Answered step by step

Verified Expert Solution

Question

1 Approved Answer

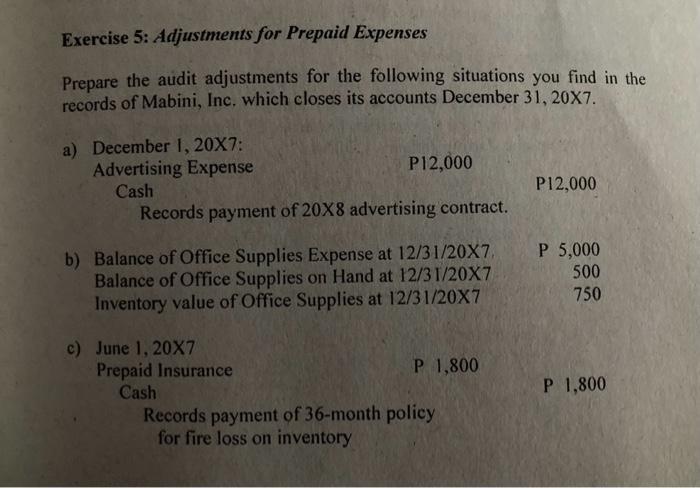

Exercise 5: Adjustments for Prepaid Expenses Prepare the audit adjustments for the following situations you find in the records of Mabini, Inc. which closes

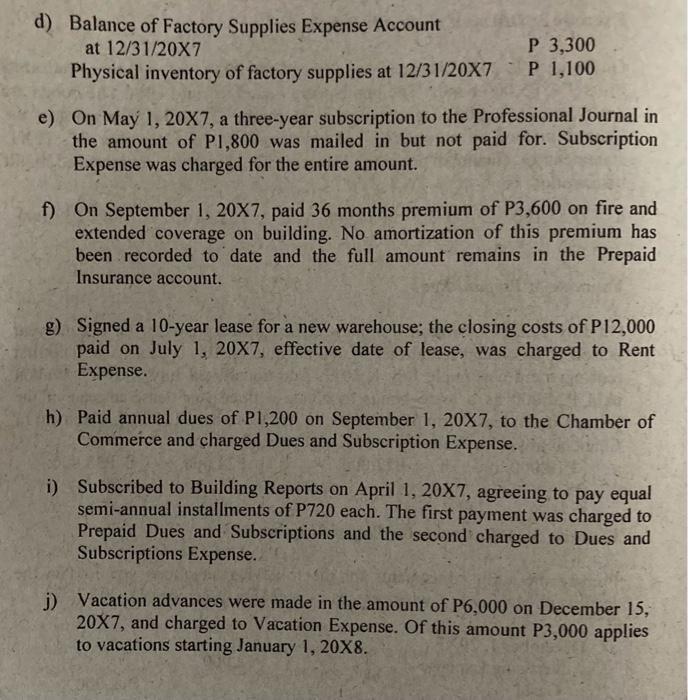

Exercise 5: Adjustments for Prepaid Expenses Prepare the audit adjustments for the following situations you find in the records of Mabini, Inc. which closes its accounts December 31, 20X7. a) December 1, 20X7: Advertising Expense Cash Records payment of 20X8 advertising contract. b) Balance of Office Supplies Expense at 12/31/20X7, Balance of Office Supplies on Hand at 12/31/20X7 Inventory value of Office Supplies at 12/31/20X7 c) June 1, 20X7 P12,000 Prepaid Insurance Cash P 1,800 Records payment of 36-month policy for fire loss on inventory P12,000 P 5,000 500 750 P 1,800 d) Balance of Factory Supplies Expense Account at 12/31/20X7 Physical inventory of factory supplies at 12/31/20X7 P 3,300 P 1,100 e) On May 1, 20X7, a three-year subscription to the Professional Journal in the amount of P1,800 was mailed in but not paid for. Subscription Expense was charged for the entire amount. f) On September 1, 20X7, paid 36 months premium of P3,600 on fire and extended coverage on building. No amortization of this premium has been recorded to date and the full amount remains in the Prepaid Insurance account. g) Signed a 10-year lease for a new warehouse; the closing costs of P12,000 paid on July 1, 20X7, effective date of lease, was charged to Rent Expense. h) Paid annual dues of P1,200 on September 1, 20X7, to the Chamber of Commerce and charged Dues and Subscription Expense. i) Subscribed to Building Reports on April 1, 20X7, agreeing to pay equal semi-annual installments of P720 each. The first payment was charged to Prepaid Dues and Subscriptions and the second charged to Dues and Subscriptions Expense.. j) Vacation advances were made in the amount of P6,000 on December 15, 20X7, and charged to Vacation Expense. Of this amount P3,000 applies to vacations starting January 1, 20X8.

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started