Answered step by step

Verified Expert Solution

Question

1 Approved Answer

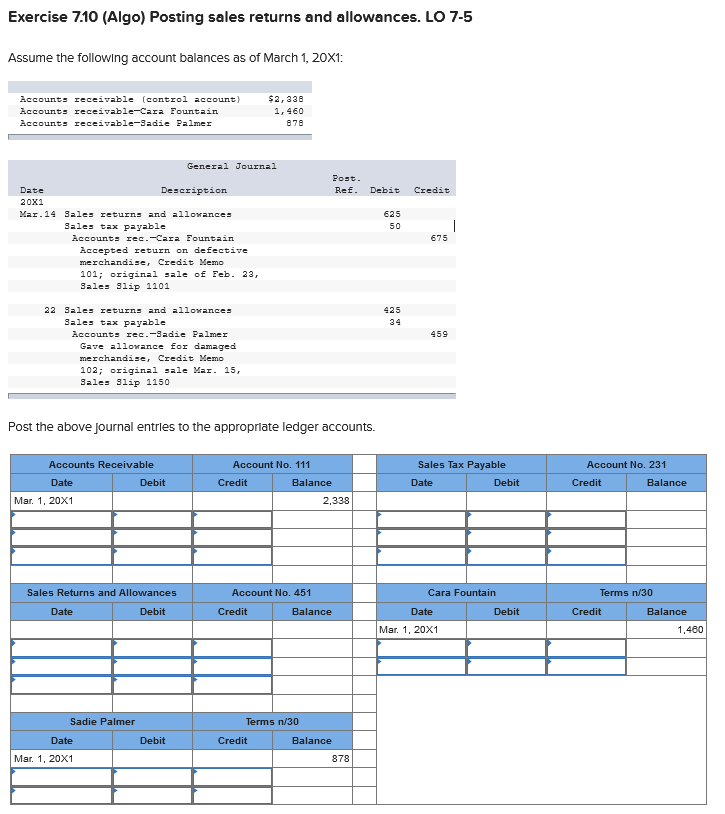

Exercise 7.10 (Algo) Posting sales returns and allowances. LO 7-5 Assume the following account balances as of March 1, 20x1: Accounts receivable (control account)

Exercise 7.10 (Algo) Posting sales returns and allowances. LO 7-5 Assume the following account balances as of March 1, 20x1: Accounts receivable (control account) Accounts receivable-Cara Fountain Accounts receivable-Sadie Palmer $2,338 1,460 878 General Journal Post. Ref. Debit Credit Date 20X1 Description Mar 14 Sales returns and allowances Sales tax payable Accounts rec.-Cara Fountain Accepted return on defective merchandise, Credit Memo 101; original sale of Feb. 23, Sales Slip 1101 22 Sales returns and allowances Sales tax payable Accounts rec.-Sadie Palmer Gave allowance for damaged merchandise, Credit Memo 102; original sale Mar. 15, Sales Slip 1150 625 50 675 425 34 459 Debit Post the above journal entries to the appropriate ledger accounts. Accounts Receivable Date Credit Account No. 111 Balance Sales Tax Payable Account No. 231 Date Debit Credit Balance Mar. 1, 20X1 2,338 Sales Returns and Allowances Date Account No. 451 Cara Fountain Terms n/30 Debit Credit Balance Date Debit Credit Balance Mar. 1, 20X1 1,460 Sadie Palmer Terms n/30 Date Debit Credit Balance Mar. 1, 20X1 878

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started