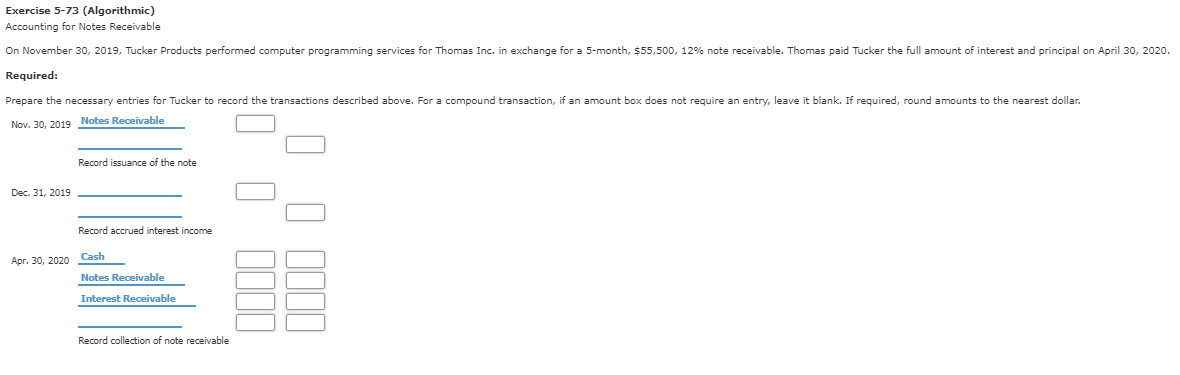

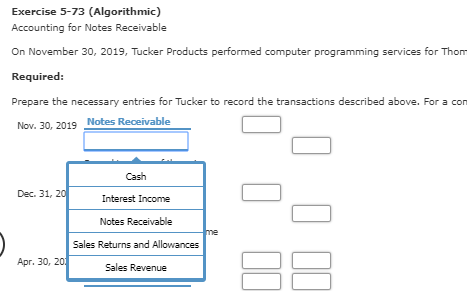

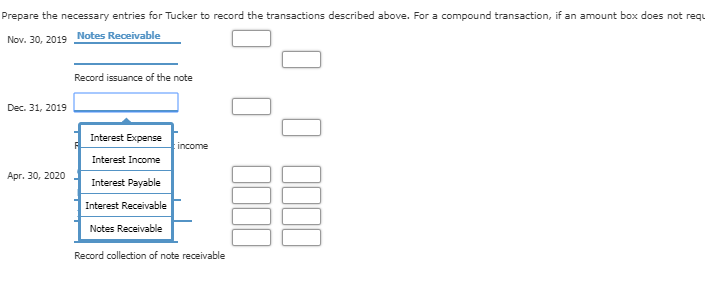

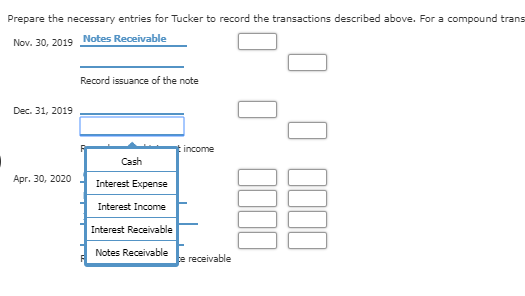

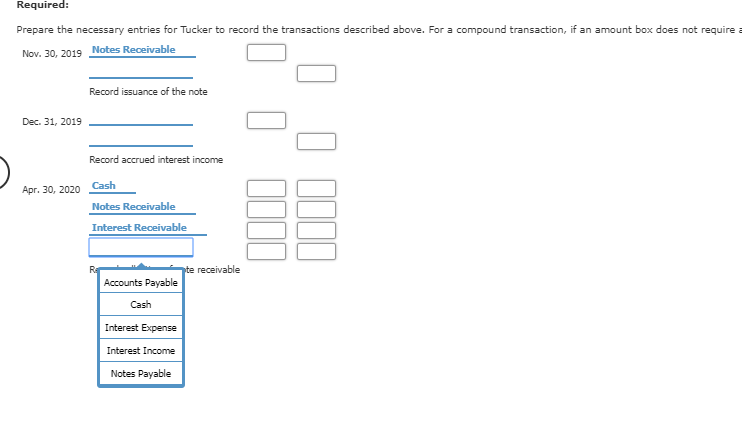

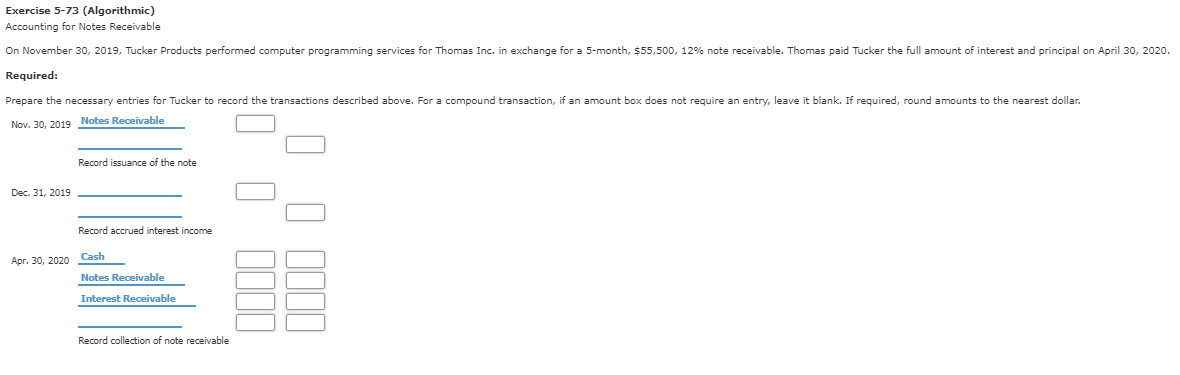

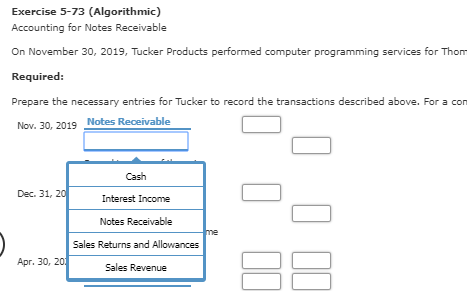

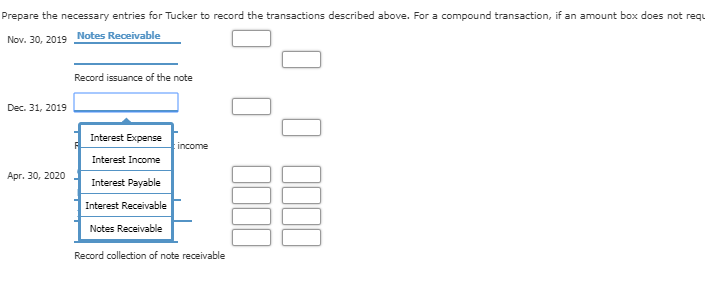

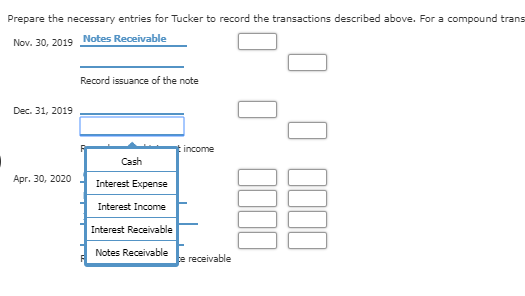

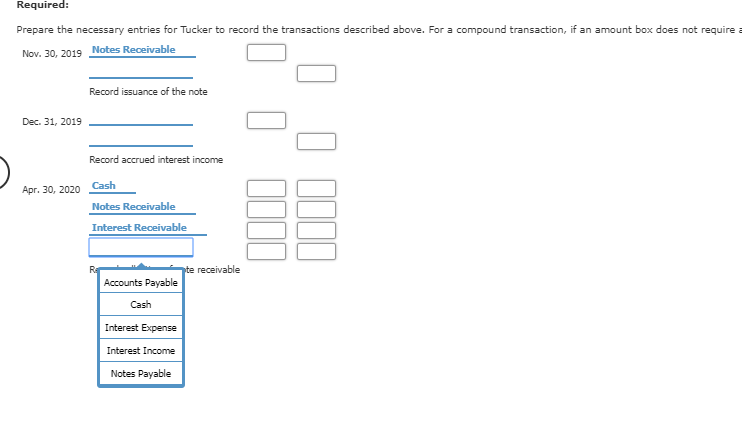

Exercise 5-73 (Algorithmic) Accounting for Notes Receivable On November 30, 2019, Tucker Products performed computer programming services for Thomas Inc. in exchange for a 5-month, $55,500, 12% note receivable. Thomas paid Tucker the full amount of interest and principal on April 30, 2020. Required: Prepare the necessary entries for Tucker to record the transactions described above. For a compound transaction, if an amount box does not require an entry, leave it blank. If required, round amounts to the nearest dollar. Nov. 30, 2019 Notes Receivable Record issuance of the note Dec. 31, 2019 Record accrued interest income Apr. 30, 2020 Cash Notes Receivable Interest Receivable Record collection of note receivable Exercise 5-73 (Algorithmic) Accounting for Notes Receivable On November 30, 2019, Tucker Products performed computer programming services for Thor Required: Prepare the necessary entries for Tucker to record the transactions described above. For a cor Nov. 30, 2019 Notes Receivable Cash Dec 31, 20 Interest Income Notes Receivable Sales Returns and Allowances Apr 30, 201 Sales Revenue Prepare the necessary entries for Tucker to record the transactions described above. For a compound transaction, if an amount box does not requ Nov. 30, 2019 Notes Receivable Record issuance of the note Dec 31, 2019 Interest Expense Interest Income Apr. 30, 2020 Interest Payable Interest Receivable Notes Receivable Record collection of note receivable Prepare the necessary entries for Tucker to record the transactions described above. For a compound trans Nov. 30, 2019 Notes Receivable Record issuance of the note Dec 31, 2019 income Cash Apr. 30, 2020 Interest Expense Interest Income Interest Receivable Notes Receivable e receivable Required: Prepare the necessary entries for Tucker to record the transactions described above. For a compound transaction, if an amount box does not require a Nov. 30, 2019 Notes Receivable Record issuance of the note Dec 31, 2019 0001 101 Record accrued interest income Apr. 30, 2020 Cash Notes Receivable Interest Receivable te receivable Accounts Payable Cash Interest Expense Interest Income Notes Payable