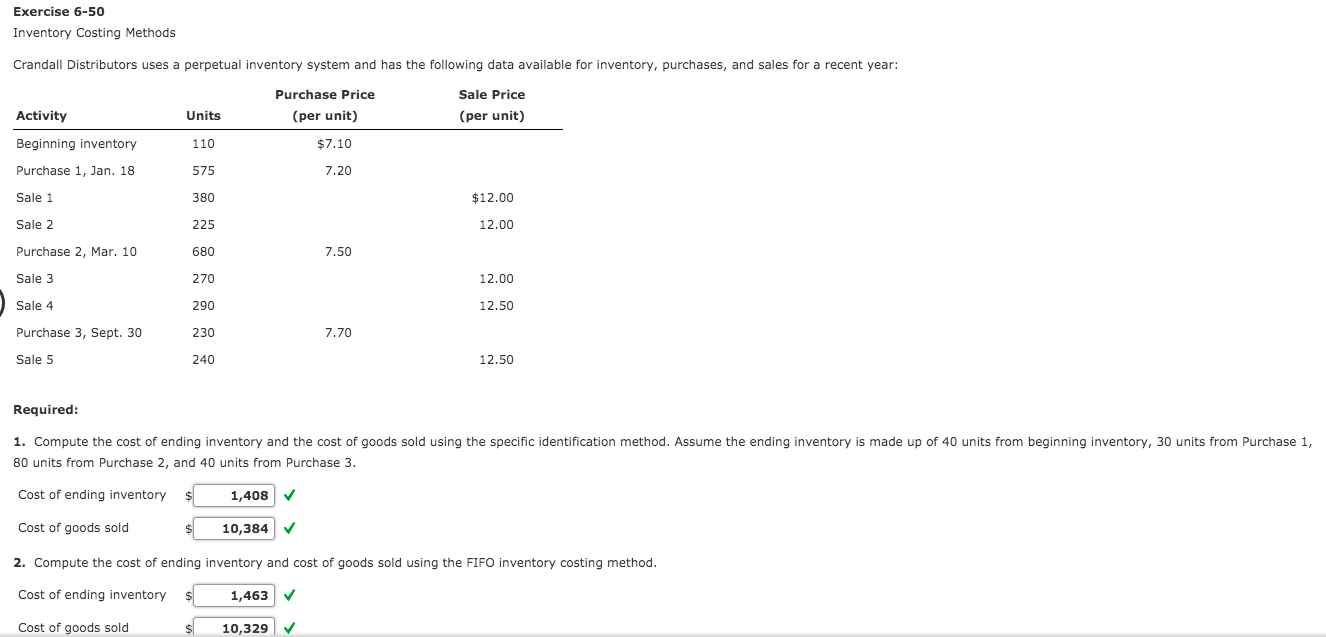

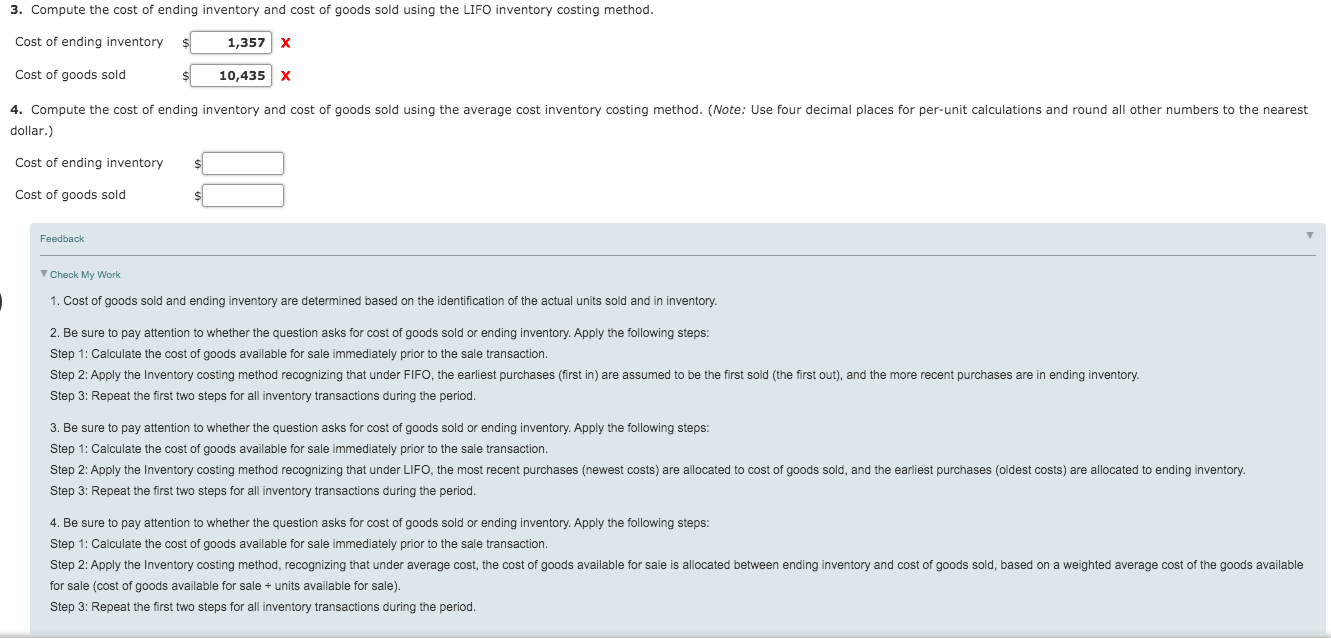

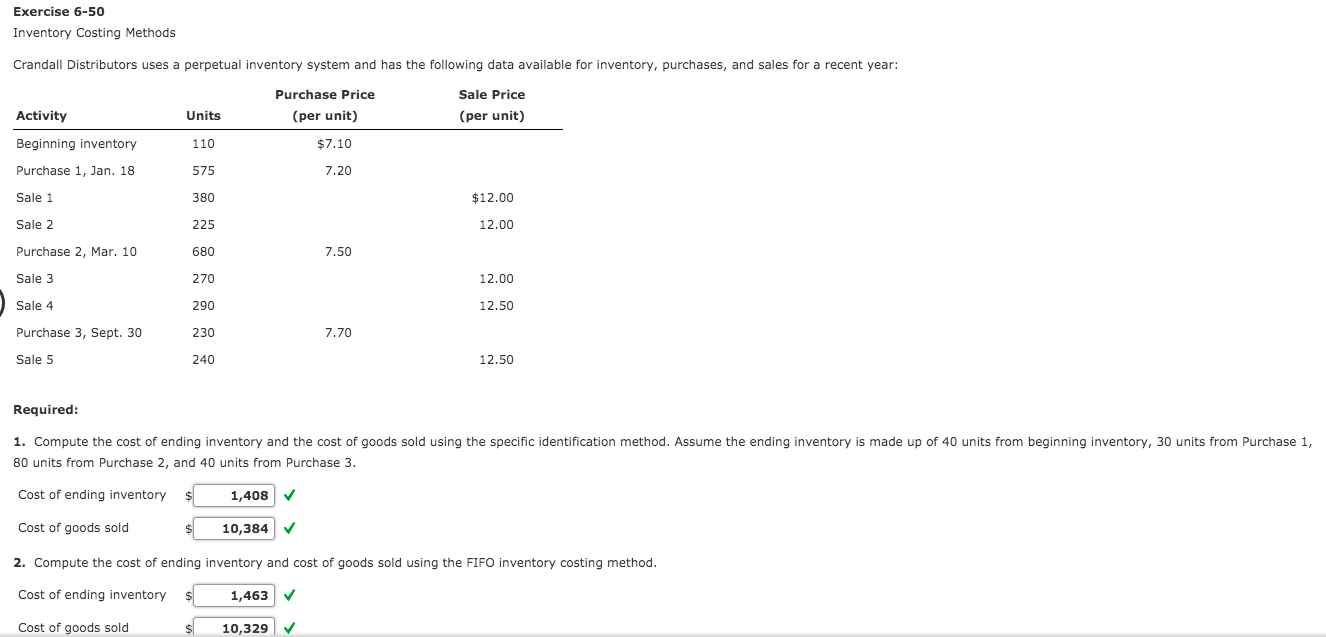

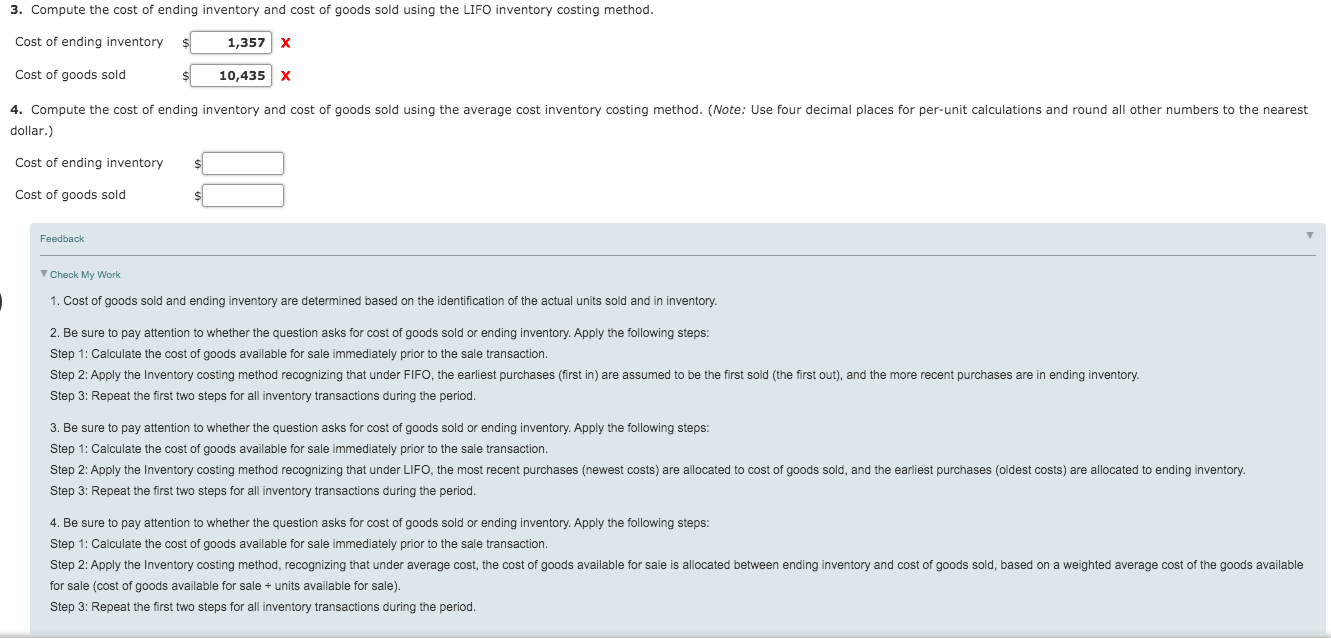

Exercise 6-50 Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the following data available for inventory, purchases, and sales for a recent year: Purchase Price (per unit) Sale Price (per unit) Activity Units 110 $7.10 Beginning inventory Purchase 1, Jan. 18 7.20 Sale 1 $12.00 12.00 Sale 2 575 380 225 680 270 290 7.50 Purchase 2, Mar. 10 Sale 3 12.00 Sale 4 12.50 Purchase 3, Sept. 30 230 7.70 Sale 5 12.50 Required: 1. Compute the cost of ending inventory and the cost of goods sold using the specific identification method. Assume the ending inventory is made up of 40 units from beginning inventory, 30 units from Purchase 1, 80 units from Purchase 2, and 40 units from Purchase 3. Cost of ending inventory $ 1,408 Cost of goods sold $ 10,384 2. Compute the cost of ending inventory and cost of goods sold using the FIFO inventory costing method. Cost of ending inventory $ $ 1,463 10,329 Cost of goods sold 3. Compute the cost of ending inventory and cost of goods sold using the LIFO inventory costing method. Cost of ending inventory $ 1,357 X Cost of goods sold $ 10,435 x 4. Compute the cost of ending inventory and cost of goods sold using the average cost inventory costing method. (Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) Cost of ending inventory Cost of goods sold Feedback Check My Work 1. Cost of goods sold and ending inventory are determined based on the identification of the actual units sold and in inventory 2. Be sure to pay attention to whether the question asks for cost of goods sold or ending inventory. Apply the following steps: Step 1: Calculate the cost of goods available for sale immediately prior to the sale transaction Step 2: Apply the Inventory costing method recognizing that under FIFO, the earliest purchases (first in) are assumed to be the first sold (the first out), and the more recent purchases are in ending inventory. Step 3: Repeat the first two steps for all inventory transactions during the period. 3. Be sure to pay attention to whether the question asks for cost of goods sold or ending inventory. Apply the following steps: Step 1: Calculate the cost of goods available for sale immediately prior to the sale transaction. Step 2: Apply the Inventory costing method recognizing that under LIFO, the most recent purchases (newest costs) are allocated to cost of goods sold, and the earliest purchases (oldest costs) are allocated to ending inventory. Step 3: Repeat the first two steps for all inventory transactions during the period. 4. Be sure to pay attention to whether the question asks for cost of goods sold or ending inventory. Apply the following steps: Step 1: Calculate the cost of goods available for sale immediately prior to the sale transaction. Step 2: Apply the Inventory costing method, recognizing that under average cost, the cost of goods available for sale is allocated between ending inventory and cost of goods sold, based on a weighted average cost of the goods available for sale (cost of goods available for sale + units available for sale). Step 3: Repeat the first two steps for all inventory transactions during the period