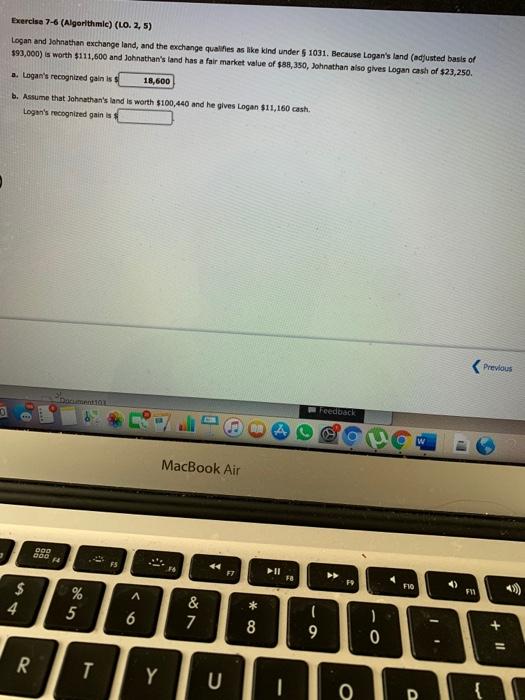

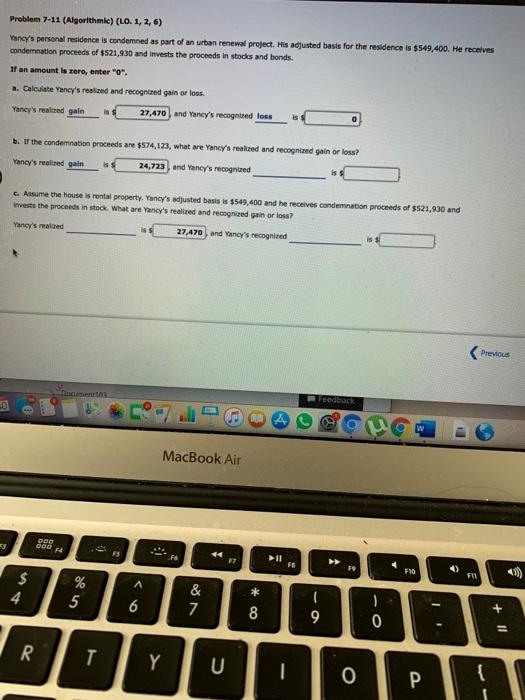

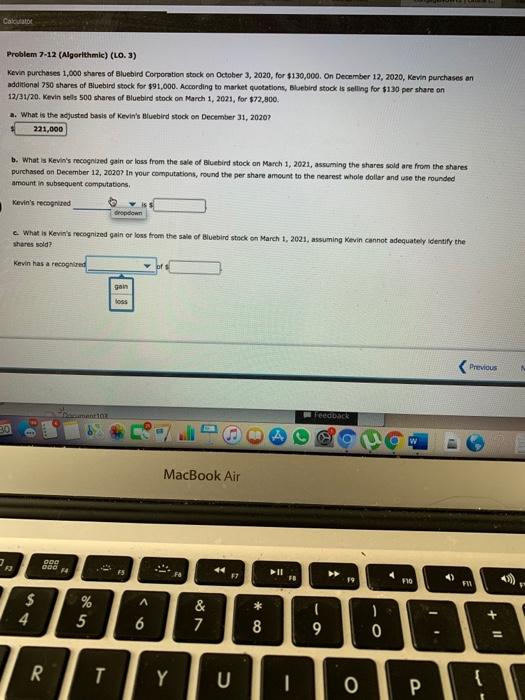

Exercise 7-6 (Algorithmic) (LO. 2,5) Logan and Johnathan exchange land, and the exchange qualifies as the kind under 5 1031. Because Logan's land (adjusted basis of $93,000) is worth $111,600 and Johnathan's land has a fair market value of $88,350, Johnathan also gives Logan cash of $23,250. .. Logan's recognized gainis 18,600 b. Assume that Johnathan's land is worth $100,440 and he gives Logan $11,160 cash. Logan's recognized gain is s Previous boom Feedback MacBook Air 000 COD FS F1 FB $ F10 A F11 4 % 5 * 6 & 7 8 ( 9 1 0 + Il R T Y U OP Problem 7-11 (Algorithmic) (LO. 1, 2, 6) Yancy's personal residence is condemned as part of an urban renewal project. His adjusted basis for the residence is $549,400. He receives condemnation proceeds of $521,930 and invests the proceeds in stodes and bonds. If an amount is zero, enter "o". a. Calculate Yancy's realized and recognized gain or loss. Yancy's reared gain is 27,470 and Yancy's recogated loss is b. If the condemnation proceeds are $574,123, what are Yancy's realized and recognized gain or loss? Yancy's realized gain 24,723 and Yaney's recognised c. Assume the house is rental property. Yoney's adjusted basis is $549,400 and he receives condemnation proceeds of $521,930 and Invests the proceeds in stock. What are Yancy's reared and recognized gain or loss? Yancy's realed 27,470 and Yancy's recognized Previous Feedback MacBook Air 3 000 DOO F 44 FO FIO F11 $ 4 1 % 5 6 & 7 * 0 8 9 0 R T Y 0 P Calculator Problem 7-12 (Algorithmic) (LO. 3) Kevin purchases 1,000 shares of Bluebird Corporation stock on October 3, 2020, for $130,000. On December 12, 2020, Kevin purchases an additional 750 shares of Bluebird stock for $91,000. According to market quotations, Bluebird stock is selling for $130 per share on 12/31/20. Kevin sells 500 shares of Bluebird stock on March 1, 2021, for $72,800 a. What is the adjusted basis of Kevin's Bluebird stock on December 31, 20207 221,000 b. What is Kevin's recognized gain or loss from the sale of Bluebird stock on March 1, 2021, assuming the shares sold are from the shares purchased on December 12, 2020? In your computations, round the per share amount to the nearest whole dollar and use the rounded amount in subsequent computations Kevin's recognized What is Kevin's recognized gain or loss from the sale of Bluebird stack on March 1, 2021, assuming Kevin cannot adequately identify the shares sold? Kevin has a recognized gain loss Previous ment102 Feedback MacBook Air 000 GOO F3 > FE 19 Po 1) FI