Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 6-18B Asset replacement decision Orr Electronics management are trying to decide whether to continue operating their current plant or purchase a replacement plant. The

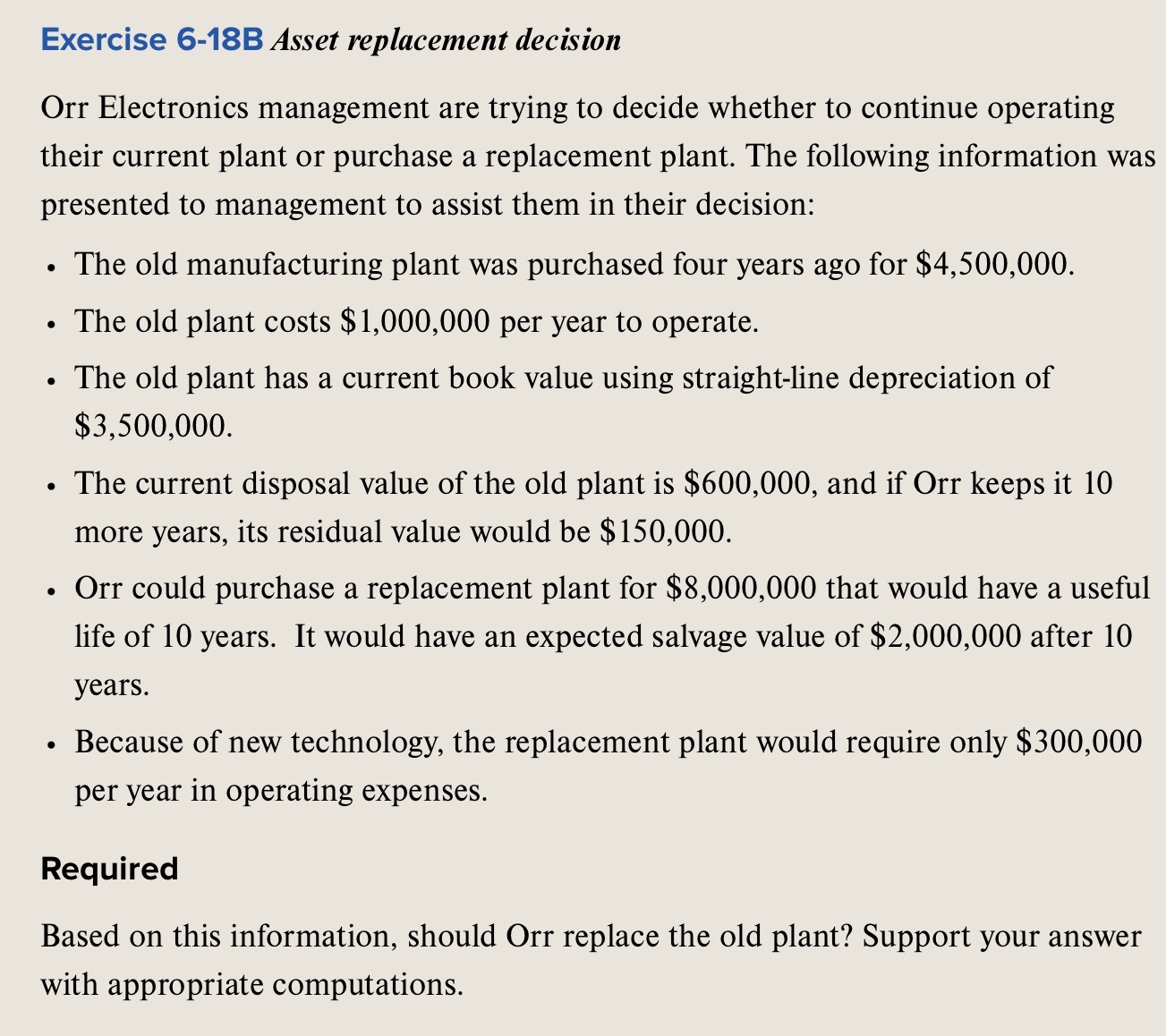

Exercise 6-18B Asset replacement decision Orr Electronics management are trying to decide whether to continue operating their current plant or purchase a replacement plant. The following information was presented to management to assist them in their decision: - The old manufacturing plant was purchased four years ago for $4,500,000. - The old plant costs $1,000,000 per year to operate. - The old plant has a current book value using straight-line depreciation of $3,500,000. - The current disposal value of the old plant is $600,000, and if Orr keeps it 10 more years, its residual value would be $150,000. - Orr could purchase a replacement plant for $8,000,000 that would have a useful life of 10 years. It would have an expected salvage value of $2,000,000 after 10 years. - Because of new technology, the replacement plant would require only $300,000 per year in operating expenses. Required Based on this information, should Orr replace the old plant? Support your answer with appropriate computations

Exercise 6-18B Asset replacement decision Orr Electronics management are trying to decide whether to continue operating their current plant or purchase a replacement plant. The following information was presented to management to assist them in their decision: - The old manufacturing plant was purchased four years ago for $4,500,000. - The old plant costs $1,000,000 per year to operate. - The old plant has a current book value using straight-line depreciation of $3,500,000. - The current disposal value of the old plant is $600,000, and if Orr keeps it 10 more years, its residual value would be $150,000. - Orr could purchase a replacement plant for $8,000,000 that would have a useful life of 10 years. It would have an expected salvage value of $2,000,000 after 10 years. - Because of new technology, the replacement plant would require only $300,000 per year in operating expenses. Required Based on this information, should Orr replace the old plant? Support your answer with appropriate computations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started