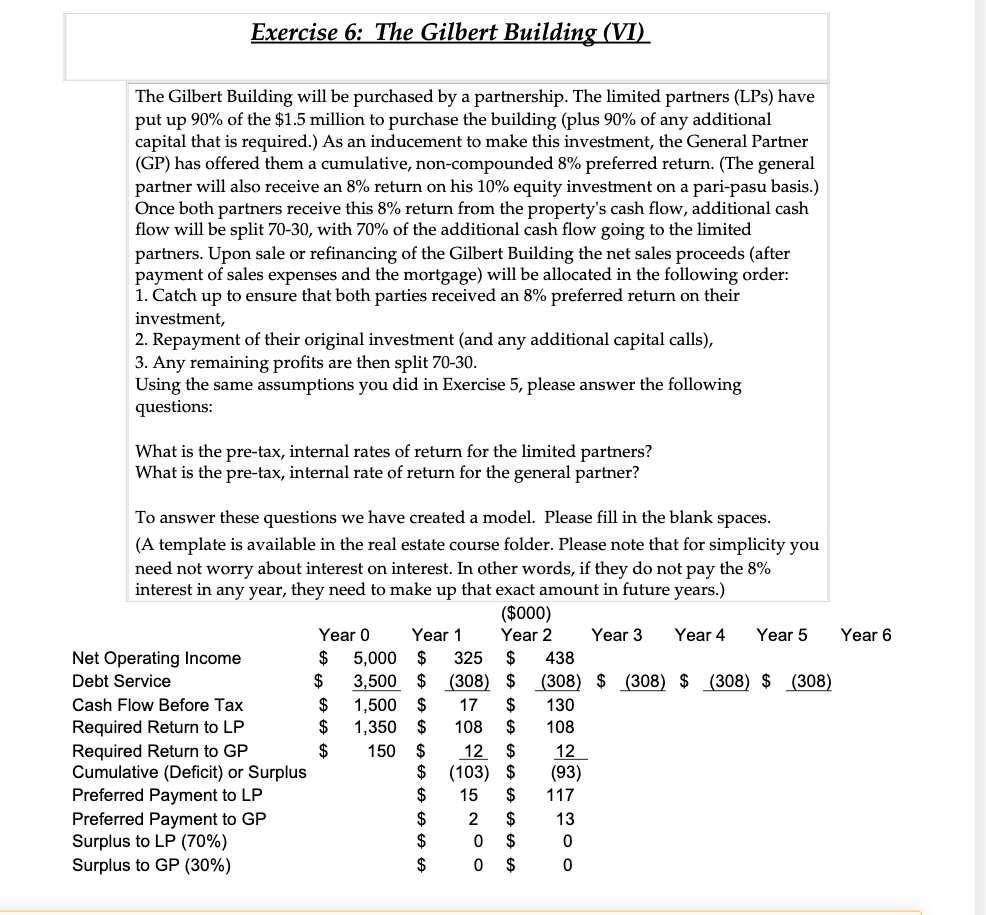

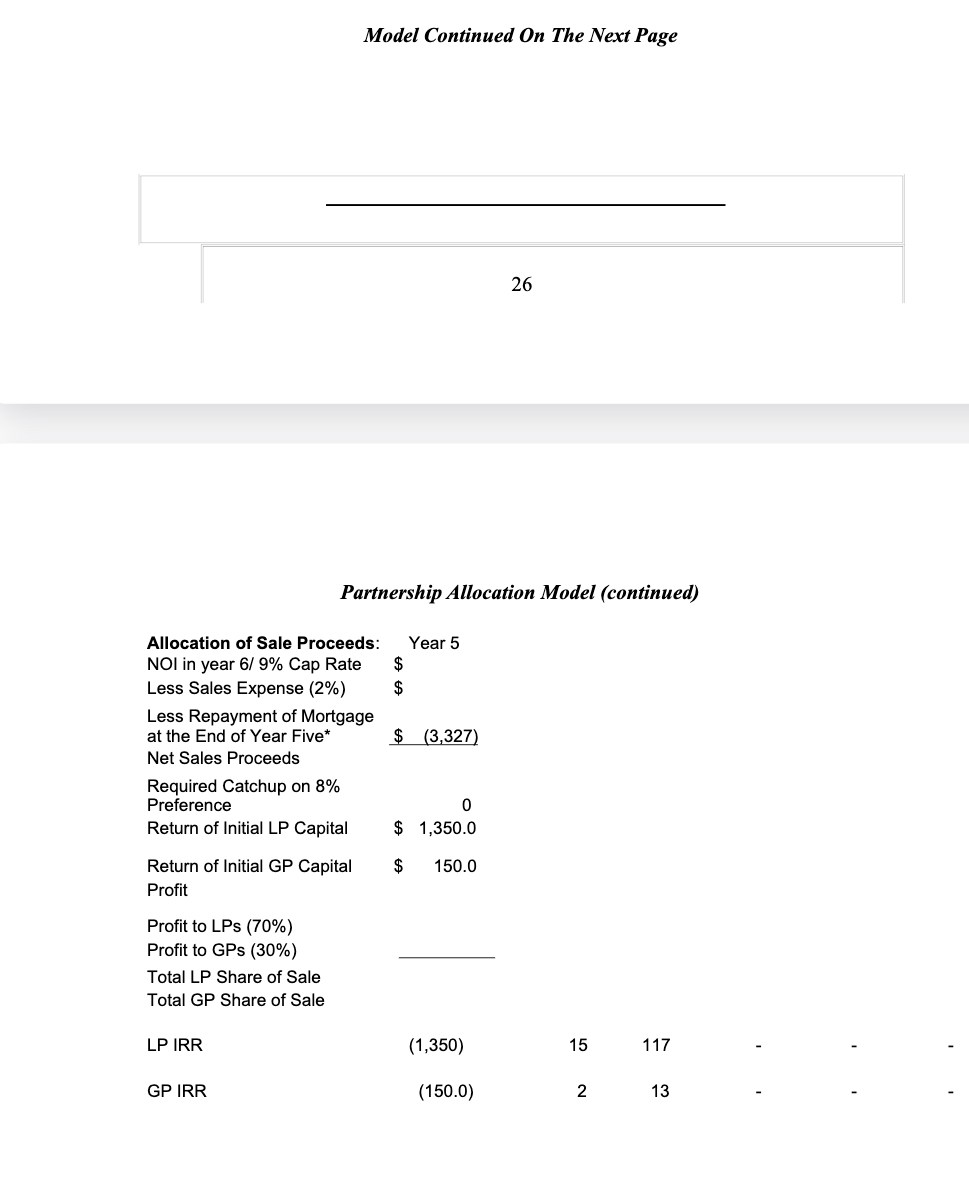

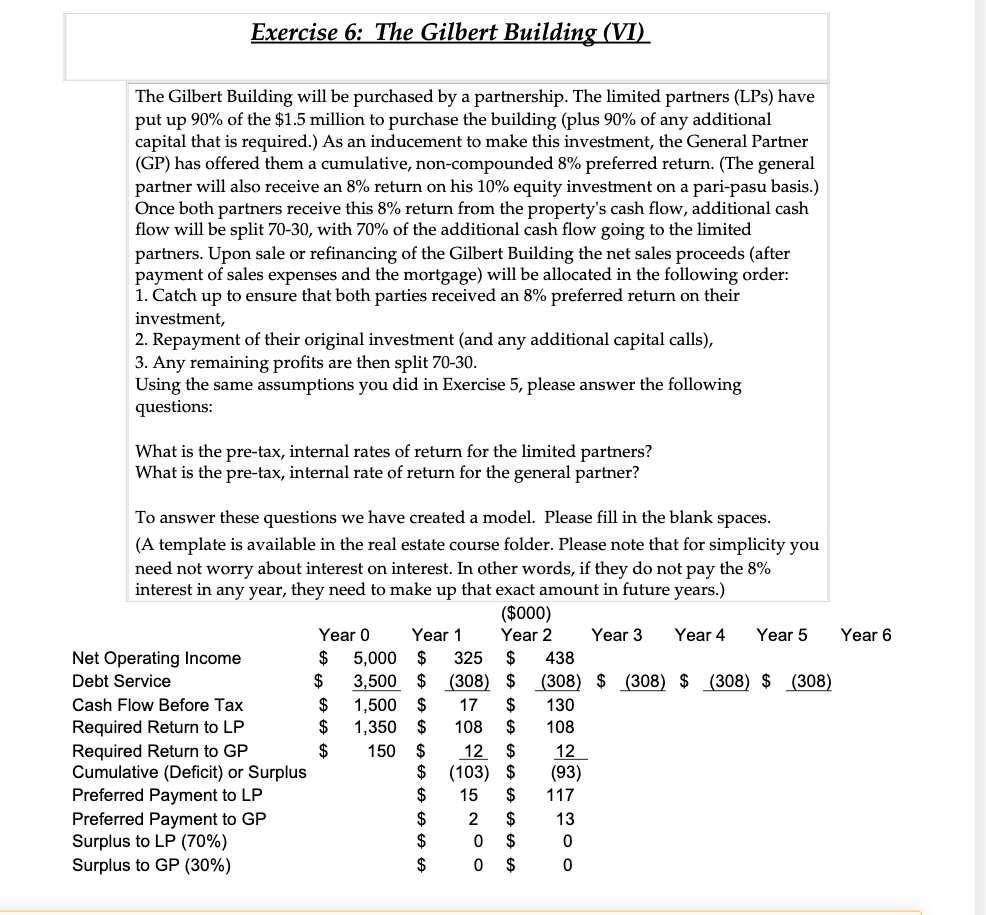

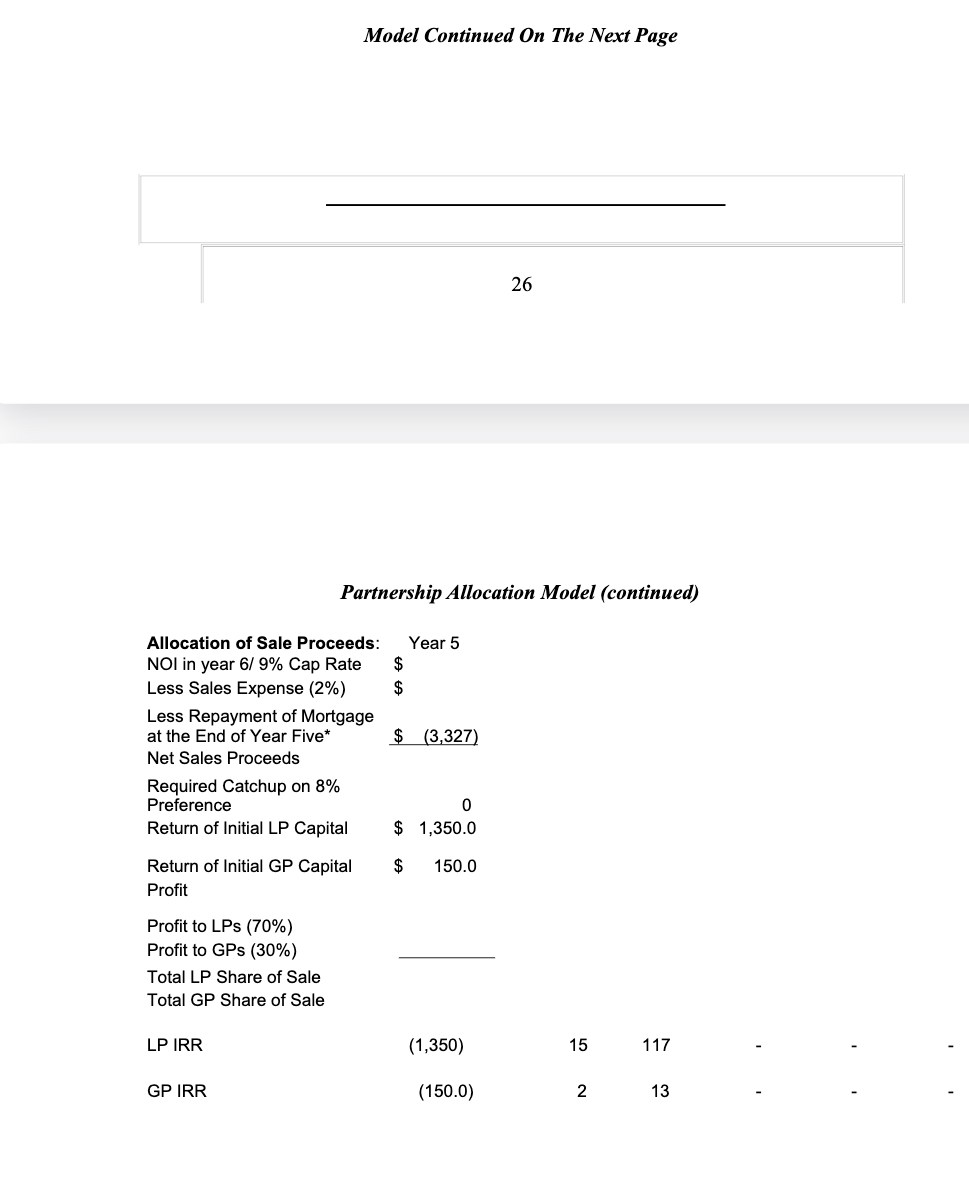

Exercise 6: The Gilbert Building (VI) The Gilbert Building will be purchased by a partnership. The limited partners (LPs) have put up 90% of the $1.5 million to purchase the building (plus 90% of any additional capital that is required.) As an inducement to make this investment, the General Partner (GP) has offered them a cumulative, non-compounded 8% preferred return. (The general partner will also receive an 8% return on his 10% equity investment on a pari-pasu basis.) Once both partners receive this 8% return from the property's cash flow, additional cash flow will be split 70-30, with 70% of the additional cash flow going to the limited partners. Upon sale or refinancing of the Gilbert Building the net sales proceeds (after payment of sales expenses and the mortgage) will be allocated in the following order: 1. Catch up to ensure that both parties received an 8% preferred return on their investment, 2. Repayment of their original investment and any additional capital calls), 3. Any remaining profits are then split 70-30. Using the same assumptions you did in Exercise 5, please answer the following questions: What is the pre-tax, internal rates of return for the limited partners? What is the pre-tax, internal rate of return for the general partner? To answer these questions we have created a model. Please fill in the blank spaces. (A template is available in the real estate course folder. Please note that for simplicity you need not worry about interest on interest. In other words, if they do not pay the 8% interest in any year, they need to make up that exact amount in future years.) ($000) Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Net Operating Income $ 5,000 $ 325 $ 438 Debt Service $ 3,500 $ (308) $ (308) $ (308) $ (308) $ (308) Cash Flow Before Tax $ 1,500 $ 17 $ 130 Required Return to LP $ 1,350 $ 108 $ 108 Required Return to GP $ 150 $ 12 $ 12 Cumulative (Deficit) or Surplus $ (103) $ Preferred Payment to LP $ 15 $ 117 Preferred Payment to GP $ 2 $ 13 Surplus to LP (70%) $ 0 $ 0 Surplus to GP (30%) $ 0 $ 0 (93) Model Continued On The Next Page 26 Partnership Allocation Model (continued) Year 5 $ $ Allocation of Sale Proceeds: NOI in year 6/ 9% Cap Rate Less Sales Expense (2%) Less Repayment of Mortgage at the End of Year Five* Net Sales Proceeds Required Catchup on 8% Preference Return of Initial LP Capital $ (3,327) 0 $ 1,350.0 $ 150.0 Return of Initial GP Capital Profit Profit to LPs (70%) Profit to GPs (30%) Total LP Share of Sale Total GP Share of Sale LP IRR (1,350) 15 117 GP IRR (150.0) 2 13 Exercise 6: The Gilbert Building (VI) The Gilbert Building will be purchased by a partnership. The limited partners (LPs) have put up 90% of the $1.5 million to purchase the building (plus 90% of any additional capital that is required.) As an inducement to make this investment, the General Partner (GP) has offered them a cumulative, non-compounded 8% preferred return. (The general partner will also receive an 8% return on his 10% equity investment on a pari-pasu basis.) Once both partners receive this 8% return from the property's cash flow, additional cash flow will be split 70-30, with 70% of the additional cash flow going to the limited partners. Upon sale or refinancing of the Gilbert Building the net sales proceeds (after payment of sales expenses and the mortgage) will be allocated in the following order: 1. Catch up to ensure that both parties received an 8% preferred return on their investment, 2. Repayment of their original investment and any additional capital calls), 3. Any remaining profits are then split 70-30. Using the same assumptions you did in Exercise 5, please answer the following questions: What is the pre-tax, internal rates of return for the limited partners? What is the pre-tax, internal rate of return for the general partner? To answer these questions we have created a model. Please fill in the blank spaces. (A template is available in the real estate course folder. Please note that for simplicity you need not worry about interest on interest. In other words, if they do not pay the 8% interest in any year, they need to make up that exact amount in future years.) ($000) Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Net Operating Income $ 5,000 $ 325 $ 438 Debt Service $ 3,500 $ (308) $ (308) $ (308) $ (308) $ (308) Cash Flow Before Tax $ 1,500 $ 17 $ 130 Required Return to LP $ 1,350 $ 108 $ 108 Required Return to GP $ 150 $ 12 $ 12 Cumulative (Deficit) or Surplus $ (103) $ Preferred Payment to LP $ 15 $ 117 Preferred Payment to GP $ 2 $ 13 Surplus to LP (70%) $ 0 $ 0 Surplus to GP (30%) $ 0 $ 0 (93) Model Continued On The Next Page 26 Partnership Allocation Model (continued) Year 5 $ $ Allocation of Sale Proceeds: NOI in year 6/ 9% Cap Rate Less Sales Expense (2%) Less Repayment of Mortgage at the End of Year Five* Net Sales Proceeds Required Catchup on 8% Preference Return of Initial LP Capital $ (3,327) 0 $ 1,350.0 $ 150.0 Return of Initial GP Capital Profit Profit to LPs (70%) Profit to GPs (30%) Total LP Share of Sale Total GP Share of Sale LP IRR (1,350) 15 117 GP IRR (150.0) 2 13