Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 6-13 (Algo) Depreciation calculation methods LO 3 Millco Inc., acquired a machine that cost $576,000 early in 2019. The machine is expected to

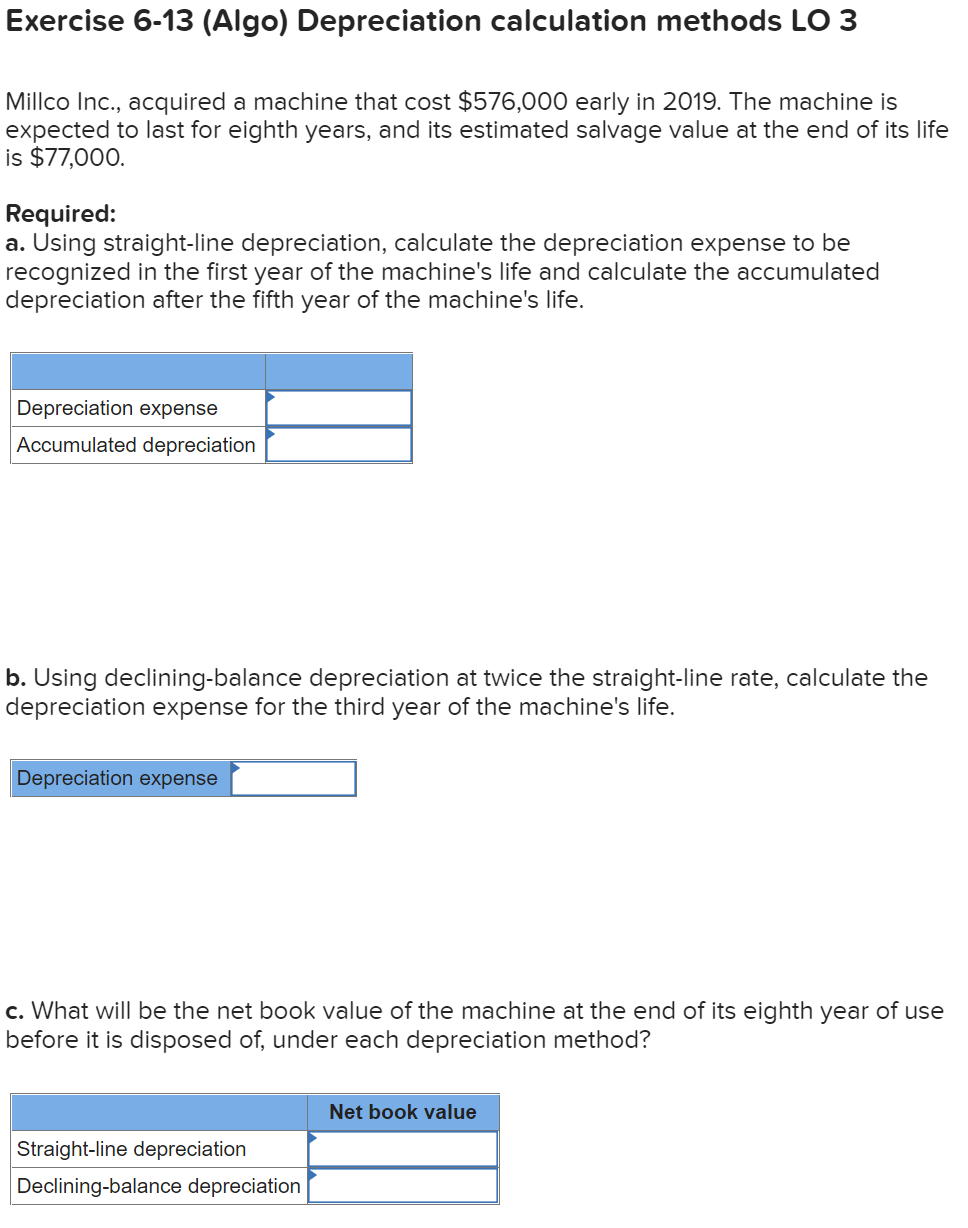

Exercise 6-13 (Algo) Depreciation calculation methods LO 3 Millco Inc., acquired a machine that cost $576,000 early in 2019. The machine is expected to last for eighth years, and its estimated salvage value at the end of its life is $77,000. Required: a. Using straight-line depreciation, calculate the depreciation expense to be recognized in the first year of the machine's life and calculate the accumulated depreciation after the fifth year of the machine's life. Depreciation expense Accumulated depreciation b. Using declining-balance depreciation at twice the straight-line rate, calculate the depreciation expense for the third year of the machine's life. Depreciation expense c. What will be the net book value of the machine at the end of its eighth year of use before it is disposed of, under each depreciation method? Straight-line depreciation Declining-balance depreciation Net book value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started