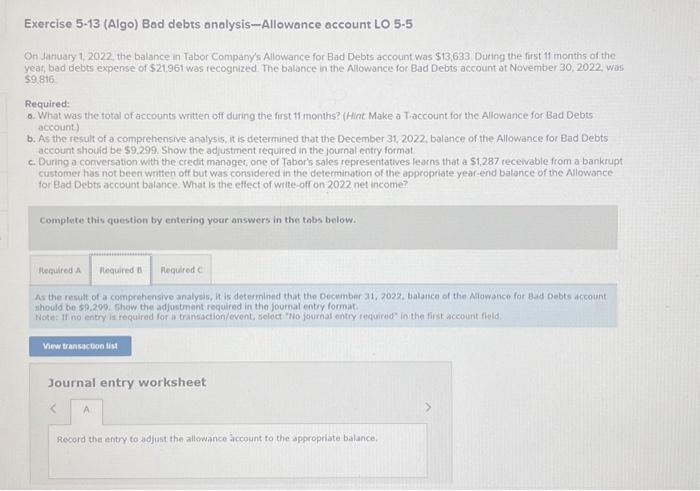

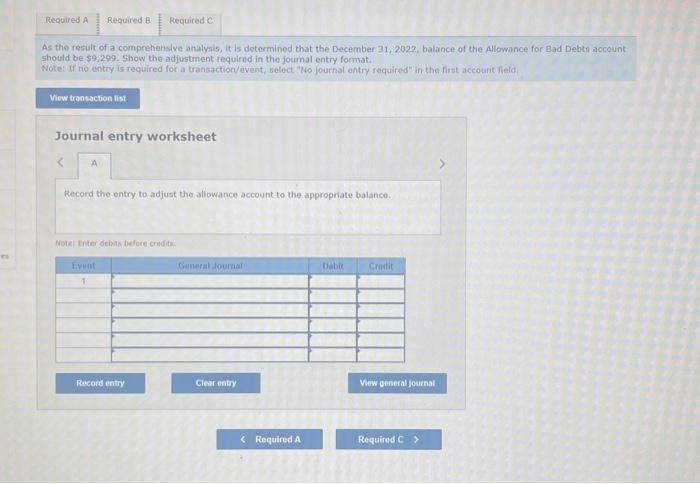

Exercise 5-13 (Algo) Bad debts analysis-Allowance account LO 5.5 On January 1, 2022 the balance in Tabor Company's Allowance for Bad Debts account was $13,633. During the first 11 months of the year, bad debts expense of $21,961 was recognized. The balance in the Allowance for Bad Debts account at Novernber 30, 2022, was $9,816. Required: a. What was the total of accounts written off during the first 11 months? (Hint: Make a T-account for the Allowance for Bad Debts account) b. As the resuit of a comprehensive analysis, it is determined that the December 31, 2022. balance of the Allowance for Bad Debts account should be $9,299. Show the adjustment required in the journal entry format: c. During a conversation with the credit manager, one of Tabor's sales representatives learns that a $1,287 receivable from a bankrupt customer has not been written off but was considered in the determination of the appropriate year-end balance of the Allowance for Bad Debts account balance. What is the effect of write-off on 2022 net income? Complete this question by entering your onswers in the tobs below. What was the total of accounts written off during the first 11 months? (Hint: Make a Traccount for the Allowance for Bad Debts account.) Exercise 5.13 (Algo) Bad debts analysis-Allowance account LO 5-5 On January 1, 2022, the balance in Tabor Company's Allowance for Bad Debts account was \$13,633. During the first 11 months of the year, bad debts expense of $21.961 was recognized. The balance in the Allowance for Bad Debts account at November 30, 2022, was 59.816 Required: o. What was the total of accounts written off during the first 11 months? (Hint Make a Taccount for the Allowance for Bad Debts account) b. As the result of a comprehensive analysis, it is determined that the December 31, 2022, balance of the Allowance for Bad Debts account should be $9.299. Show the adjustment required in the journal entry format c. During a conversation with the credit manager, one of Tabor's sales representatives learns that a \$1,287 receivable from a bankrupt customer has not been written off but was considered in the determination of the appropriate year-end balance of the Alowance for Bad Debts account balance. What is the effect of write-off on 2022 net income? Complete this question by entering your answers in the tabs below. As the result of a comprehensive analyeis, it is determined that the December 31, 2022, balance of the Alowance for 8-id Debts account should be 59,200. Show the adjustment required in the journal entry format: Fote: if no entry is required for a transactiondevent, seloct "No journat entry required" in the first account fleld. Journal entry worksheet Record the entry to adjust the allowance count to the appropriate balance. As the result of a comprehenslve anulysis, it is determined that the December 31,2022 , balance of the Allowance for Bad Debth account should be $9,299. Show the adjustment required in the foumal entry format. Note: If no entry is required for a transaction/event, select "No fournal entry requifed" in the first account field. Journal entry worksheet Record the entry to adjust the allowance account to the appropriate balance. Note Enter bebas before oredits. Exercise 5-13 (Algo) Bad debts analysis-Allowance account LO 5.5 On January 1, 2022, the balance in Tabor Company's. Aliowance for Bad Debts account was $13,633. During the first 11 months of the year, bad debts expense of $21,961 was recognized. The balance in the Allowance for Bad Debts account at November 30, 2022, was $9,816. Required: a. What was the total of accounts written off during the first 11 months? (Hint Make a T-account for the Allowance for Bad Debts account) b. As the result of a comprehensive analysis, it is determined that the December 31,2022 . balance of the Allowance for Bad Debts account should be $9,299. Show the adjustment required in the journal entry format c. During a conversation with the credit manager, one of Tabor's sales representatives leatns that a \$1,287 receivable from a bankrupt customer has not been written off but was considered in the determination of the appropriate year-end balance of the Allowance for Bad Debts account balance. What is the effect of write-off on 2022 net income? Complete this question by entering your answers in the tabs below. During a comversation with the crodit manager, ono of Tabor's sales representabves learns that a $1,287 recelvable from a bankrupt customer has not been written off but was considered in the determination of the appropriate yeat-end balance of the Allowance for Bad Debts account balances. What is the effect of writer off on 2022 net income