Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 7 - 3 2 ( Static ) Predetermined Overhead Rates ( LO 7 - 3 ) Antoine Machining estimated its manufacturing overhead to be

Exercise Static Predetermined Overhead Rates LO

Antoine Machining estimated its manufacturing overhead to be $ and its direct materials costs to be $ in Year

Three of the jobs that Antoine Machining worked on in Year had actual direct materials costs of $ for Job AM

$ for Job AM and $ for Job AM For Year actual manufacturing overhead was $ and total direc

materials cost was $ Manufacturing overhead is applied to jobs on the basis of direct materials costs using

predetermined rates.

Required:

a How much overhead was assigned to each of the three jobs, AM AM and AM

b What was the over or underapplied manufacturing overhead for Year

Complete this question by entering your answers in the tabs below.

Required B

How much overhead was assigned to each of the three jobs, AM AM and AM

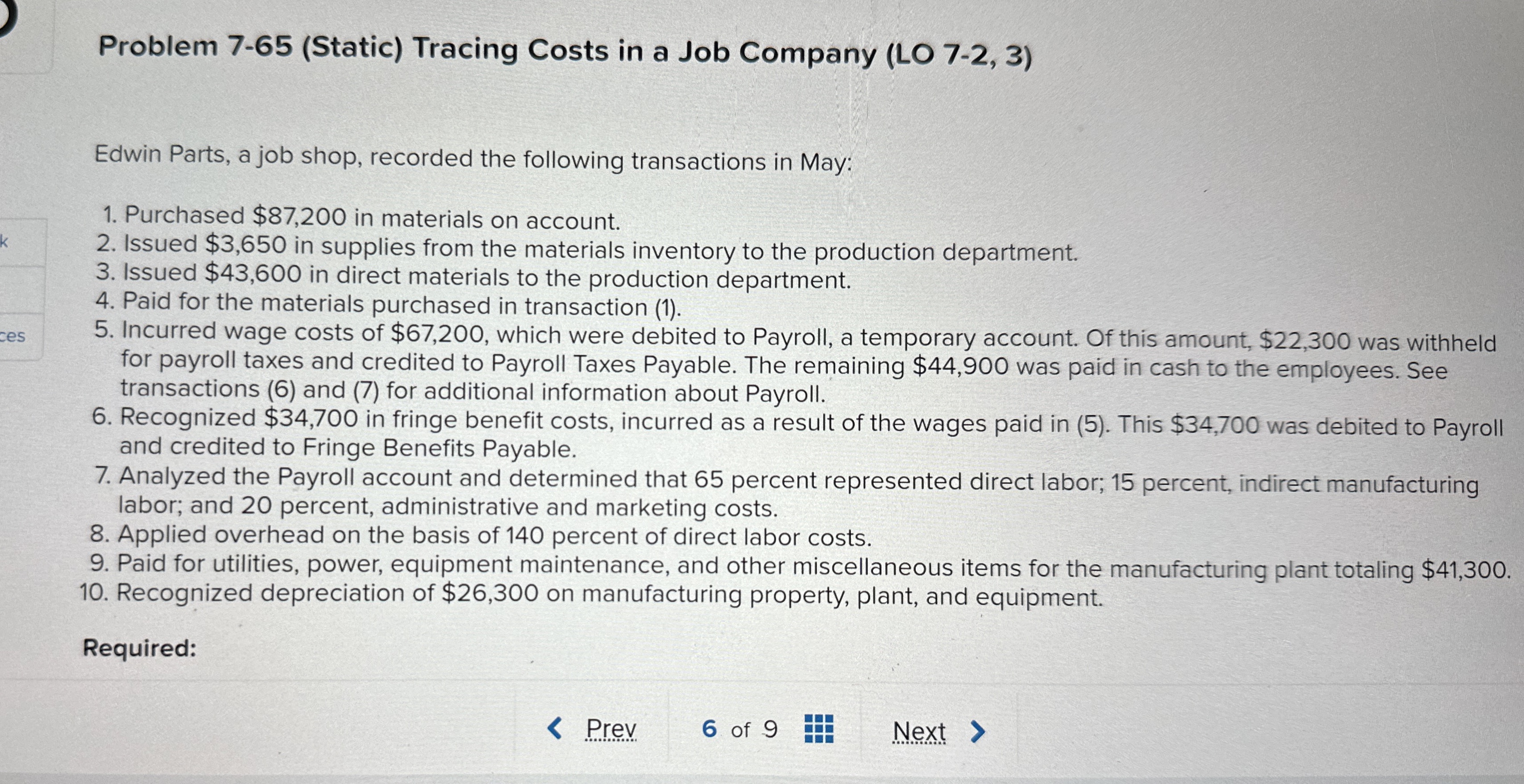

Problem Static Tracing Costs in a Job Company LO

Edwin Parts, a job shop, recorded the following transactions in May:

Purchased $ in materials on account.

Issued $ in supplies from the materials inventory to the production department.

Issued $ in direct materials to the production department.

Paid for the materials purchased in transaction

Incurred wage costs of $ which were debited to Payroll, a temporary account. Of this amount, $ was withheld

for payroll taxes and credited to Payroll Taxes Payable. The remaining $ was paid in cash to the employees. See

transactions and for additional information about Payroll.

Recognized $ in fringe benefit costs, incurred as a result of the wages paid in This $ was debited to Payroll

and credited to Fringe Benefits Payable.

Analyzed the Payroll account and determined that percent represented direct labor; percent, indirect manufacturing

labor; and percent, administrative and marketing costs.

Applied overhead on the basis of percent of direct labor costs.

Paid for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing plant totaling $

Recognized depreciation of $ on manufacturing property, plant, and equipment.

Required:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started