Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 8-14A (Algo) Calculating and explaining labor price and usage variances LO 8-6 Russell and Sons, a CPA firm, established the following standard labor

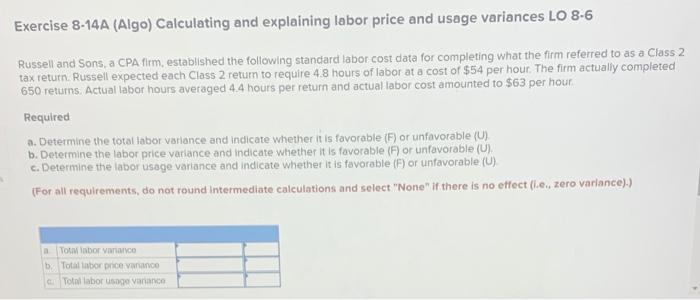

Exercise 8-14A (Algo) Calculating and explaining labor price and usage variances LO 8-6 Russell and Sons, a CPA firm, established the following standard labor cost data for completing what the firm referred to as a Class 2 tax return. Russell expected each Class 2 return to require 4.8 hours of labor at a cost of $54 per hour. The firm actually completed 650 returns. Actual labor hours averaged 4.4 hours per return and actual labor cost amounted to $63 per hour. Required a. Determine the total labor variance and indicate whether it is favorable (F) or unfavorable (U). b. Determine the labor price variance and indicate whether it is favorable (F) or unfavorable (U). c. Determine the labor usage variance and indicate whether it is favorable (F) or unfavorable (U) (For all requirements, do not round intermediate calculations and select "None" if there is no effect (i.e., zero variance).) a Total labor variance b. Total labor price variance Total labor usage variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started