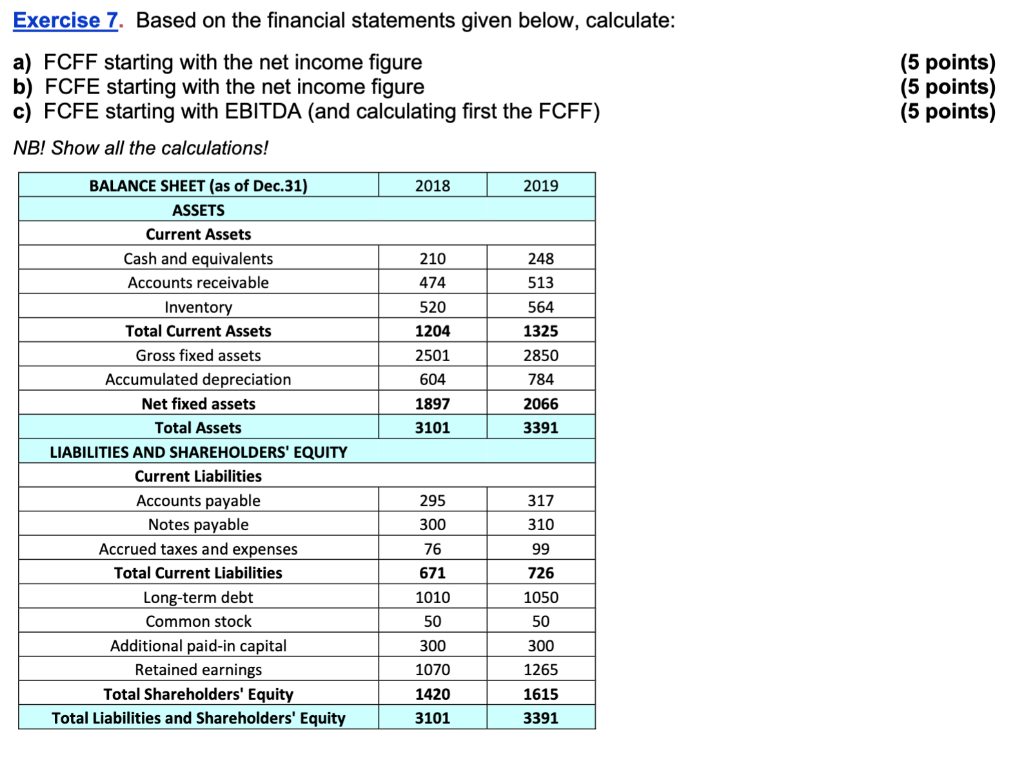

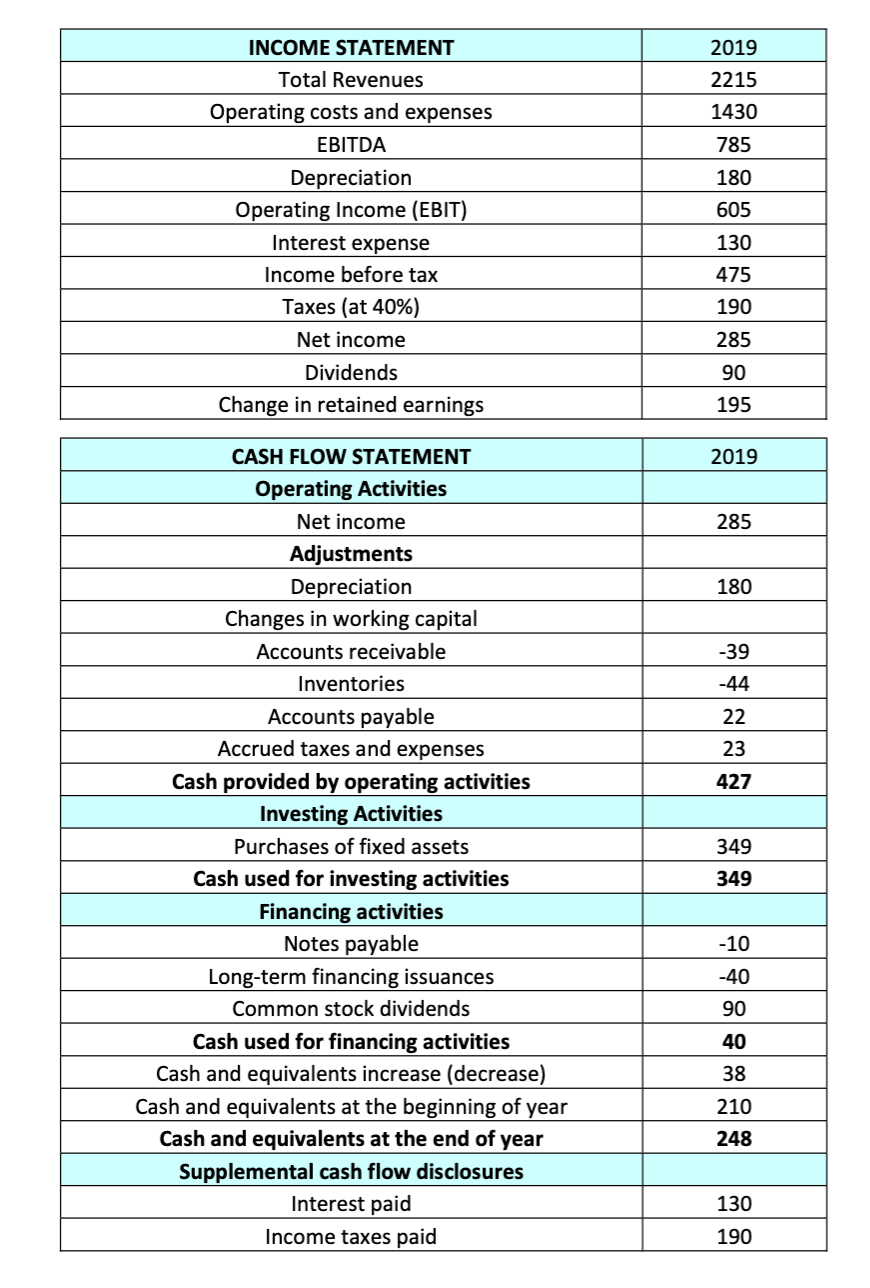

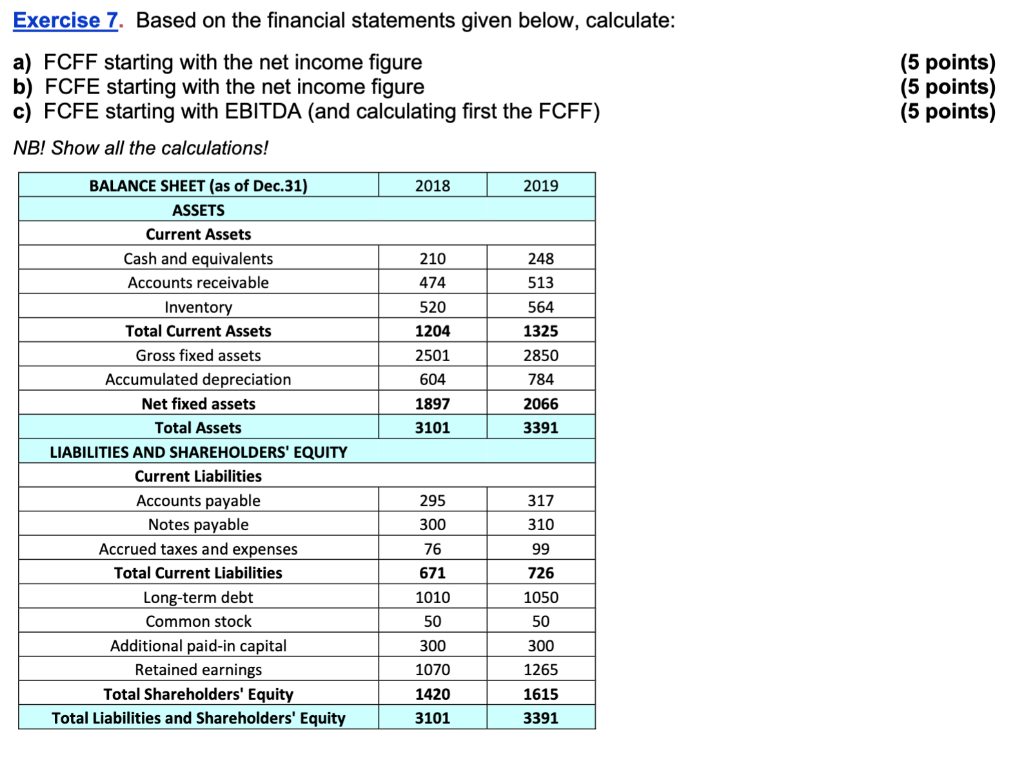

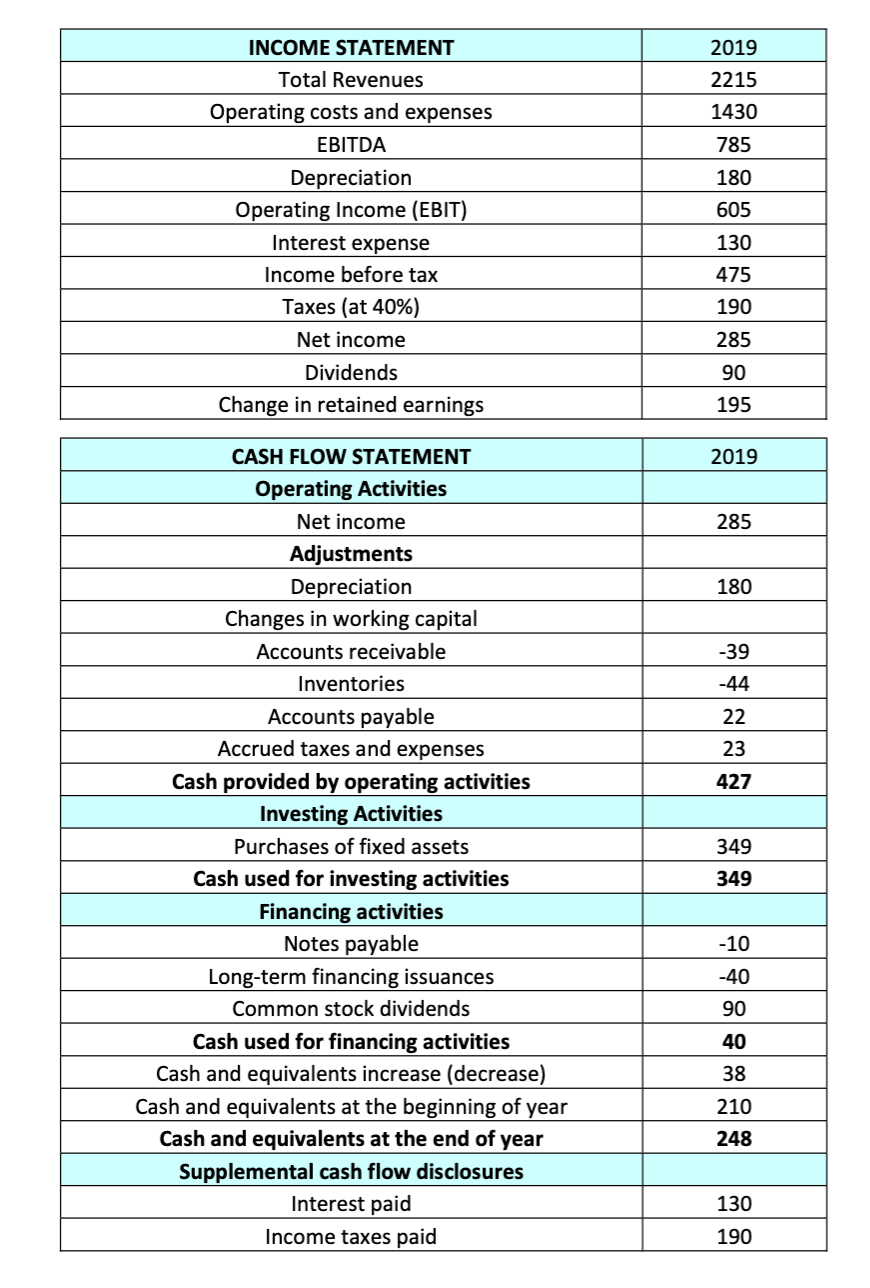

Exercise 7. Based on the financial statements given below, calculate: a) FCFF starting with the net income figure b) FCFE starting with the net income figure c) FCFE starting with EBITDA (and calculating first the FCFF) NB! Show all the calculations! (5 points) (5 points) (5 points) 2018 2019 210 248 513 474 520 1204 2501 604 564 1325 2850 784 2066 3391 1897 3101 BALANCE SHEET (as of Dec.31) ASSETS Current Assets Cash and equivalents Accounts receivable Inventory Total Current Assets Gross fixed assets Accumulated depreciation Net fixed assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Accounts payable Notes payable Accrued taxes and expenses Total Current Liabilities Long-term debt Common stock Additional paid-in capital Retained earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 317 310 99 295 300 76 671 1010 50 300 1070 1420 3101 726 1050 50 300 1265 1615 3391 2019 2215 1430 785 180 605 INCOME STATEMENT Total Revenues Operating costs and expenses EBITDA Depreciation Operating Income (EBIT) Interest expense Income before tax Taxes (at 40%) Net income Dividends Change in retained earnings 130 475 190 285 90 195 2019 285 180 -39 -44 22 23 427 CASH FLOW STATEMENT Operating Activities Net income Adjustments Depreciation Changes in working capital Accounts receivable Inventories Accounts payable Accrued taxes and expenses Cash provided by operating activities Investing Activities Purchases of fixed assets Cash used for investing activities Financing activities Notes payable Long-term financing issuances Common stock dividends Cash used for financing activities Cash and equivalents increase (decrease) Cash and equivalents at the beginning of year Cash and equivalents at the end of year Supplemental cash flow disclosures Interest paid Income taxes paid 349 349 -10 -40 90 40 38 210 248 130 190 Exercise 7. Based on the financial statements given below, calculate: a) FCFF starting with the net income figure b) FCFE starting with the net income figure c) FCFE starting with EBITDA (and calculating first the FCFF) NB! Show all the calculations! (5 points) (5 points) (5 points) 2018 2019 210 248 513 474 520 1204 2501 604 564 1325 2850 784 2066 3391 1897 3101 BALANCE SHEET (as of Dec.31) ASSETS Current Assets Cash and equivalents Accounts receivable Inventory Total Current Assets Gross fixed assets Accumulated depreciation Net fixed assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Accounts payable Notes payable Accrued taxes and expenses Total Current Liabilities Long-term debt Common stock Additional paid-in capital Retained earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 317 310 99 295 300 76 671 1010 50 300 1070 1420 3101 726 1050 50 300 1265 1615 3391 2019 2215 1430 785 180 605 INCOME STATEMENT Total Revenues Operating costs and expenses EBITDA Depreciation Operating Income (EBIT) Interest expense Income before tax Taxes (at 40%) Net income Dividends Change in retained earnings 130 475 190 285 90 195 2019 285 180 -39 -44 22 23 427 CASH FLOW STATEMENT Operating Activities Net income Adjustments Depreciation Changes in working capital Accounts receivable Inventories Accounts payable Accrued taxes and expenses Cash provided by operating activities Investing Activities Purchases of fixed assets Cash used for investing activities Financing activities Notes payable Long-term financing issuances Common stock dividends Cash used for financing activities Cash and equivalents increase (decrease) Cash and equivalents at the beginning of year Cash and equivalents at the end of year Supplemental cash flow disclosures Interest paid Income taxes paid 349 349 -10 -40 90 40 38 210 248 130 190