Exercise 4-50 Preparing Note Disclosures for Financial Statements LO3 Match each of the following excerpts a through i from actual financial statements with one of the five disclosure options where we are likely to find the excerpt. Disclosure Options 1. Disclose as a separate note on the summary of significant accounting policies. 2. Disclose as a separate note on fair value. 3. Disclose as a separate note on related parties. 4. Disclose as a separate note on subsequent events. 5. Disclose as a separate note on errors, fraud, or illegal acts. 6. Disclose as a separate note on a subject not indicated in the list above. Financial Reporting Items a. On February 16, 2016. VF's Board of Directors declared a quarterly cash dividend of $0.37 per share, payable on March 18, 2016 to shareholders of record on March 8, 2016. (Source: VF Corporation 10K (DO cember 31. 2015)) b. We classify time deposits and other investments that are highly liquid and have maturities of three months or less at the date of purchase as cash equivalents. (Source: Coca-Cola Company 10-K) c. As of March 1, 2014, the Company retired all existing treasury stock. Upon retirement, the treasury stock balance as of March 1, 2014 was reduced for the amount originally recorded for the shares repur- chased. (Source: The Gap Inc. 10-K) d. The Company has an operating lease agreement with an entity controlled by the Company's CEO to lease an aircraft for business purposes. (Source: Under Armour Inc. 10-K) e. The Company identified a prior period error in the classification of available-for-sale securities ("AFS") for the first and second quarters of 2015. The Company concluded that the error was not material to any of its previously issued financial statements. (Source: Under Armour Inc. 10-x) 4. Subsequent to fiscal year-end, the Company repurchased approximately 7.8 million shares of the Com- pany's common stock at an average price per share of $30.15 for a total of approximately $234 million (Source: Whole Foods Market Inc. 10-K) - 8. During the three months ended January 31, 2015, the Company recorded a cumulative adjustment to net sales for $7.7 million related to amounts owed to a customer resulting from an incorrect calculation of contractual obligations to that customer from fiscal year 2009 through fiscal year 2014. (Source: United Natural Foods Inc. 10-K) h. We review the carrying amount of long-lived assets for impairment whenever events or changes in circum- stances indicate that the carrying amount of an asset may not be recoverable. (Source: The Gap Inc. 10-K) i. Level 3 inputs are not observable in the market and include management's judgments about the assump- tions market participants would use in pricing the asset or liability. (Source: Harley-Davidson Inc. 10-K) Match each of the following financial reporting itement Exercise 4-51 Identifying Where Grad