Answered step by step

Verified Expert Solution

Question

1 Approved Answer

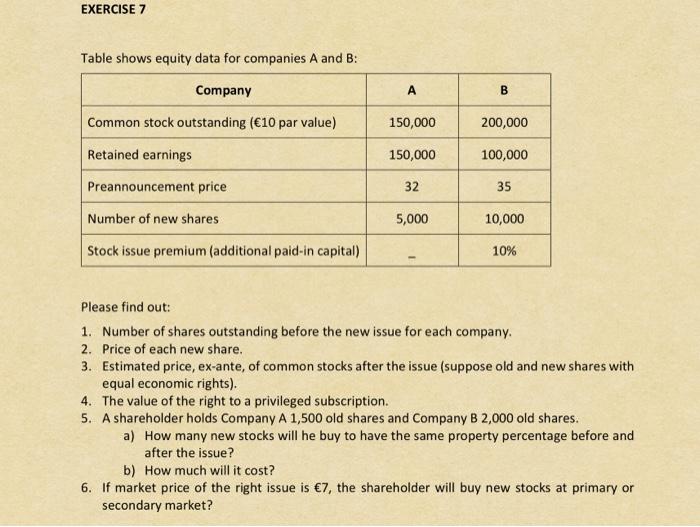

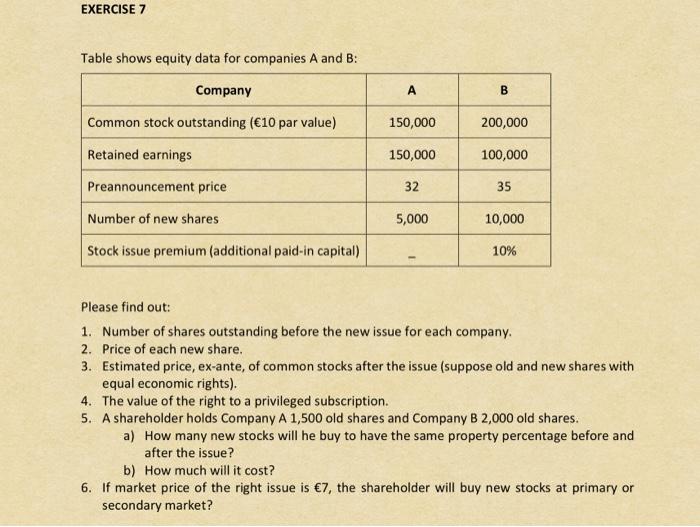

EXERCISE 7 Table shows equity data for companies A and B: Company A Common stock outstanding (10 par value) 150,000 200,000 Retained earnings 150,000 100,000

EXERCISE 7 Table shows equity data for companies A and B: Company A Common stock outstanding (10 par value) 150,000 200,000 Retained earnings 150,000 100,000 Preannouncement price 32 35 Number of new shares 5,000 10,000 Stock issue premium (additional paid-in capital) 10% Please find out: 1. Number of shares outstanding before the new issue for each company. 2. Price of each new share. 3. Estimated price, ex-ante, of common stocks after the issue (suppose old and new shares with equal economic rights). 4. The value of the right to a privileged subscription. 5. A shareholder holds Company A 1,500 old shares and Company B 2,000 old shares. a) How many new stocks will he buy to have the same property percentage before and after the issue? b) How much will it cost? 6. If market price of the right issue is 7, the shareholder will buy new stocks at primary or secondary market?  EXERCISE 7 Table shows equity data for companies A and B: Company A B Common stock outstanding (10 par value) 150,000 200,000 Retained earnings 150,000 100,000 Preannouncement price 32 35 Number of new shares 5,000 10,000 Stock issue premium (additional paid-in capital) 10% Please find out: 1. Number of shares outstanding before the new issue for each company. 2. Price of each new share. 3. Estimated price, ex-ante, of common stocks after the issue (suppose old and new shares with equal economic rights). 4. The value of the right to a privileged subscription. 5. A shareholder holds Company A 1,500 old shares and Company B 2,000 old shares. a) How many new stocks will he buy to have the same property percentage before and after the issue? b) How much will it cost? 6. If market price of the right issue is 7, the shareholder will buy new stocks at primary or secondary market? EXERCISE 7 Table shows equity data for companies A and B: Company A B Common stock outstanding (10 par value) 150,000 200,000 Retained earnings 150,000 100,000 Preannouncement price 32 35 Number of new shares 5,000 10,000 Stock issue premium (additional paid-in capital) 10% Please find out: 1. Number of shares outstanding before the new issue for each company. 2. Price of each new share. 3. Estimated price, ex-ante, of common stocks after the issue (suppose old and new shares with equal economic rights). 4. The value of the right to a privileged subscription. 5. A shareholder holds Company A 1,500 old shares and Company B 2,000 old shares. a) How many new stocks will he buy to have the same property percentage before and after the issue? b) How much will it cost? 6. If market price of the right issue is 7, the shareholder will buy new stocks at primary or secondary market

EXERCISE 7 Table shows equity data for companies A and B: Company A B Common stock outstanding (10 par value) 150,000 200,000 Retained earnings 150,000 100,000 Preannouncement price 32 35 Number of new shares 5,000 10,000 Stock issue premium (additional paid-in capital) 10% Please find out: 1. Number of shares outstanding before the new issue for each company. 2. Price of each new share. 3. Estimated price, ex-ante, of common stocks after the issue (suppose old and new shares with equal economic rights). 4. The value of the right to a privileged subscription. 5. A shareholder holds Company A 1,500 old shares and Company B 2,000 old shares. a) How many new stocks will he buy to have the same property percentage before and after the issue? b) How much will it cost? 6. If market price of the right issue is 7, the shareholder will buy new stocks at primary or secondary market? EXERCISE 7 Table shows equity data for companies A and B: Company A B Common stock outstanding (10 par value) 150,000 200,000 Retained earnings 150,000 100,000 Preannouncement price 32 35 Number of new shares 5,000 10,000 Stock issue premium (additional paid-in capital) 10% Please find out: 1. Number of shares outstanding before the new issue for each company. 2. Price of each new share. 3. Estimated price, ex-ante, of common stocks after the issue (suppose old and new shares with equal economic rights). 4. The value of the right to a privileged subscription. 5. A shareholder holds Company A 1,500 old shares and Company B 2,000 old shares. a) How many new stocks will he buy to have the same property percentage before and after the issue? b) How much will it cost? 6. If market price of the right issue is 7, the shareholder will buy new stocks at primary or secondary market

EXERCISE 7 Table shows equity data for companies A and B: Company A Common stock outstanding (10 par value) 150,000 200,000 Retained earnings 150,000 100,000 Preannouncement price 32 35 Number of new shares 5,000 10,000 Stock issue premium (additional paid-in capital) 10% Please find out: 1. Number of shares outstanding before the new issue for each company. 2. Price of each new share. 3. Estimated price, ex-ante, of common stocks after the issue (suppose old and new shares with equal economic rights). 4. The value of the right to a privileged subscription. 5. A shareholder holds Company A 1,500 old shares and Company B 2,000 old shares. a) How many new stocks will he buy to have the same property percentage before and after the issue? b) How much will it cost? 6. If market price of the right issue is 7, the shareholder will buy new stocks at primary or secondary market?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started