Answered step by step

Verified Expert Solution

Question

1 Approved Answer

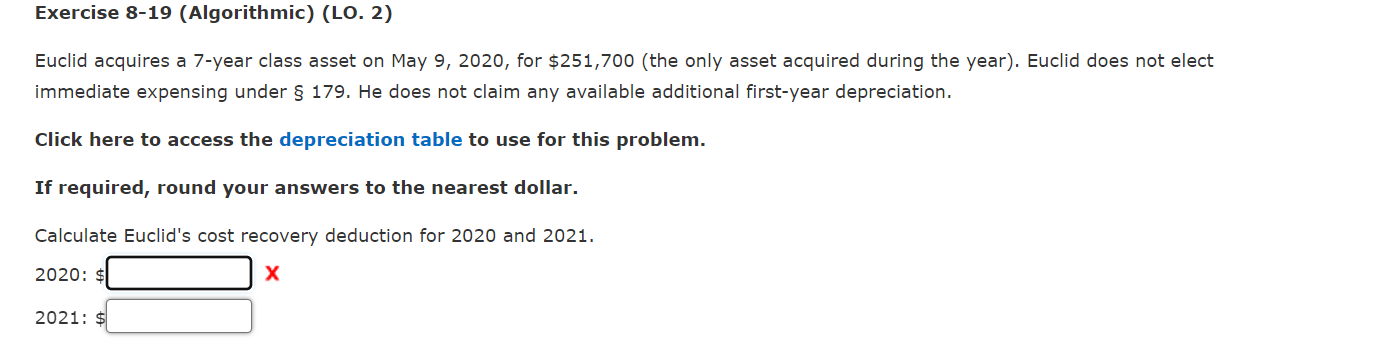

Exercise 8-19 (Algorithmic) (LO. 2) Euclid acquires a 7-year class asset on May 9, 2020, for $251,700 (the only asset acquired during the year).

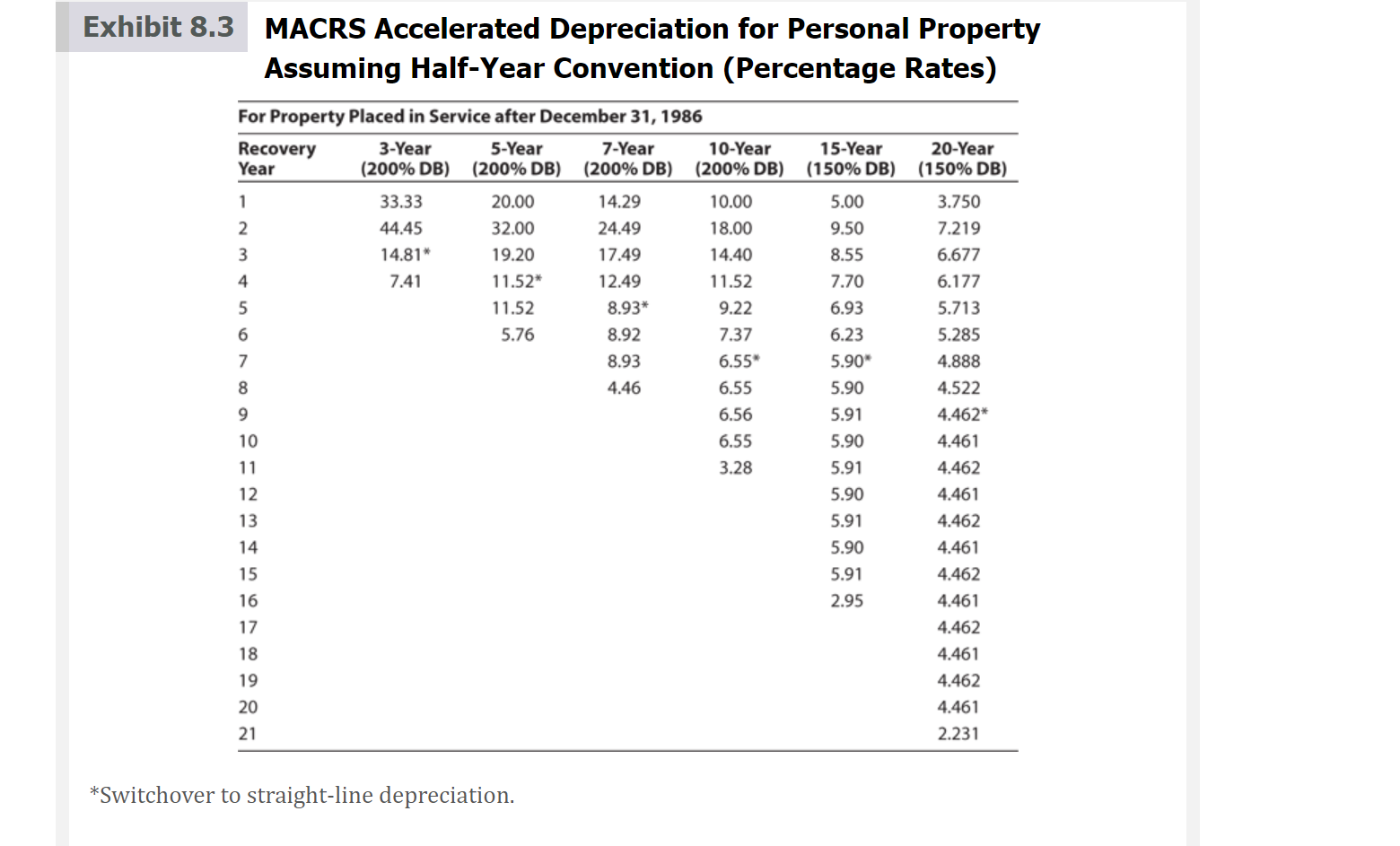

Exercise 8-19 (Algorithmic) (LO. 2) Euclid acquires a 7-year class asset on May 9, 2020, for $251,700 (the only asset acquired during the year). Euclid does not elect immediate expensing under 179. He does not claim any available additional first-year depreciation. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. Calculate Euclid's cost recovery deduction for 2020 and 2021. 2020: $ X 2021: $ Exhibit 8.3 MACRS Accelerated Depreciation for Personal Property Assuming Half-Year Convention (Percentage Rates) For Property Placed in Service after December 31, 1986 3-Year 5-Year (200% DB) (200% DB) Recovery Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 33.33 44.45 14.81* 7.41 20.00 32.00 19.20 11.52* 11.52 5.76 *Switchover to straight-line depreciation. 7-Year (200% DB) 14.29 24.49 17.49 12.49 8.93* 8.92 8.93 4.46 10-Year (200% DB) 10.00 18.00 14.40 11.52 9.22 7.37 6.55* 6.55 6.56 6.55 3.28 15-Year (150% DB) 5.00 9.50 8.55 7.70 6.93 6.23 5.90* 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 20-Year (150% DB) 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462* 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Euclids cost recovery deduction for 2020 and 2021 we can use the Modified Accelerated C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started